- United States

- /

- Metals and Mining

- /

- NasdaqGS:METC

Top US Dividend Stocks To Consider In September 2024

Reviewed by Simply Wall St

As of mid-September 2024, the U.S. stock market has been experiencing a significant rally, with major indices like the S&P 500 and Nasdaq Composite wrapping up their best week of the year. This positive momentum comes amidst investor anticipation of potential interest rate cuts by the Federal Reserve. In such an environment, dividend stocks can offer a reliable source of income and stability. Here are three top U.S. dividend stocks to consider in September 2024.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.91% | ★★★★★★ |

| WesBanco (NasdaqGS:WSBC) | 4.67% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 6.01% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.12% | ★★★★★★ |

| Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.89% | ★★★★★★ |

| OceanFirst Financial (NasdaqGS:OCFC) | 4.52% | ★★★★★★ |

| OTC Markets Group (OTCPK:OTCM) | 4.73% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.64% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 4.55% | ★★★★★★ |

| Virtus Investment Partners (NYSE:VRTS) | 4.41% | ★★★★★★ |

Click here to see the full list of 181 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

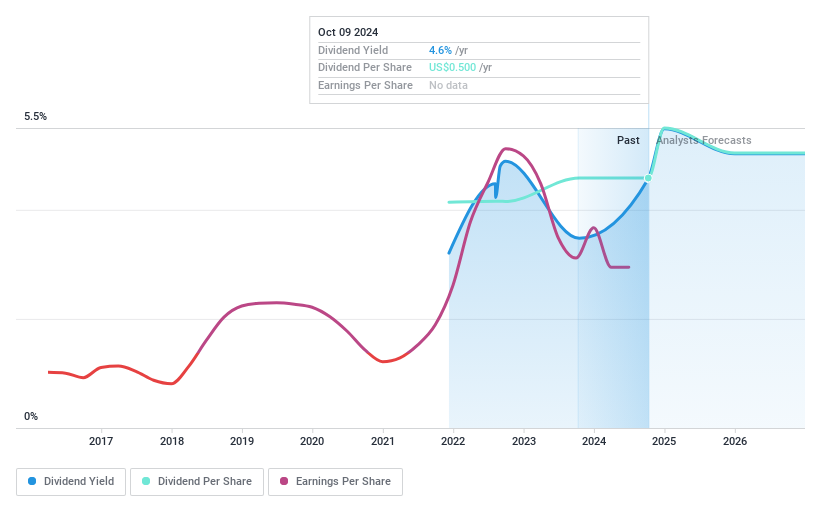

Ramaco Resources (NasdaqGS:METC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ramaco Resources, Inc. develops, operates, and sells metallurgical coal with a market cap of approximately $540.92 million.

Operations: Ramaco Resources generates $717.69 million in revenue from its Metals & Mining - Coal segment.

Dividend Yield: 4.8%

Ramaco Resources offers a stable dividend with a low payout ratio of 45.9%, ensuring coverage by both earnings and cash flows. Despite recent decreases in net income, the company maintains its dividend payments, albeit only for three years. The stock's yield is in the top 25% of US market payers, but its short track record and recent drop from several Russell indices may concern some investors seeking long-term reliability.

- Click to explore a detailed breakdown of our findings in Ramaco Resources' dividend report.

- Our expertly prepared valuation report Ramaco Resources implies its share price may be lower than expected.

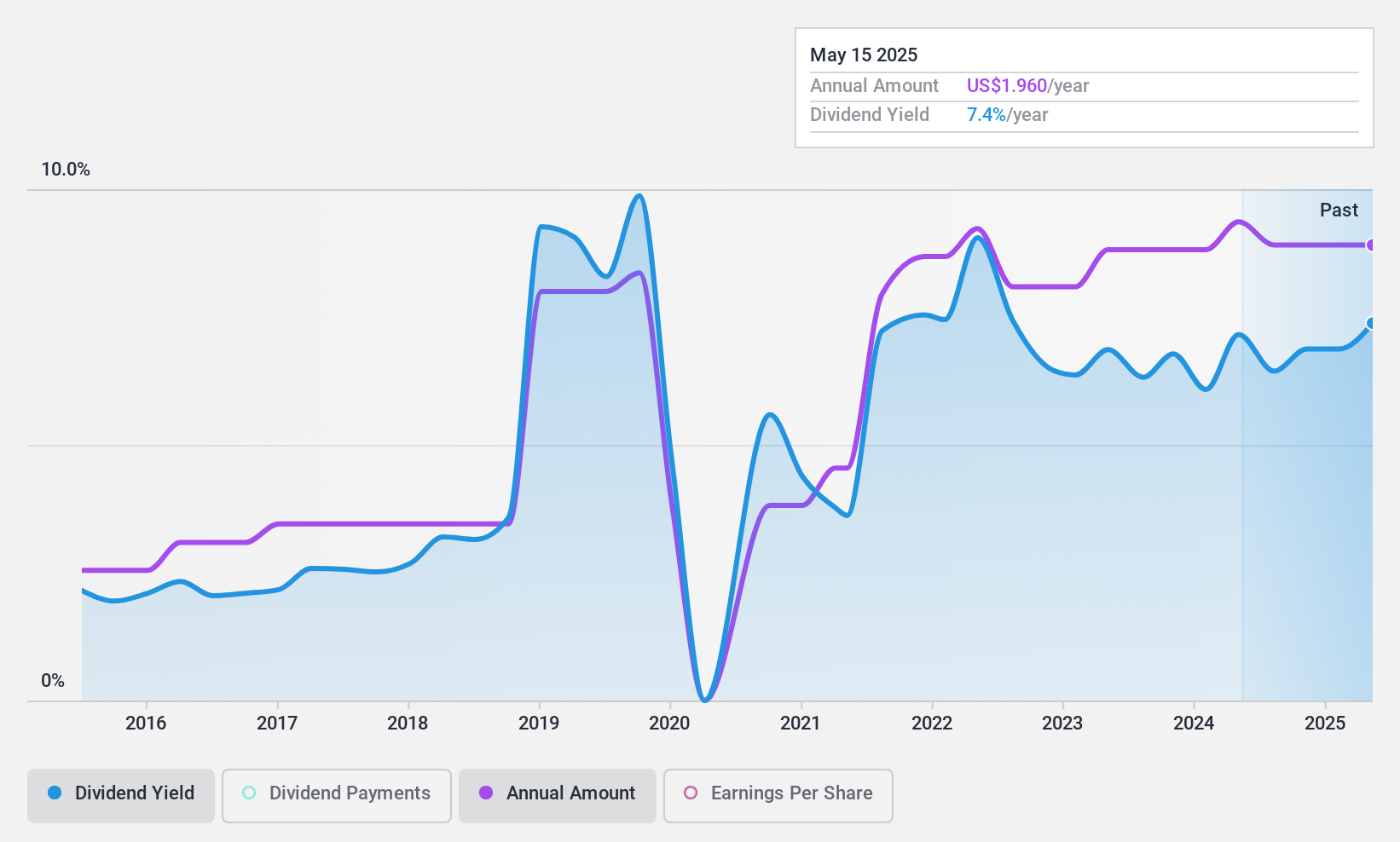

Ethan Allen Interiors (NYSE:ETD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ethan Allen Interiors Inc. operates as an interior design company, and manufacturer and retailer of home furnishings in the United States and internationally, with a market cap of $783.29 million.

Operations: Ethan Allen Interiors Inc. generates revenue from its Retail segment ($540.55 million) and Wholesale segment ($371.09 million), with an inventory profit elimination of -$265.42 million.

Dividend Yield: 6.4%

Ethan Allen Interiors' dividend yield is in the top 25% of US market payers, supported by a payout ratio of 58.8% and a cash payout ratio of 70.6%. Despite earnings forecasted to decline slightly over the next three years, the company declared both regular and special dividends recently. However, its dividend history has been volatile over the past decade, posing potential concerns for investors seeking stable income streams.

- Delve into the full analysis dividend report here for a deeper understanding of Ethan Allen Interiors.

- In light of our recent valuation report, it seems possible that Ethan Allen Interiors is trading beyond its estimated value.

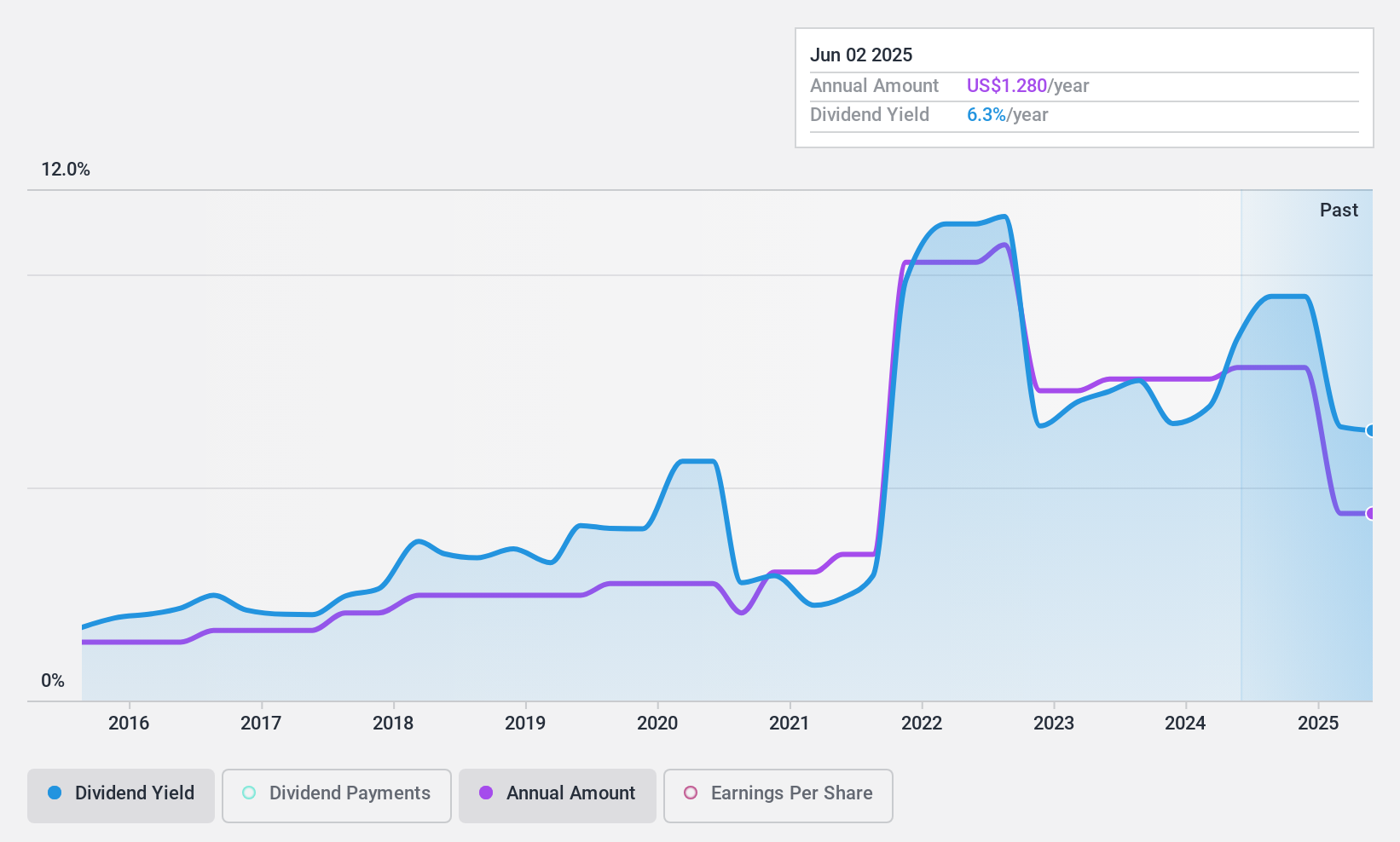

Haverty Furniture Companies (NYSE:HVT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Haverty Furniture Companies, Inc. is a specialty retailer of residential furniture and accessories in the United States with a market cap of $441.86 million.

Operations: Haverty Furniture Companies, Inc. generates $793.72 million from its home furnishings retailing segment.

Dividend Yield: 8.4%

Haverty Furniture Companies' dividend yield ranks in the top 25% of US payers, with a payout ratio of 50.9% and a cash payout ratio of 81.3%, indicating solid coverage by earnings and cash flows. Despite a history of volatile dividends, the company has consistently paid dividends since 1935. Recent financials show declining sales and net income, which may impact future payouts despite recent affirmations of dividend payments at $0.32 per share for common stock.

- Unlock comprehensive insights into our analysis of Haverty Furniture Companies stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Haverty Furniture Companies is priced lower than what may be justified by its financials.

Seize The Opportunity

- Dive into all 181 of the Top US Dividend Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:METC

Ramaco Resources

Engages in the development, operation, and sale of metallurgical coal.

Very undervalued with adequate balance sheet.