- United States

- /

- Consumer Durables

- /

- NYSE:HBB

We Think Hamilton Beach Brands Holding (NYSE:HBB) Is Taking Some Risk With Its Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Hamilton Beach Brands Holding Company (NYSE:HBB) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Hamilton Beach Brands Holding

How Much Debt Does Hamilton Beach Brands Holding Carry?

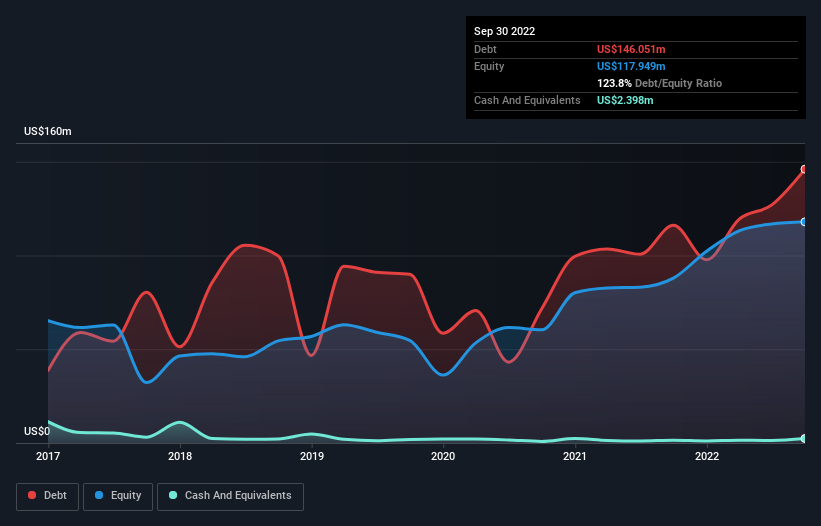

As you can see below, at the end of September 2022, Hamilton Beach Brands Holding had US$146.1m of debt, up from US$116.1m a year ago. Click the image for more detail. Net debt is about the same, since the it doesn't have much cash.

A Look At Hamilton Beach Brands Holding's Liabilities

According to the last reported balance sheet, Hamilton Beach Brands Holding had liabilities of US$139.9m due within 12 months, and liabilities of US$159.1m due beyond 12 months. Offsetting these obligations, it had cash of US$2.40m as well as receivables valued at US$97.8m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$198.8m.

When you consider that this deficiency exceeds the company's US$191.0m market capitalization, you might well be inclined to review the balance sheet intently. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Hamilton Beach Brands Holding's net debt is 3.3 times its EBITDA, which is a significant but still reasonable amount of leverage. But its EBIT was about 10.3 times its interest expense, implying the company isn't really paying a high cost to maintain that level of debt. Even were the low cost to prove unsustainable, that is a good sign. Unfortunately, Hamilton Beach Brands Holding's EBIT flopped 11% over the last four quarters. If earnings continue to decline at that rate then handling the debt will be more difficult than taking three children under 5 to a fancy pants restaurant. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Hamilton Beach Brands Holding will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Hamilton Beach Brands Holding saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Mulling over Hamilton Beach Brands Holding's attempt at converting EBIT to free cash flow, we're certainly not enthusiastic. But at least it's pretty decent at covering its interest expense with its EBIT; that's encouraging. We're quite clear that we consider Hamilton Beach Brands Holding to be really rather risky, as a result of its balance sheet health. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example Hamilton Beach Brands Holding has 3 warning signs (and 2 which are potentially serious) we think you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Hamilton Beach Brands Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:HBB

Hamilton Beach Brands Holding

Designs, markets, and distributes small electric household and specialty housewares appliances in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives