- United States

- /

- Luxury

- /

- NYSE:DECK

Deckers Outdoor (NYSE:DECK) Sees 23% Price Increase This Month

Reviewed by Simply Wall St

Deckers Outdoor (NYSE:DECK) experienced a notable 23% increase in its share price last month. This sharp price move aligns with the broader market trend of positive returns, as seen with the 1% rise over the last seven days. In contrast to some sector shifts due to economic factors, Deckers Outdoor's rise could be linked to a blend of investor optimism and potential corporate developments. In a period marked by tariff discussions affecting broader markets, Deckers managed to secure significant gains, countering any negative sentiment from external economic uncertainties, thus emphasizing its resilience amid fluctuating market conditions.

We've spotted 1 weakness for Deckers Outdoor you should be aware of.

The recent surge in Deckers Outdoor's share price by 23% in April may have implications for its ongoing brand strategies and growth narratives. This positive momentum comes at a time when Deckers is focusing on global expansion, particularly with its UGG and HOKA brands, and could enhance investor confidence in upcoming product launches and direct-to-consumer initiatives. Additionally, the robust share performance highlights the company's resilience against economic uncertainties, and may bolster future revenue and earnings forecasts, especially in expanding markets like APAC and Europe.

Over the longer-term, Deckers has experienced a significant total return of 440.22% over the past five years, marking it as a strong performer in its sector. Despite this impressive growth, its relative performance against the market in the past year shows DECK underperformed compared to the US market, which returned 8.2%. Within the luxury industry, Deckers outperformed, with industry figures showing a return of -16.1% for the same period.

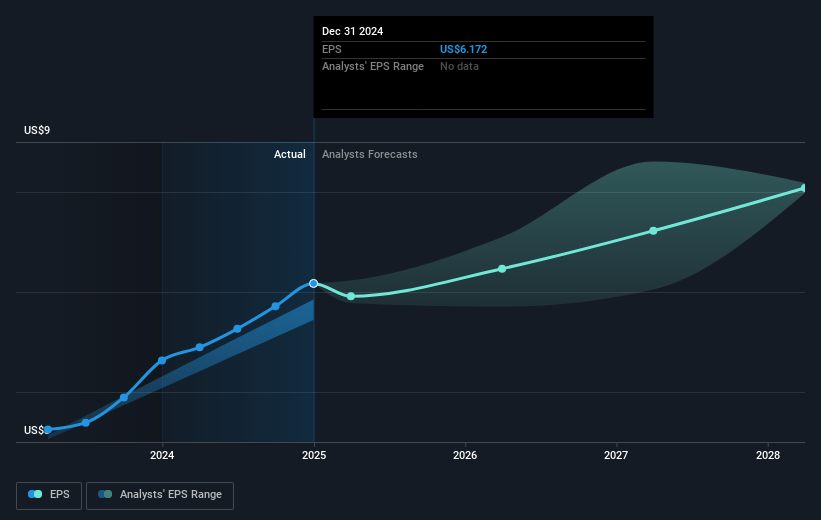

In the context of analyst expectations, the current share price of $117.07 reflects a considerable discount of 30.5% to the consensus price target of $168.56. The recent share price movement could support earnings growth projections, with analysts expecting earnings to grow to $1.1 billion by 2028, despite currency and supply chain risks. For the stock to reach the price target, it would require a valuation adjustment with a future PE ratio of 28.6x, indicating potential upward movement if the company's strategic initiatives yield the anticipated results.

Evaluate Deckers Outdoor's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Deckers Outdoor, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DECK

Deckers Outdoor

Designs, markets, and distributes footwear, apparel, and accessories for casual lifestyle use and high-performance activities in the United States and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives