- United States

- /

- Consumer Durables

- /

- NYSE:LEG

How Moody’s Downgrade at Leggett & Platt (LEG) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In recent days, Moody’s Ratings downgraded Leggett & Platt, Incorporated’s senior unsecured notes from Baa2 to Baa3 and shifted the outlook to stable, citing sustained demand challenges in key cyclical end markets and slow recovery in operating profit despite ongoing debt reduction efforts and restructuring plans.

- This development places a spotlight on ongoing risks tied to high leverage and persistent sensitivity to broader economic cycles, both of which continue to shape the company's financial profile and market expectations.

- We'll now examine how Moody’s debt downgrade and concerns around profit recovery affect Leggett & Platt's investment outlook and earnings assumptions.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Leggett & Platt Investment Narrative Recap

Being a shareholder in Leggett & Platt means believing in the company’s ability to restore earnings momentum, manage leverage, and benefit from any recovery in key cyclical end markets. Moody’s downgrade of the company’s debt rating highlights ongoing balance sheet risks, but does not materially shift the focus for the near term, where the critical catalyst remains a stabilization in bedding and mattress demand, while high leverage remains the biggest risk to the story.

One recent update of particular relevance is Leggett & Platt’s upcoming Q3 2025 earnings release, scheduled for October 27, 2025. Investors will be closely watching these results to gauge whether cost management, operating improvement, and restructuring efforts are producing tangible progress, a key factor that may signal an inflection or further validate current concerns tied to slower profit recovery.

However, what many may not realize is that despite ongoing debt reduction efforts, the company’s sizeable leverage position continues to place meaningful limits on financial flexibility in times of...

Read the full narrative on Leggett & Platt (it's free!)

Leggett & Platt's narrative projects $4.3 billion in revenue and $200.1 million in earnings by 2028. This requires a 0.7% annual revenue decline and a $57.9 million earnings increase from $142.2 million currently.

Uncover how Leggett & Platt's forecasts yield a $9.67 fair value, a 7% upside to its current price.

Exploring Other Perspectives

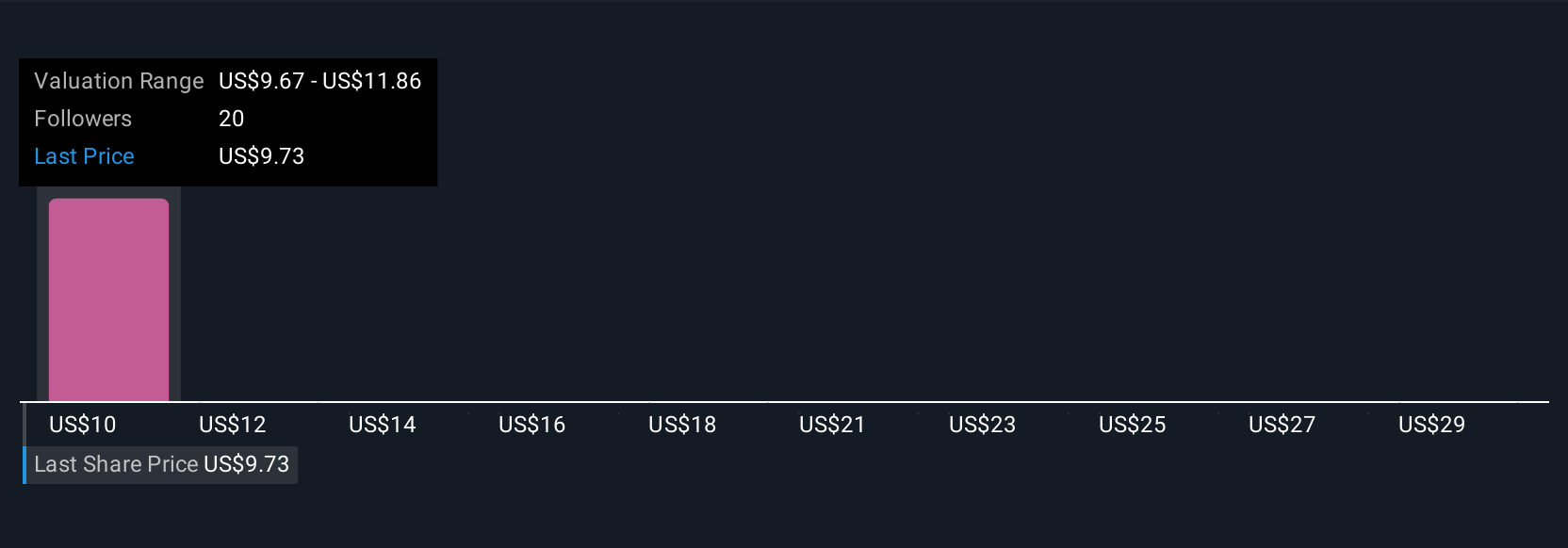

Seven members of the Simply Wall St Community see fair value for Leggett & Platt from US$9.67 up to US$31.63. As many await the upcoming earnings report, persistent high leverage stands out as a central consideration for future performance across these perspectives.

Explore 7 other fair value estimates on Leggett & Platt - why the stock might be worth just $9.67!

Build Your Own Leggett & Platt Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Leggett & Platt research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Leggett & Platt research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Leggett & Platt's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LEG

Leggett & Platt

Designs, manufactures, and sells engineered components and products in the United States, Europe, China, Canada, Mexico, and internationally.

Good value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives