- United States

- /

- Consumer Durables

- /

- NYSE:GRBK

Is the James Hardie Supply Deal Shaping Green Brick Partners' (GRBK) Quality-First Housing Strategy?

Reviewed by Simply Wall St

- James Hardie Building Products Inc. recently announced the renewal of its exclusive supply agreement with Green Brick Partners, securing Hardie® siding and trim for all Green Brick developments through 2028 across Texas, Georgia, and Florida.

- This multi-year extension underscores Green Brick Partners' distinctive in-house approach to land development and commitment to durable, innovative materials in competitive housing markets.

- We’ll now explore how this extended materials partnership may influence Green Brick Partners' investment narrative and quality-focused strategy.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Green Brick Partners Investment Narrative Recap

To be a shareholder in Green Brick Partners, you need to believe in its unique in-house land development model and the potential for lasting profitability through quality-focused execution, especially in fast-growing southern markets. The extended supply agreement with James Hardie reinforces Green Brick's commitment to premium materials but is unlikely to materially change near-term catalysts or address the biggest risks, such as margin pressures from elevated incentives and affordability challenges. The deal aligns with long-term quality themes, though it does not directly improve visibility on the critical risk of softening backlog growth or demand moderation.

Green Brick’s August 2025 announcement of the Riviera Pines development just outside Houston is closely tied to the recent Hardie partnership renewal, as every new home in this expansion will now feature exclusive Hardie siding and trim. This product consistency may help Green Brick target entry-level buyers and secure build quality, an important consideration as the company increases its exposure to high-growth but competitive markets like Houston. However, expanding in regions heavily affected by affordability trends and regional economic shifts could amplify the risks around sales volatility and margins.

Still, for all the advantages discussed, it’s important for investors to keep an eye on...

Read the full narrative on Green Brick Partners (it's free!)

Green Brick Partners' narrative projects $2.0 billion revenue and $252.1 million earnings by 2028. This requires a 2.1% annual revenue decline and a $95 million decrease in earnings from the current $347.1 million.

Uncover how Green Brick Partners' forecasts yield a $62.00 fair value, a 11% downside to its current price.

Exploring Other Perspectives

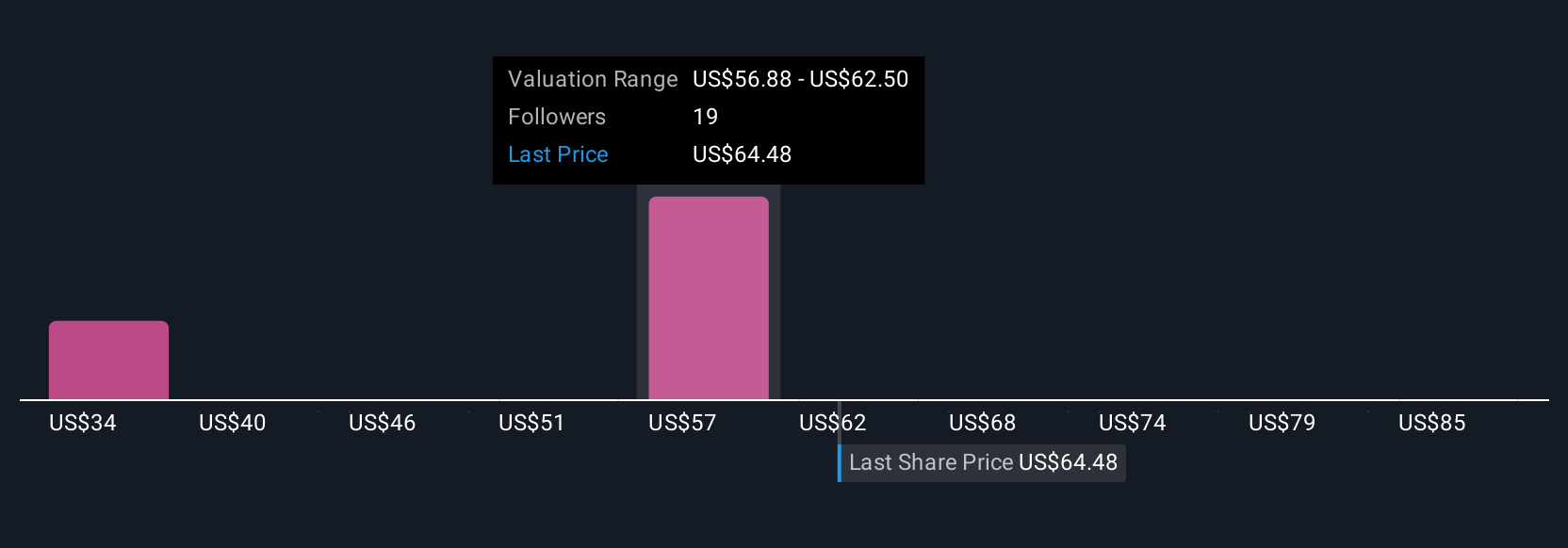

Six Simply Wall St Community valuations for Green Brick Partners show fair values spanning from US$34.02 to US$90.58, highlighting sharply split outlooks. Meanwhile, persistent margin pressures from incentives and pricing concessions remain front of mind for those considering the company’s future earnings power, reinforcing the value of reviewing a range of market perspectives.

Explore 6 other fair value estimates on Green Brick Partners - why the stock might be worth less than half the current price!

Build Your Own Green Brick Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Green Brick Partners research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Green Brick Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Green Brick Partners' overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRBK

Green Brick Partners

Green Brick Partners, Inc (NYSE: GRBK), the third largest homebuilder in Dallas-Fort Worth, is a diversified homebuilding and land development company that operates in Texas, Georgia, and Florida.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives