- United States

- /

- Consumer Durables

- /

- NYSE:GRMN

Is Garmin Attractively Priced After Recent Share Price Volatility And DCF Valuation Upside?

Reviewed by Bailey Pemberton

- Wondering if Garmin at around $197 a share is a bargain or a trap? This breakdown will walk you through what the current price implies about its long term value.

- The stock is up 2.2% over the last week but still down 7.8% over the past month and 5.8% over the last year, a choppy pattern that contrasts with its 122.4% 3 year and 79.0% 5 year returns.

- Recent headlines have focused on Garmin expanding its footprint across fitness wearables, aviation avionics, and marine navigation, reinforcing its reputation as a diversified niche hardware and software player. At the same time, investors are debating how durable its demand pipeline is as competition in smart devices and connected cars intensifies, which helps explain the mixed sentiment in the share price.

- On our framework, Garmin scores just 1/6 on valuation checks. We will walk through DCF, multiples, and other lenses to see if the market has this right, and then finish with a more intuitive way to think about what the stock may be worth.

Garmin scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Garmin Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, DCF, model estimates what a business is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today in dollar terms. For Garmin, the model used is a 2 Stage Free Cash Flow to Equity approach, starting from last twelve months free cash flow of about $1.33 billion.

Analysts expect free cash flow to rise to around $1.45 billion by 2026 and $1.57 billion by 2027, with Simply Wall St then extrapolating further growth to roughly $2.78 billion by 2035 as the business matures. These future cash flows are discounted back to today to reflect risk and the time value of money.

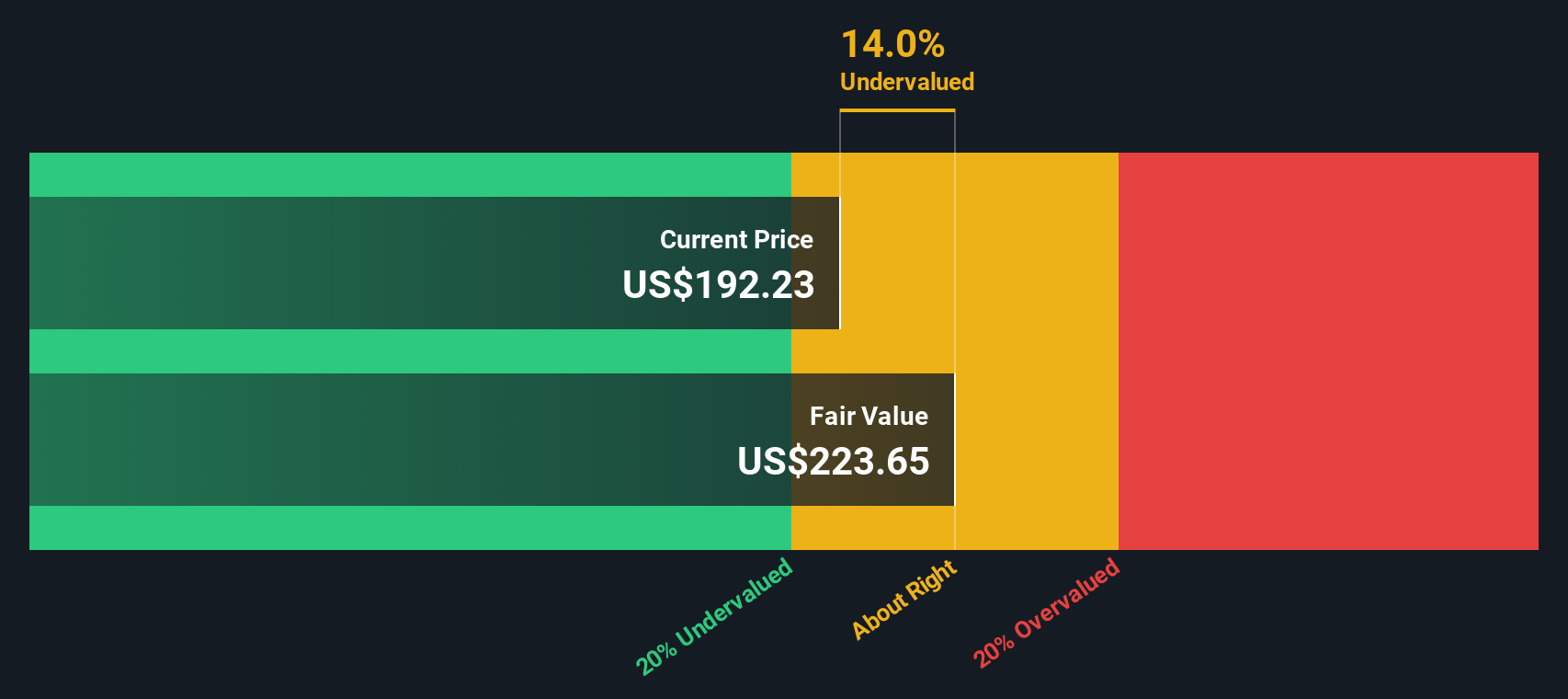

On this basis, the DCF model estimates an intrinsic value of about $221.46 per share. Compared with the current share price around $197, that implies the stock is roughly 11.0% undervalued, which indicates the market may not be fully pricing in Garmin's projected cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Garmin is undervalued by 11.0%. Track this in your watchlist or portfolio, or discover 925 more undervalued stocks based on cash flows.

Approach 2: Garmin Price vs Earnings

For profitable companies like Garmin, the price to earnings (PE) ratio is a useful way to gauge whether investors are paying a reasonable price for each dollar of current earnings. In general, higher expected growth and lower perceived risk justify a higher PE, while slower growth or higher risk call for a lower, more cautious multiple.

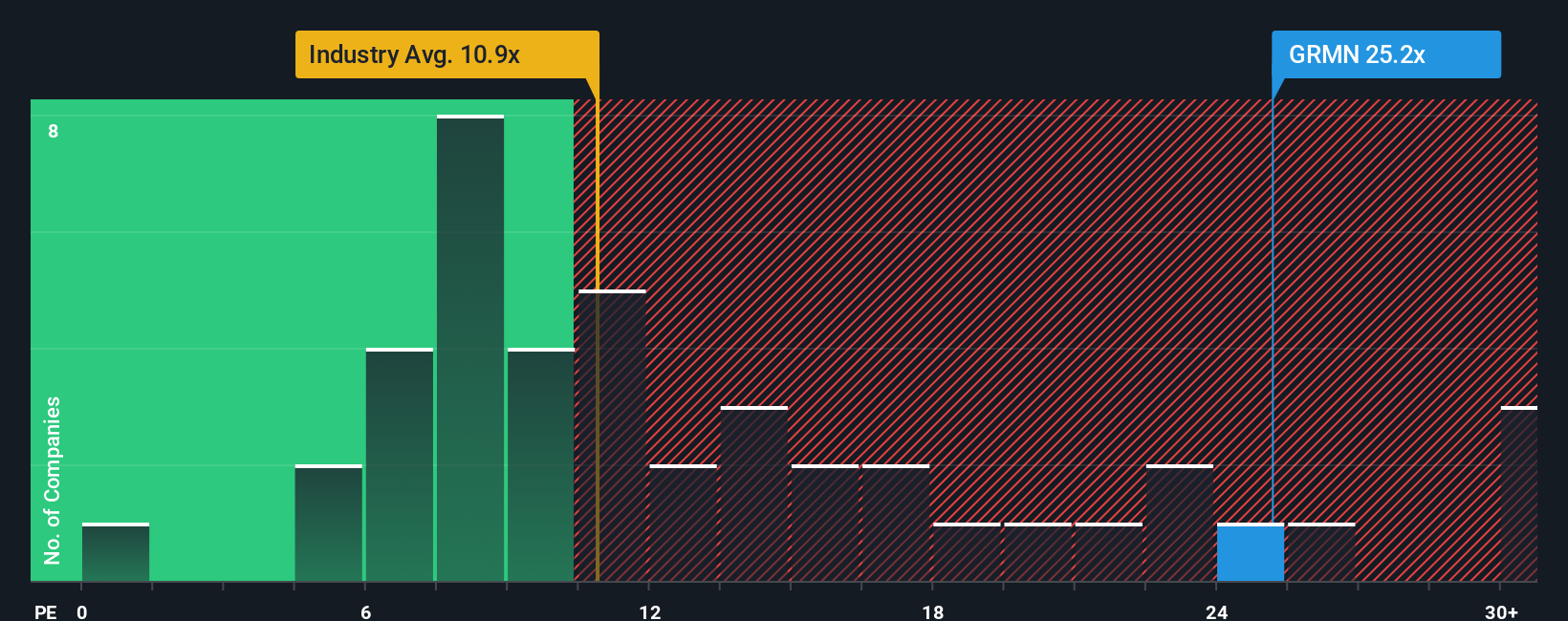

Garmin currently trades on a PE of about 24.1x. That is broadly in line with the peer average of 24.0x, but well above the wider Consumer Durables industry average of roughly 11.8x, reflecting Garmin's stronger profitability and growth profile than the typical company in its sector.

Simply Wall St's Fair Ratio is a proprietary estimate of what Garmin's PE should be once you factor in its earnings growth outlook, profit margins, industry characteristics, market cap, and risk profile. This is more informative than a simple peer or industry comparison because it tailors the multiple to Garmin's specific fundamentals rather than assuming all companies deserve the same valuation band. For Garmin, the Fair Ratio is 20.6x, moderately below the current 24.1x, suggesting the shares are pricing in more optimism than the fundamentals fully support.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

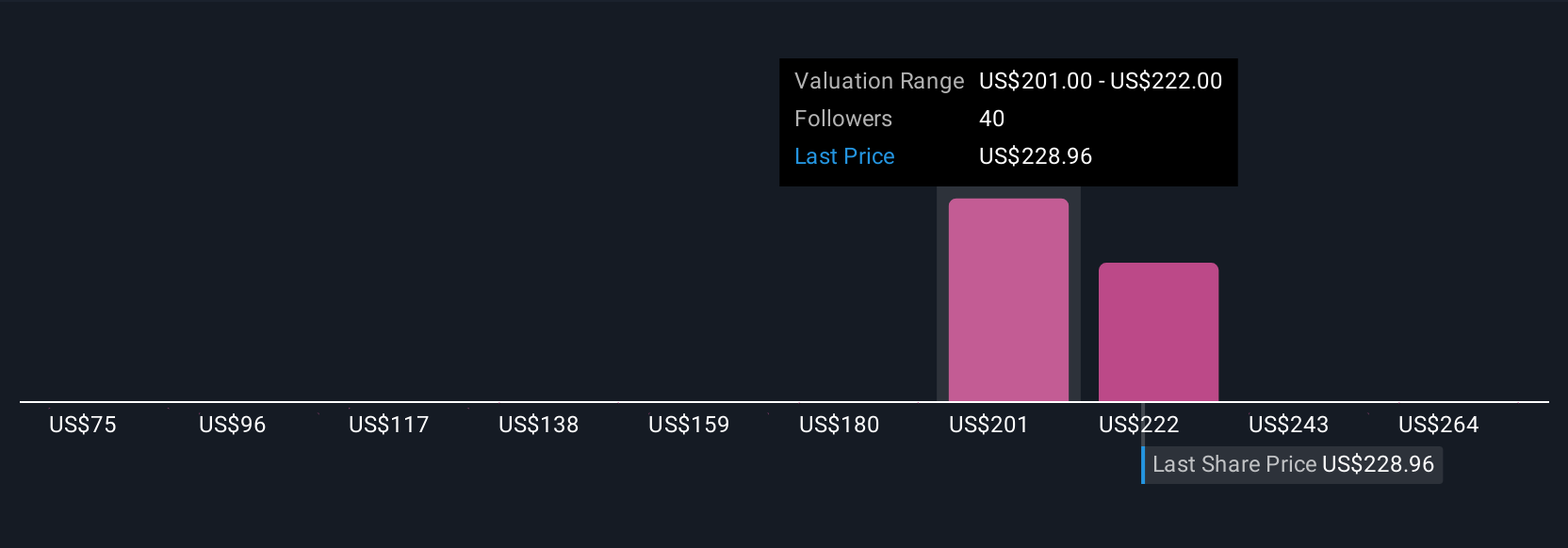

Upgrade Your Decision Making: Choose your Garmin Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach your story about a company to the numbers you think are realistic for its future revenue, earnings, margins, and ultimately its fair value. A Narrative connects three things in one place: the business story you believe, the financial forecast that flows from that story, and the fair value estimate that drops out of those assumptions. On Simply Wall St, used by millions of investors, Narratives live in the Community page and make this process accessible, helping you think through potential entry or exit points by comparing your Fair Value to the live market price. They update dynamically as new information like earnings, guidance, or news arrives, so your view stays current without you rebuilding your model from scratch. For example, one Garmin Narrative might lean bullish and land closer to the high analyst target of just over $300 per share, while a more cautious Narrative might cluster near the low end around $190, showing how different yet structured perspectives can coexist around the same stock.

Do you think there's more to the story for Garmin? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRMN

Garmin

Designs, develops, manufactures, markets, and distributes a range of wireless devices worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026