- United States

- /

- Luxury

- /

- NYSE:DECK

Should Urban Outfitters and UGG’s In-Store Collaboration Influence Deckers Outdoor (DECK) Investors’ Decisions?

Reviewed by Sasha Jovanovic

- In early November 2025, Urban Outfitters announced an immersive in-store concept in partnership with Deckers Outdoor’s UGG brand, highlighting popular styles and holiday-ready products in select locations nationwide.

- This collaboration aims to strengthen UGG’s cultural connection with Gen Z shoppers, while recent institutional investor interest has spotlighted Deckers Outdoor ahead of the key holiday season.

- We’ll examine how the heightened Gen Z brand engagement through Urban Outfitters may influence Deckers Outdoor’s longer-term investment outlook.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Deckers Outdoor Investment Narrative Recap

The core investment case for Deckers Outdoor rests on the continued success and cultural resonance of its UGG and HOKA brands, international expansion, and innovative retail partnerships. While the UGG x Urban Outfitters experiential launch targets Gen Z engagement, a key short-term catalyst for holiday sales, the overall impact on margins and risk from heightened discounting environments is not yet clear, so the near-term effect may prove modest. The biggest risk remains the industry-wide pressure on gross margins from increasing promotions and possible inventory closeouts. Recent guidance from Deckers management sets expectations for fiscal-year net sales of US$5.35 billion and diluted EPS between US$6.30 and US$6.39, highlighting confidence heading into the peak holiday season. This aligns with the focus on strong direct-to-consumer and retail partnerships, a catalyst for maintaining brand heat and healthier margins while navigating retail environment changes. Yet, investors should not ignore the contrasting risk that pricing discipline could be tested if consumer demand wavers during...

Read the full narrative on Deckers Outdoor (it's free!)

Deckers Outdoor's narrative projects $6.5 billion in revenue and $1.1 billion in earnings by 2028. This requires 8.5% yearly revenue growth and an $110 million earnings increase from current earnings of $989.7 million.

Uncover how Deckers Outdoor's forecasts yield a $111.97 fair value, a 33% upside to its current price.

Exploring Other Perspectives

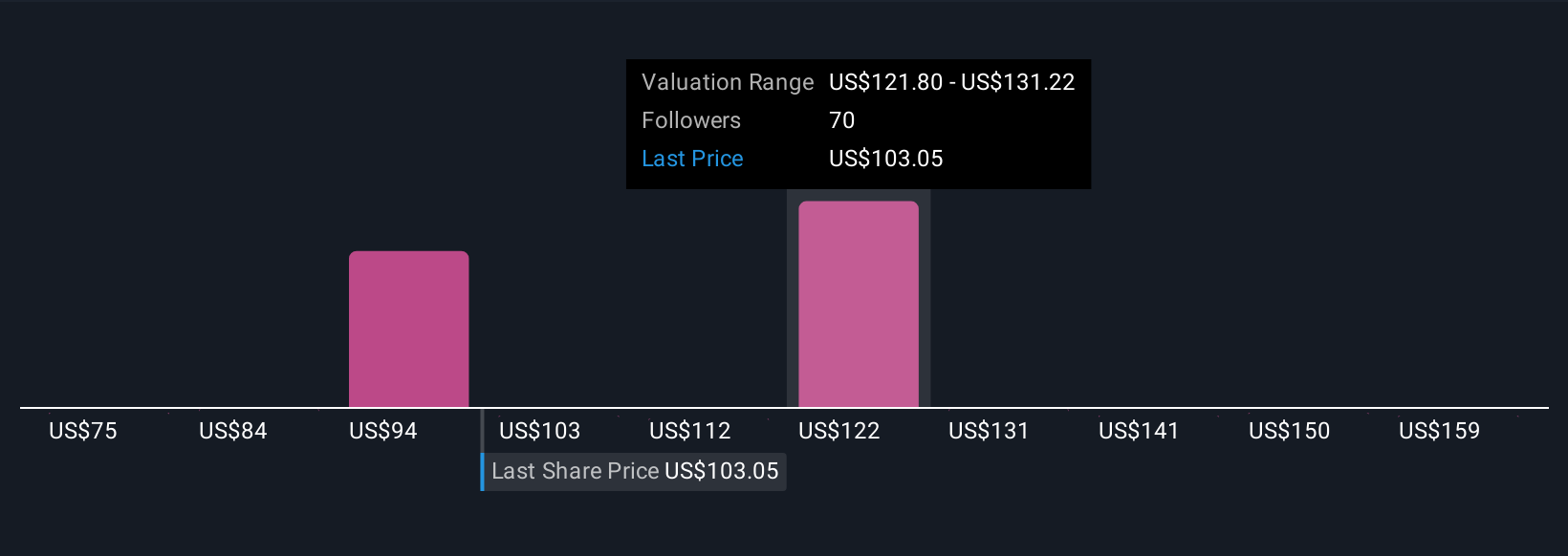

Simply Wall St Community members have estimated fair value for Deckers Outdoor from US$74.68 to US$158 across 22 opinions. Despite recent brand partnerships fueling growth expectations, many in the market continue to watch for signs of margin erosion as competitive pressures rise.

Explore 22 other fair value estimates on Deckers Outdoor - why the stock might be worth as much as 87% more than the current price!

Build Your Own Deckers Outdoor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Deckers Outdoor research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Deckers Outdoor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Deckers Outdoor's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DECK

Deckers Outdoor

Designs, markets, and distributes footwear, apparel, and accessories for casual lifestyle use and high-performance activities in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives