- United States

- /

- Consumer Durables

- /

- NYSE:LEG

Can the Recent Stabilization in Leggett & Platt Shares Signal a Turning Point in 2025?

Reviewed by Bailey Pemberton

If you have been watching Leggett & Platt lately and wondering whether now is the time to buy, hold, or move on, you are definitely not alone. Investors have felt the sting of a stock that closed most recently at $8.90, with the past year bringing a drop of 29.5%, and longer timelines showing even deeper declines. In the last five years, shares have fallen more than 75%. It is understandable that you might be asking yourself what these moves really mean, and whether the market might be missing something when it comes to this company’s true worth.

Interestingly, despite the long decline, Leggett & Platt’s stock has only lost 0.3% in the last week, suggesting that the wave of negative sentiment could be settling, or at least pausing. While there hasn’t been any single headline spark for these price moves, the furniture and bedding industry as a whole has faced shifting demand and cost pressures, contributing to a general sense of uncertainty. All this increases the importance of a clear, grounded valuation to cut through the noise and help investors make a more confident decision.

Digging deeper, Leggett & Platt earns a valuation score of 4 out of 6, meaning it is undervalued on the majority of the most important checks. This makes it an intriguing candidate for value-focused investors. In the next section, we will look at the specific valuation methods behind this score, but we will also introduce a broader and potentially more insightful way to think about a stock’s true value before we wrap up.

Why Leggett & Platt is lagging behind its peers

Approach 1: Leggett & Platt Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and discounting those amounts back to their value in today’s dollars. This approach essentially asks: if you owned Leggett & Platt’s future cash earnings, what would you pay for them right now?

For Leggett & Platt, the latest reported Free Cash Flow stands at $222.9 million. The model projects cash flow over the next decade, starting with analyst estimates for five years, then extending projections using trend analysis. In 2026, Free Cash Flow is forecast at $189.1 million, which is estimated to decrease at an average annual rate of about -15.2% from current levels. By 2035, Simply Wall St’s extended methodology projects Free Cash Flow at $164.5 million.

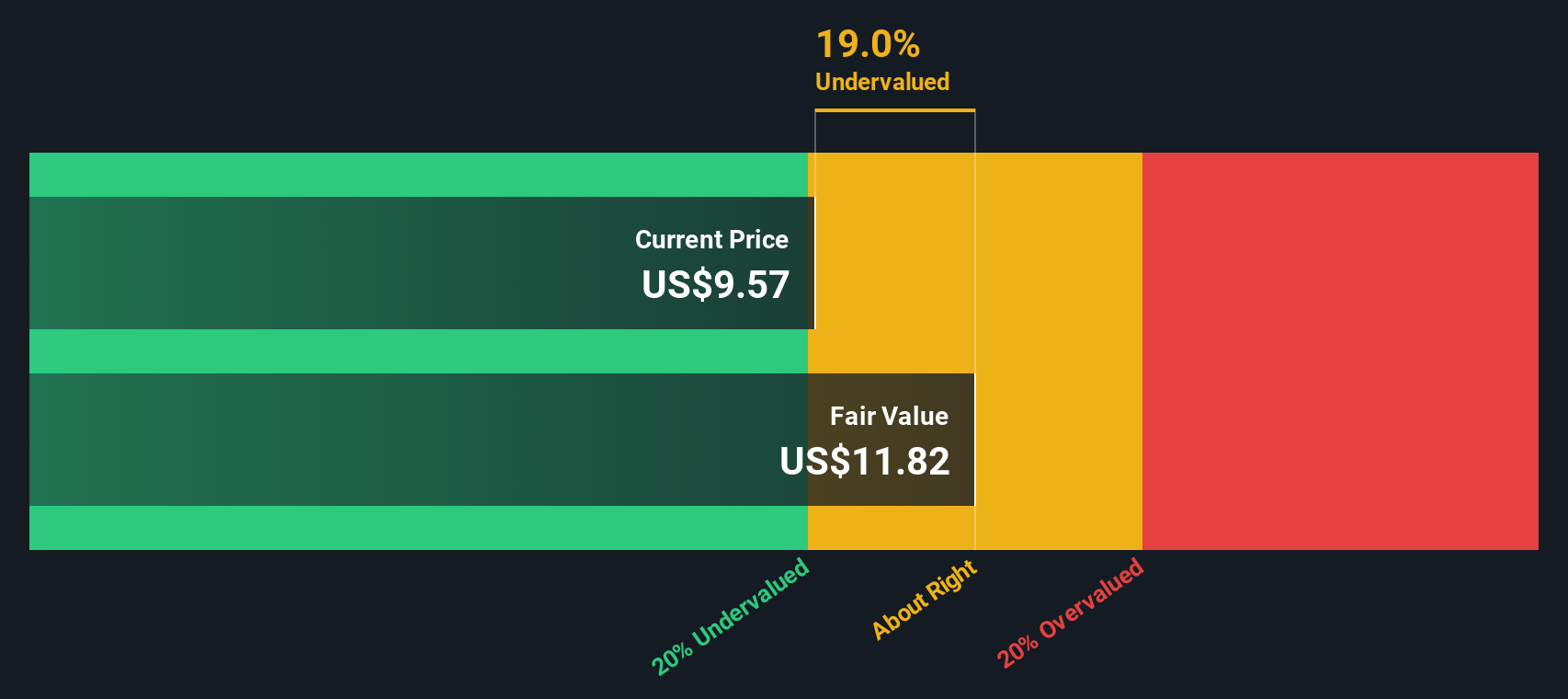

Pulling together all these forecasts and discounting them to the present, the DCF model calculates Leggett & Platt’s intrinsic value per share at $11.01. This is roughly 19.2% above the recent share price of $8.90, which may indicate the stock is undervalued based on this metric.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Leggett & Platt is undervalued by 19.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Leggett & Platt Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely accepted way to value profitable companies like Leggett & Platt, as it links a company’s share price directly to its ability to generate profits. The lower the ratio, the less investors are paying for each dollar of current earnings, but what’s considered “normal” can vary. Growth expectations and overall company risk play a significant role in determining what makes a fair or attractive PE ratio. Companies with better growth, strong margins, or lower risk tend to warrant higher multiples. On the other hand, riskier or shrinking businesses might see lower ones.

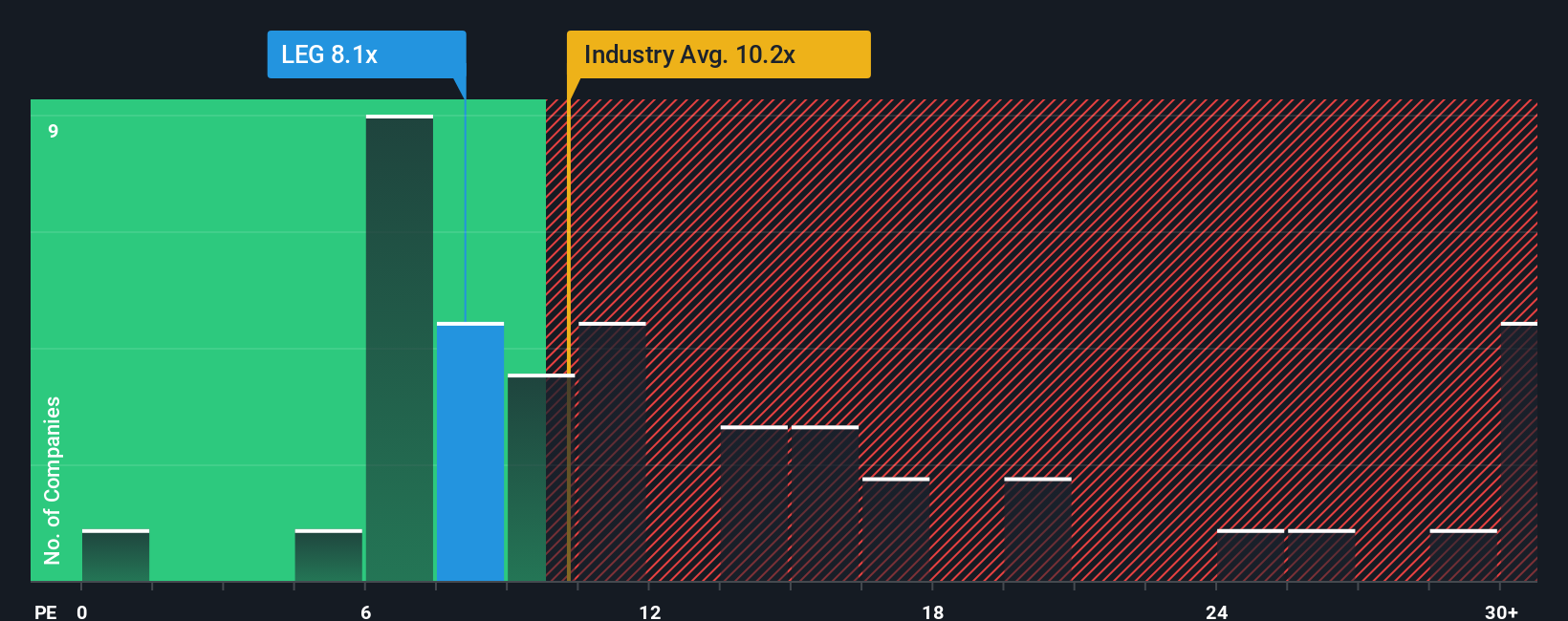

Currently, Leggett & Platt trades at a PE ratio of 8.5x. That is significantly below both the Consumer Durables industry average PE of 10.9x and the average for its peers, which stands at 14.4x. On the surface, this discount may look like a bargain, but simple averages do not always tell the full story. This is where the “Fair Ratio” comes in.

Simply Wall St’s Fair Ratio tool estimates what a stock’s PE ratio should be based on factors like earnings growth, profit margin, market cap, industry type, and relevant risks, offering a more tailored benchmark. For Leggett & Platt, the Fair Ratio is 15.9x. This is meaningfully higher than the company’s current multiple, suggesting that the market may be undervaluing the stock based on its true fundamentals and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Leggett & Platt Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story about a company, describing how you see Leggett & Platt’s future by combining your own estimates for its sales, profits, and margins with your view of what makes the business unique or risky. Narratives connect this story to a financial forecast and, ultimately, to a fair value, showing you not just what the numbers say, but why they matter.

Narratives take investment analysis beyond static ratios. They are available and easy to use on Simply Wall St’s Community page, trusted by millions of investors. You can build a Narrative in minutes and see in real time how your assumptions stack up to consensus views. If Fair Value from your Narrative is above the current share price, it could be a signal to buy; if it is less, perhaps it is time to wait or sell. What is more, Narratives update automatically as new data or news is released, keeping your outlook relevant and actionable.

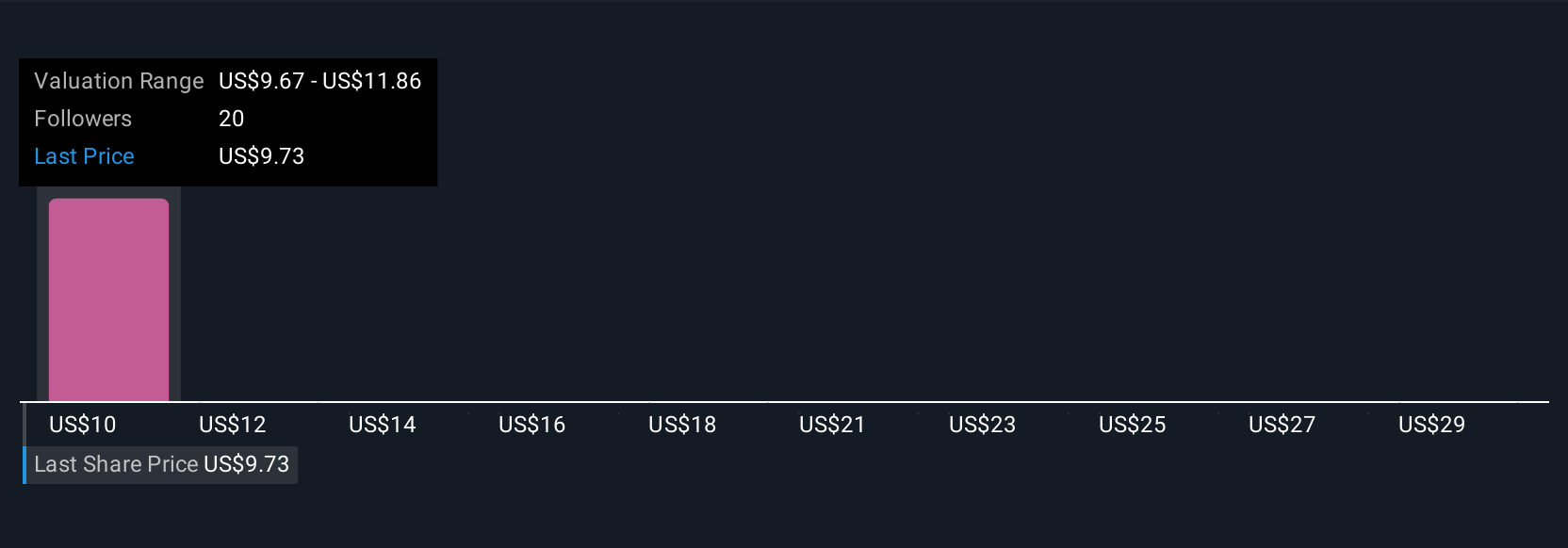

For example, one investor might write an upbeat Narrative for Leggett & Platt projecting higher revenues thanks to industry reforms, justifying a fair value of $9.67 per share. Another may focus on ongoing demand weakness and risks, resulting in a more cautious perspective and lower fair value estimate. Narratives let you chart your own investment course with clarity and context.

Do you think there's more to the story for Leggett & Platt? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LEG

Leggett & Platt

Designs, manufactures, and sells engineered components and products in the United States, Europe, China, Canada, Mexico, and internationally.

Good value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives