- United States

- /

- Consumer Durables

- /

- NYSE:KBH

Has KB Home Pulled Back Too Far After Its Recent 26% Drop?

Reviewed by Simply Wall St

Trying to figure out whether now is the right time to make a move with KB Home stock? You are definitely not alone. After a stellar run over the last few years, with shares leaping a whopping 157.5% over the past three years and nearly doubling over five, KB Home has hit a bit of a cooling period. Year to date, the stock has dipped by 1.1% and is down 1.9% just in the last week. Even looking back a full year, the stock has retreated by 26.3%, which is a significant reversal. This has many investors rethinking what comes next.

So, what’s really driving these shifts? Broader market action and changing perceptions about the homebuilding sector have been front and center. As interest rates and housing affordability dominate the conversation, risk sentiment can swing quickly, and that has clearly filtered through to KB Home’s share price. Still, it is worth noting that despite these near-term bumps, the company’s value score sits at 5 out of 6. This means KB Home is considered to be undervalued in a majority of standard valuation checks, a statistic that is hard for any rational investor to ignore.

But how do these valuation approaches actually work, and is there an even better way to judge whether KB Home is a smart buy right now? Let’s break down the usual methods analysts use to figure out true value. Stay tuned for a perspective that goes beyond the numbers by the end of the article.

Why KB Home is lagging behind its peersApproach 1: KB Home Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model helps estimate a company’s true value by projecting its future cash flows and discounting them back to today’s value. This method aims to determine what the business is really worth based on how much cash it can generate in the future, rather than relying purely on recent earnings or the stock price.

For KB Home, the latest twelve months’ Free Cash Flow comes in at $66.7 Million. Analysts project this figure will grow steadily each year, reaching $574.1 Million by 2035. While direct estimates only go out five years, further projections are extrapolated to give a broader sense of long-term potential. All numbers are reflected in US Dollars.

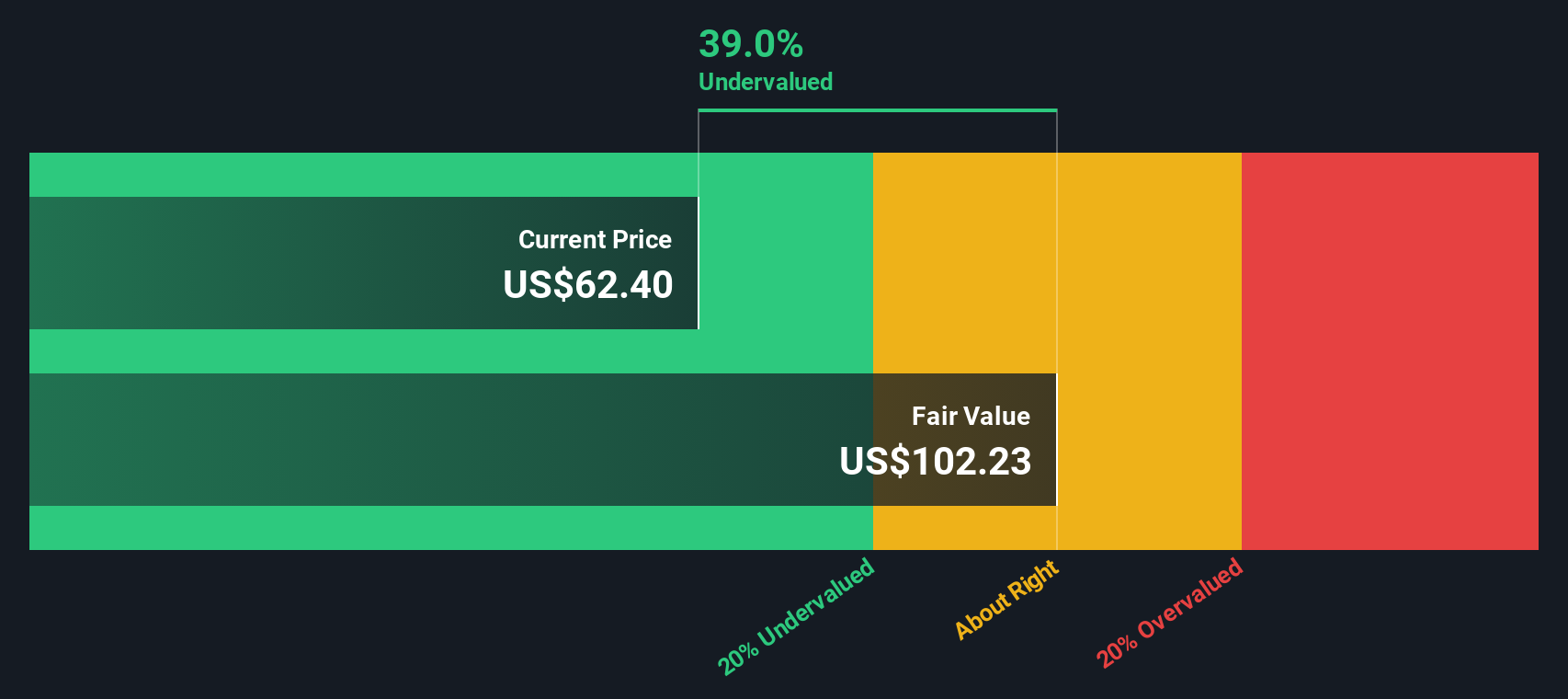

According to the DCF analysis, KB Home’s intrinsic value per share is estimated at $102.23. With the stock currently trading about 37.5% below this value, the model suggests KB Home is significantly undervalued based on cash flow expectations.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for KB Home.

Approach 2: KB Home Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used valuation tools for profitable companies like KB Home, as it compares the current share price to its per-share earnings. This makes it a powerful metric to gauge how the market values a business’s profitability. However, what constitutes a “normal” or “fair” PE ratio changes according to how quickly a company is growing its earnings and how much risk investors perceive in its future results. Faster growth and lower risk typically command a higher PE, while slow growth or higher uncertainty means a lower ratio is justified.

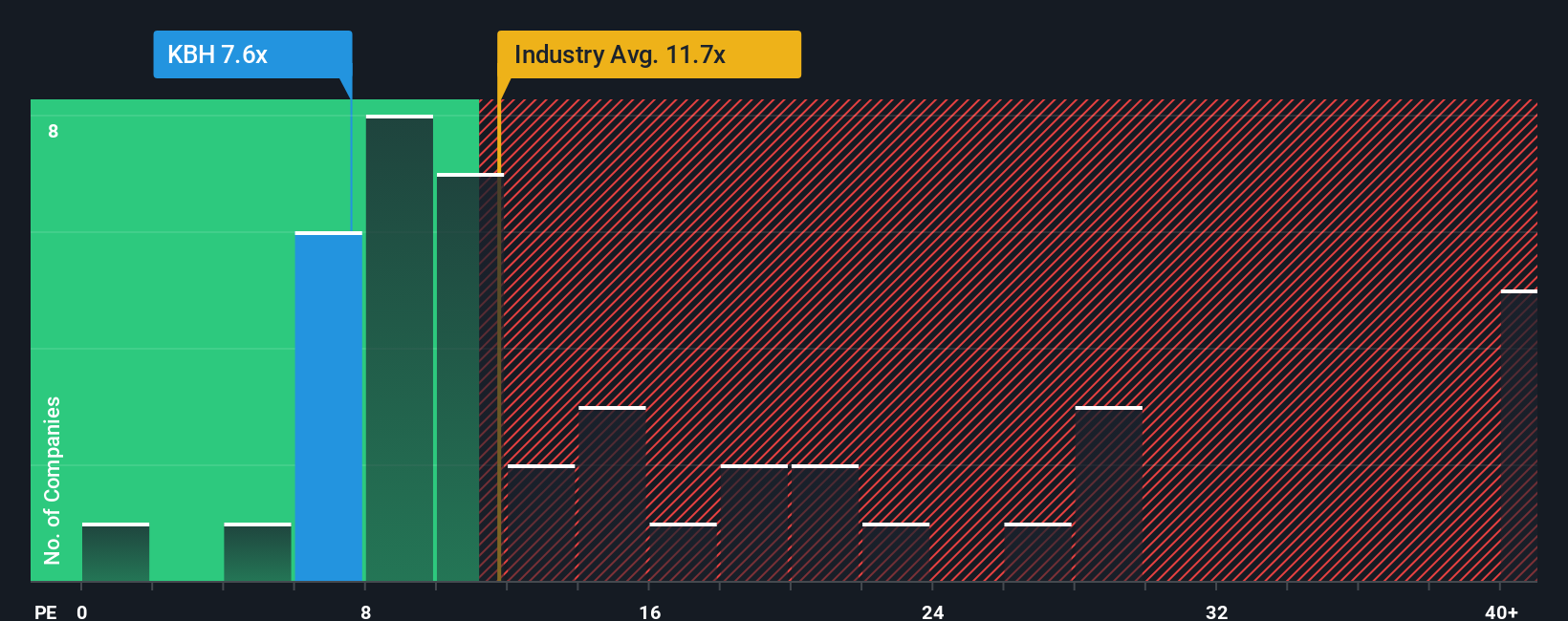

Currently, KB Home trades at a PE ratio of 7.7x. That is noticeably lower than both the industry average of 11.6x and the peer group average of 14.7x. On paper, this suggests KB Home could be trading at a bargain valuation compared to similar companies.

To move beyond simple benchmarking, Simply Wall St calculates a custom “Fair Ratio” for KB Home by factoring in crucial elements like the company’s earnings growth outlook, financial risk level, profit margins, its size (market cap), and position within its industry. This holistic approach delivers a fair value PE ratio of 11.5x, providing a clearer picture than raw averages, since it recognizes the unique qualities and risks facing KB Home right now.

Comparing this proprietary Fair Ratio to the actual PE, with KB Home trading at 7.7x versus a fair value of 11.5x, highlights a meaningful discount. This signals that the stock is undervalued based on the preferred multiple method.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your KB Home Narrative

Earlier, we mentioned there is an even smarter way to understand valuation, so let’s introduce you to Narratives. A Narrative is a story that investors create about a company, where they connect what is happening in the real world with specific forecasts of future revenue, earnings, and profit margins. Instead of just looking at the numbers, Narratives help you lay out your assumptions and then see how these directly influence your own calculated fair value.

This approach takes the company’s story, whether it is faster home build times, new land deals, or shifting economic conditions, and ties it to a unique financial forecast and valuation, making sense of both facts and opinions. Narratives are easy to use and available on Simply Wall St’s Community page, where millions of investors share and evolve their perspectives.

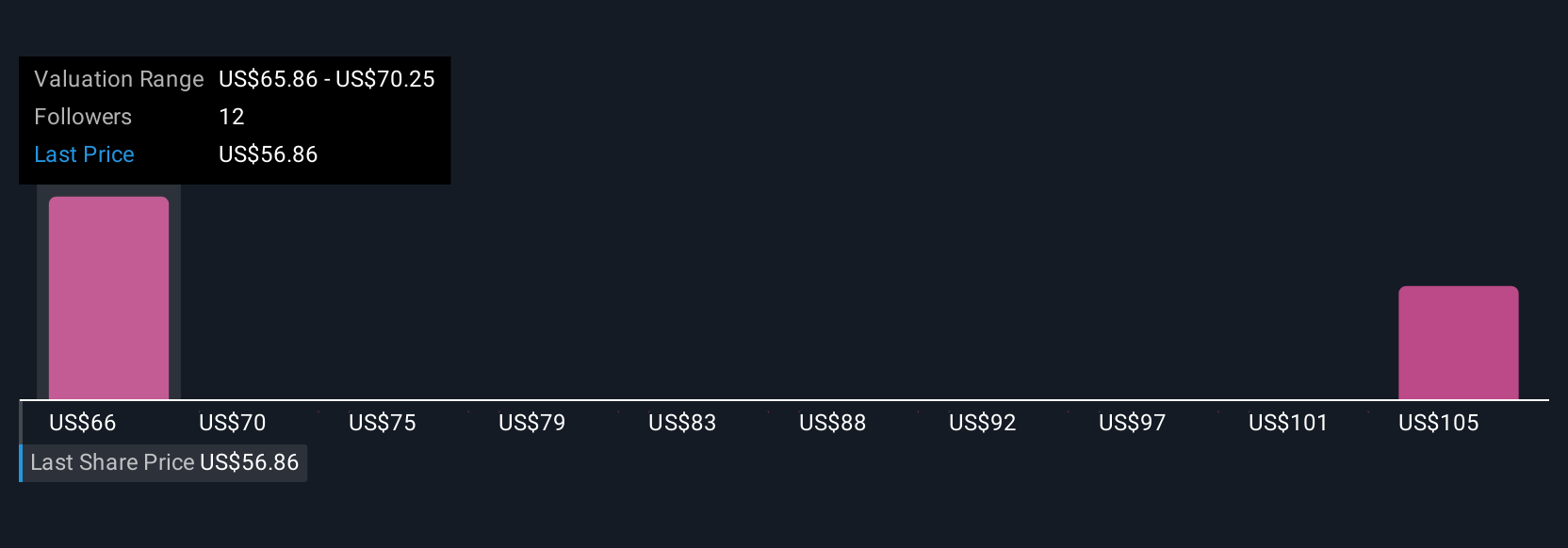

By comparing your Narrative-driven fair value with the current KB Home share price, you have a clear, personalized signal on whether to buy, sell, or hold. These values adjust automatically whenever fresh news or earnings results emerge. For example, some investors expect KB Home to outperform and value the stock at $86.00 per share based on strong efficiency and land investments, while others see tougher times ahead and set their fair value as low as $55.00, with both views reflecting different beliefs about its future.

Do you think there's more to the story for KB Home? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if KB Home might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KBH

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)