- United States

- /

- Consumer Durables

- /

- NYSE:LEN

A Fresh Look at Lennar (LEN) Valuation as Recent Returns Lag Highs

Reviewed by Simply Wall St

Lennar (LEN) has seen its stock price hold steady recently, reflecting a mix of market sentiment and company fundamentals. With investors watching closely, Lennar’s performance continues to offer cues about the broader housing market landscape.

See our latest analysis for Lennar.

While Lennar’s share price recently gained 6.6% over the past week, the stock still trails its highs from last year, with a 1-year total shareholder return of -17.1%. Three- and five-year total returns remain strongly positive, but momentum has faded lately as the market reassesses the company’s growth prospects.

If you’re interested in seeing what else might be gathering steam, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

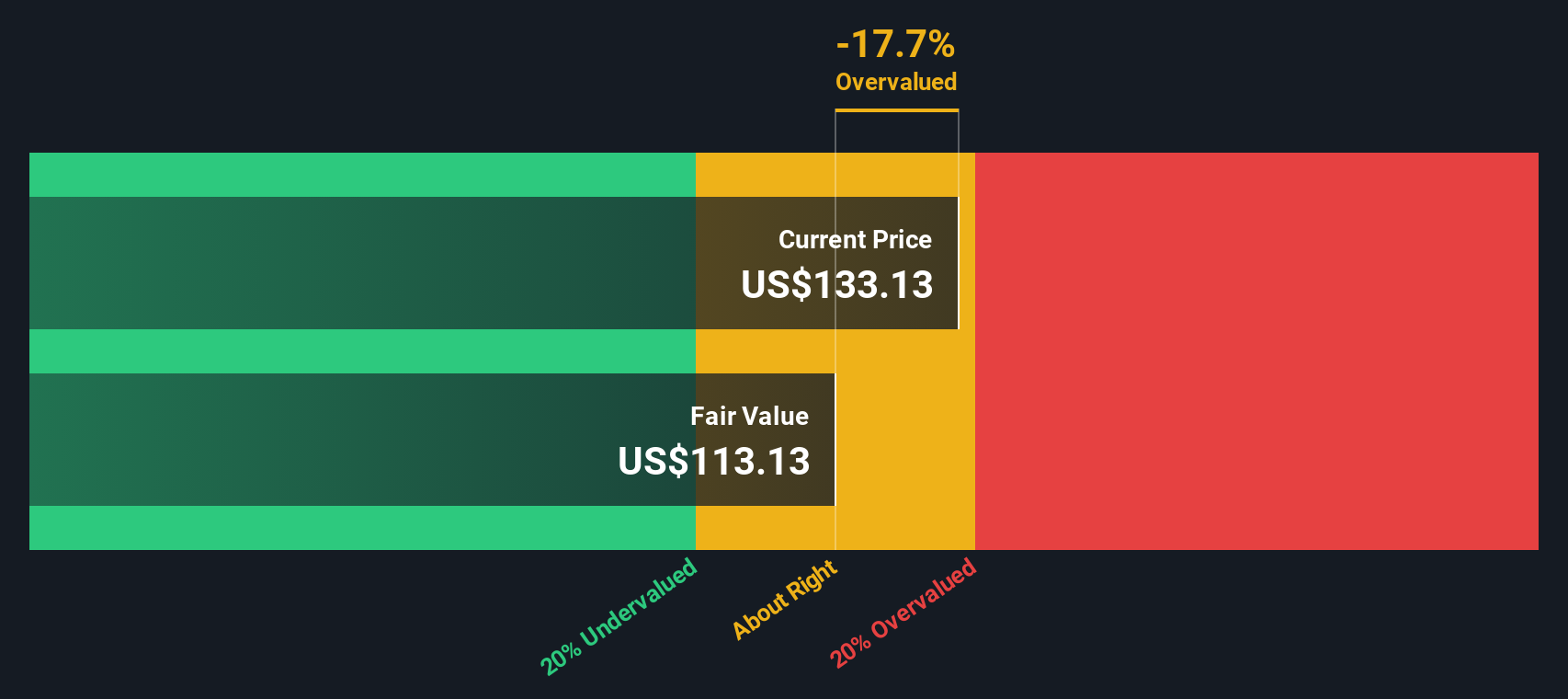

With recent returns lagging and valuations appearing less compelling, the key question for investors now is whether Lennar is trading below its true worth or if the market is already factoring in all future growth potential.

Most Popular Narrative: 3% Overvalued

Lennar’s last close of $131.28 stands above the narrative’s fair value estimate of $127.50. This highlights skepticism about near-term upside even as analysts see catalysts for future growth. The stage is set for diverging views as momentum and risk/reward calculations shift.

The company's focus on driving consistent volume and production efficiency by matching production pace with sales pace aims to maximize profitability and operational efficiency. This strategy is expected to lower construction costs and cycle times, thereby impacting future earnings positively.

Want to know what bold assumptions underpin this valuation? The narrative hints at operational changes and a profit trajectory not seen in the numbers alone. Curious which levers drive this price target and what could flip the valuation? Dive in to unpack the crucial forecasts shaping this fair value.

Result: Fair Value of $127.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressures and continued weakness in housing demand could challenge the optimistic outlook. This could potentially shift the narrative if conditions do not improve.

Find out about the key risks to this Lennar narrative.

Another View: SWS DCF Model Suggests a Different Story

Looking at Lennar with our DCF model provides a more conservative estimate. The SWS DCF model points to a fair value of $83.27 per share, which is well below the current price. This places Lennar in the overvalued category according to this method. Which forecasted future do you believe?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Lennar Narrative

If you’re not convinced by these valuations or prefer diving into the details yourself, you can assemble your own narrative in just a few minutes using the same tools. Do it your way.

A great starting point for your Lennar research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss the chance to supercharge your portfolio. Smart investors stay a step ahead by scanning fresh ideas on Simply Wall Street’s powerful Screener.

- Increase your yield by targeting top income opportunities through these 15 dividend stocks with yields > 3% that pay reliable dividends above 3%.

- Tap into emerging trends by uncovering potential growth leaders with these 25 AI penny stocks focused on artificial intelligence-driven innovation.

- Secure value before others spot it by scanning these 923 undervalued stocks based on cash flows to find stocks whose prices don’t yet reflect true potential based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LEN

Lennar

Operates as a homebuilder primarily under the Lennar brand in the United States.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.