- United States

- /

- Consumer Durables

- /

- NYSE:KBH

Is KB Home's (KBH) Lower Revenue Forecast Shifting the Investment Case After Strong Q3 Profits?

Reviewed by Sasha Jovanovic

- Earlier this week, KB Home released its third-quarter earnings, exceeding analyst expectations on profits but lowering its full-year revenue forecast amid a 4% year-over-year decline in net orders.

- While operational efficiency and cost control helped the company outperform on the bottom line, management’s cautious outlook highlights persistent challenges in the current housing market.

- We will examine how KB Home’s trimmed revenue guidance and order slowdown could influence its investment narrative and future expectations.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

KB Home Investment Narrative Recap

For an investor to be confident in KB Home, they need to believe that the company’s push for operational efficiency and disciplined pricing will offset ongoing headwinds in demand and the softer housing market. The recent earnings announcement, where KB Home beat profit expectations but lowered its full-year revenue guidance, brings the short-term catalyst of improved operational execution into focus, while also highlighting the risk of prolonged weak consumer demand, a risk that remains material and should not be ignored.

Among recent announcements, the update on the company’s significant share buyback program stands out. By repurchasing nearly 5% of its shares last quarter, KB Home continues to focus on returning capital to shareholders, which can support earnings per share even when sales growth is muted. However, as encouraging as this may seem for shareholders in the near term…

Read the full narrative on KB Home (it's free!)

KB Home's outlook anticipates $6.8 billion in revenue and $496.4 million in earnings by 2028. This calls for a 0.2% annual revenue decline and a $125.1 million decrease in earnings from the current $621.5 million.

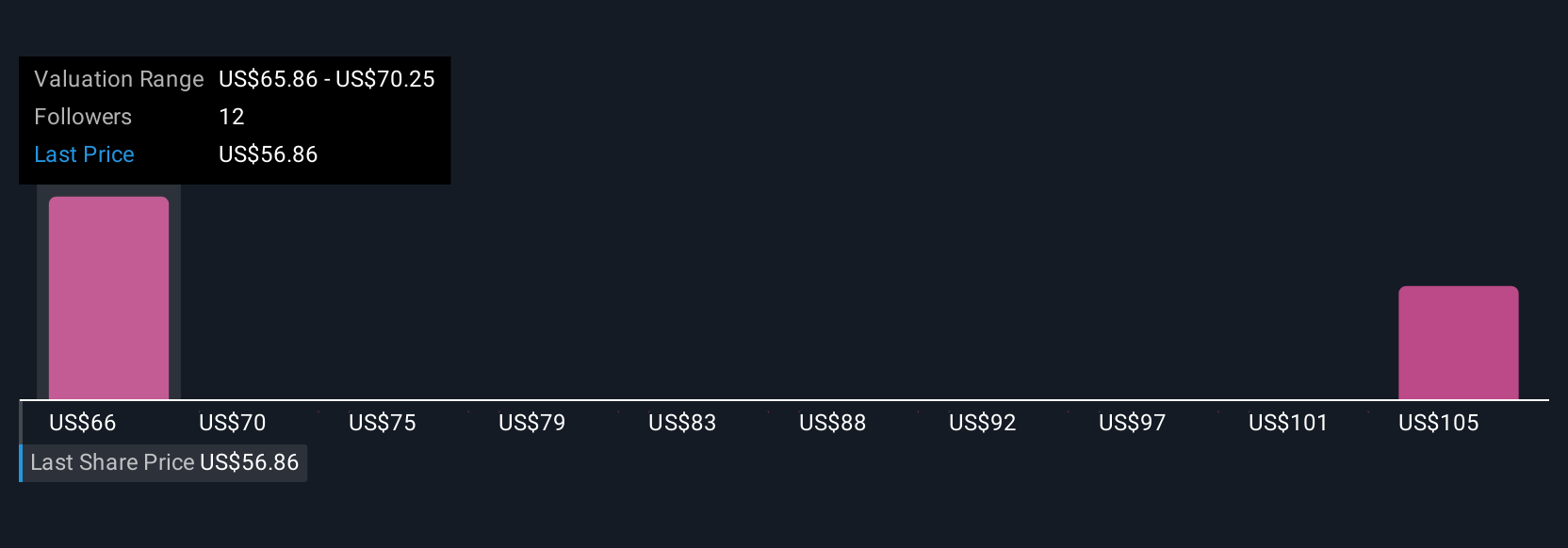

Uncover how KB Home's forecasts yield a $66.00 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Four distinct fair value estimates from the Simply Wall St Community range from US$8 to US$172,746. With opinions this far apart, some see value while others expect caution, especially as risks from waning consumer confidence persist for KB Home.

Explore 4 other fair value estimates on KB Home - why the stock might be worth less than half the current price!

Build Your Own KB Home Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KB Home research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free KB Home research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KB Home's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KB Home might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KBH

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives