- United States

- /

- Luxury

- /

- NYSE:KTB

Is Kontoor Brands Offering Value After Shift Toward Direct to Consumer Growth Strategy?

Reviewed by Bailey Pemberton

- Wondering if Kontoor Brands at around $75 is quietly turning into good value, or if the market still has it roughly right? Let us walk through what the numbers say, without the usual noise.

- The stock is up 1.7% over the last week and 1.8% over the last month, but it is still down 11.2% year to date and 15.8% over the past year, despite almost doubling over three and five years.

- Recent headlines have centered on Kontoor’s focus on strengthening its core Wrangler and Lee brands and pushing more aggressively into direct to consumer channels. This can shift how investors think about its long term growth and margin profile. At the same time, changing expectations around consumer spending and apparel demand have kept sentiment mixed, helping explain the tug of war you see in the share price.

- On our framework, Kontoor scores a 4 out of 6 on undervaluation checks, suggesting the market might be missing some of the upside. Next, we will break down what that means under different valuation approaches, and then look at a deeper way to think about the company’s true worth beyond the headline multiples.

Find out why Kontoor Brands's -15.8% return over the last year is lagging behind its peers.

Approach 1: Kontoor Brands Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model projects the cash a company is expected to generate in the future and then discounts those dollars back into today’s terms to estimate what the business is worth now.

For Kontoor Brands, the model starts with last twelve month free cash flow of about $219.7 Million and builds a two stage forecast of future free cash flows in $. Analyst expectations, combined with Simply Wall St extrapolations, see free cash flow rising toward roughly $424.9 Million by 2035, with nearer term projections like $387.7 Million in 2026 and $375.6 Million in 2027 forming the backbone of the valuation.

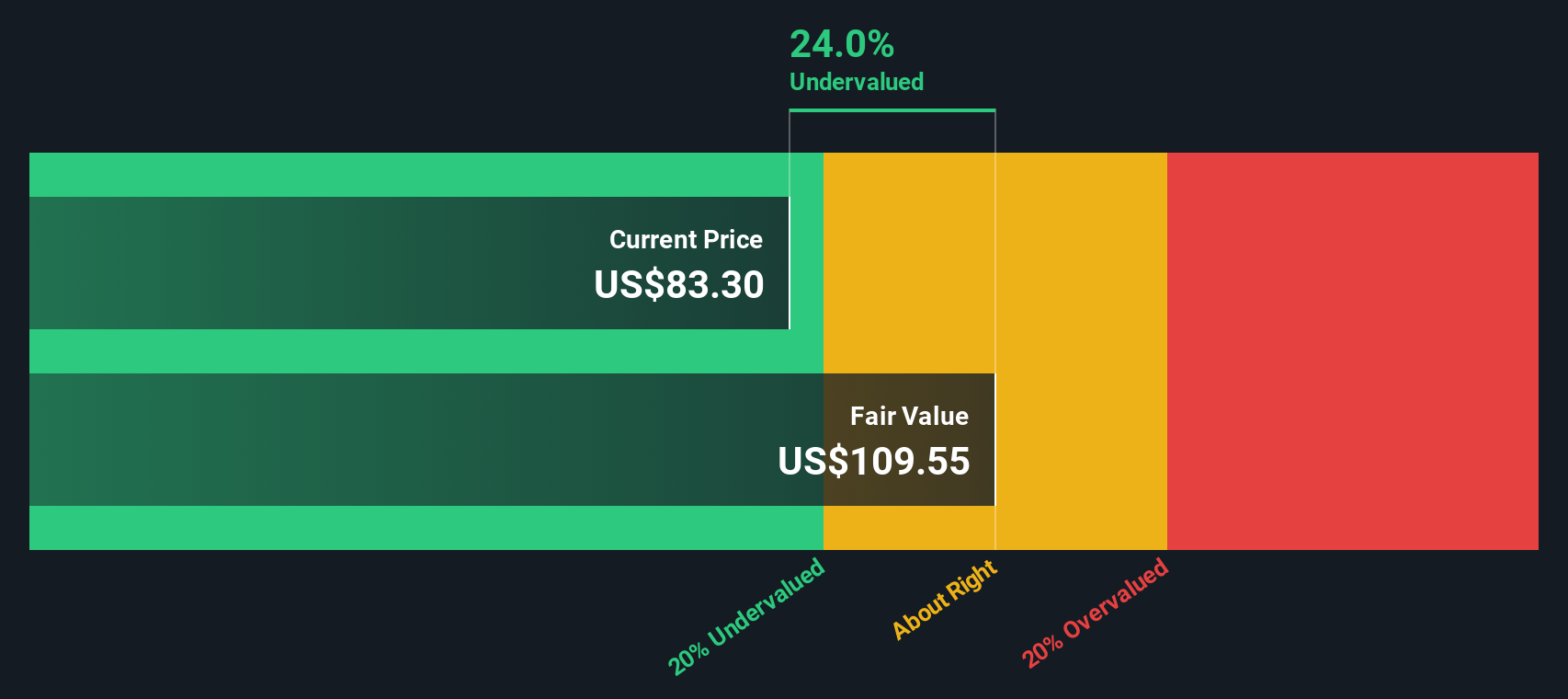

When these projected cash flows are discounted back, the DCF model arrives at an estimated intrinsic value of about $93.15 per share. Versus a recent share price around $75, this implies the stock trades at roughly an 18.9% discount to its calculated fair value, which suggests the market may be under appreciating Kontoor’s cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kontoor Brands is undervalued by 18.9%. Track this in your watchlist or portfolio, or discover 909 more undervalued stocks based on cash flows.

Approach 2: Kontoor Brands Price vs Earnings

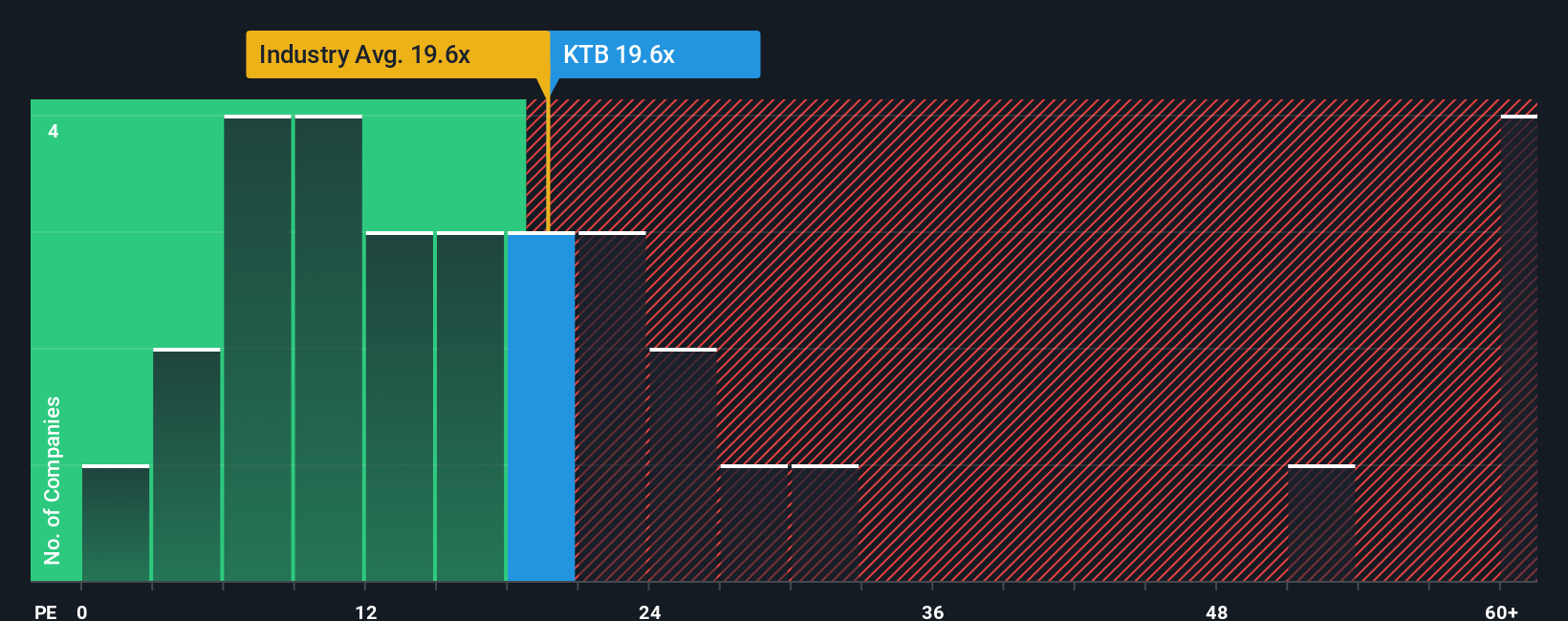

For a consistently profitable company like Kontoor Brands, the price to earnings, or PE, ratio is a straightforward way to gauge how much investors are paying for each dollar of earnings. A higher PE usually reflects stronger growth expectations or lower perceived risk, while slower growth or higher uncertainty tends to justify a lower, more restrained multiple.

Kontoor currently trades on a PE of about 19.3x, which sits below both the wider luxury industry average of around 21.3x and the peer group average near 32.4x. To go a step further than simple comparisons, Simply Wall St calculates a proprietary Fair Ratio, which estimates the PE Kontoor should trade on given its earnings growth outlook, margins, industry, market cap and risk profile. This is more tailored than using broad peer or industry benchmarks that may bundle together very different business models and risk levels.

For Kontoor, the Fair Ratio comes out at roughly 21.2x, modestly above the current 19.3x multiple. This suggests the shares are trading at a discount to what its fundamentals might justify.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kontoor Brands Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Kontoor Brands’ future to hard numbers. You can do this by telling a story about its growth, margins and risks, turning that story into a forecast for revenue, earnings and cash flows, and then into a Fair Value you can easily compare with today’s share price to help inform a decision to buy, hold or sell.

On Simply Wall St’s Community page, used by millions of investors, Narratives are an accessible tool that lets you quickly set your own assumptions, see how they translate into a Fair Value, and then watch that view update dynamically as fresh news, earnings and guidance are released.

For Kontoor, one investor might build a bullish Narrative around a Helly Hansen driven portfolio transformation and see fair value closer to the upper analyst target near $99. Another might lean into the risks from aging brands and digital competition and land closer to the bearish $49 view. Narratives make those different perspectives transparent, comparable and grounded in numbers instead of vague opinions.

Do you think there's more to the story for Kontoor Brands? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kontoor Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KTB

Kontoor Brands

A lifestyle apparel company, designs, produces, procures, markets, distributes, and licenses denim, apparel, footwear, and accessories, primarily under the Wrangler and Lee brands.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026