- United States

- /

- Luxury

- /

- NYSE:DECK

Deckers Outdoor (DECK): Evaluating Valuation as Hoka Growth and Analyst Optimism Fuel Pre-Earnings Buzz

Reviewed by Kshitija Bhandaru

Deckers Outdoor (DECK) is in the spotlight as anticipation builds ahead of its upcoming quarterly earnings release. Investors are watching closely, especially as Hoka’s rising presence in the premium running shoe segment is fueling conversation.

See our latest analysis for Deckers Outdoor.

Deckers Outdoor’s share price has seen some turbulence lately, down 16.5% over the past month and sliding more than 51% year-to-date. Even so, the broader business story, highlighted by Hoka’s momentum and resilient multi-year execution, offers hope for a turnaround. While the 1-year total shareholder return stands at -38.2%, those who stayed the course over five years have seen a compelling 139.9% total return. This makes the company a name with proven long-term potential despite current volatility.

If you’re interested in where growth and leadership overlap, now’s a great moment to explore fast growing stocks with high insider ownership

With shares hovering well below recent highs and analysts still forecasting notable upside, the real question is whether Deckers Outdoor's current valuation leaves the stock undervalued or if the market has already taken its future growth prospects into account.

Most Popular Narrative: 21.9% Undervalued

Deckers Outdoor’s last close at $99.06 is notably below the narrative’s fair value estimate of $126.77, signaling significant potential upside if analyst projections come to fruition. This gap sets the table for a lively debate about whether the current price is really a bargain or a trap, based on the company’s prospects, growth assumptions, and the latest margin outlook.

Deckers' focus on international expansion, particularly in APAC regions like China and Europe, is expected to continue driving substantial revenue improvements, as seen with UGG's and HOKA's current performance internationally.

Want to know what underpins this bold upside? The fair value hinges on global brand momentum, ambitious revenue targets, and a profit multiple usually reserved for market favorites. Which of these levers matters most? Only the full narrative breaks down the exact mix driving that valuation leap.

Result: Fair Value of $126.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential headwinds such as softening demand in direct-to-consumer channels and foreign currency swings could challenge the bullish narrative for Deckers Outdoor.

Find out about the key risks to this Deckers Outdoor narrative.

Another View: What About the DCF Model?

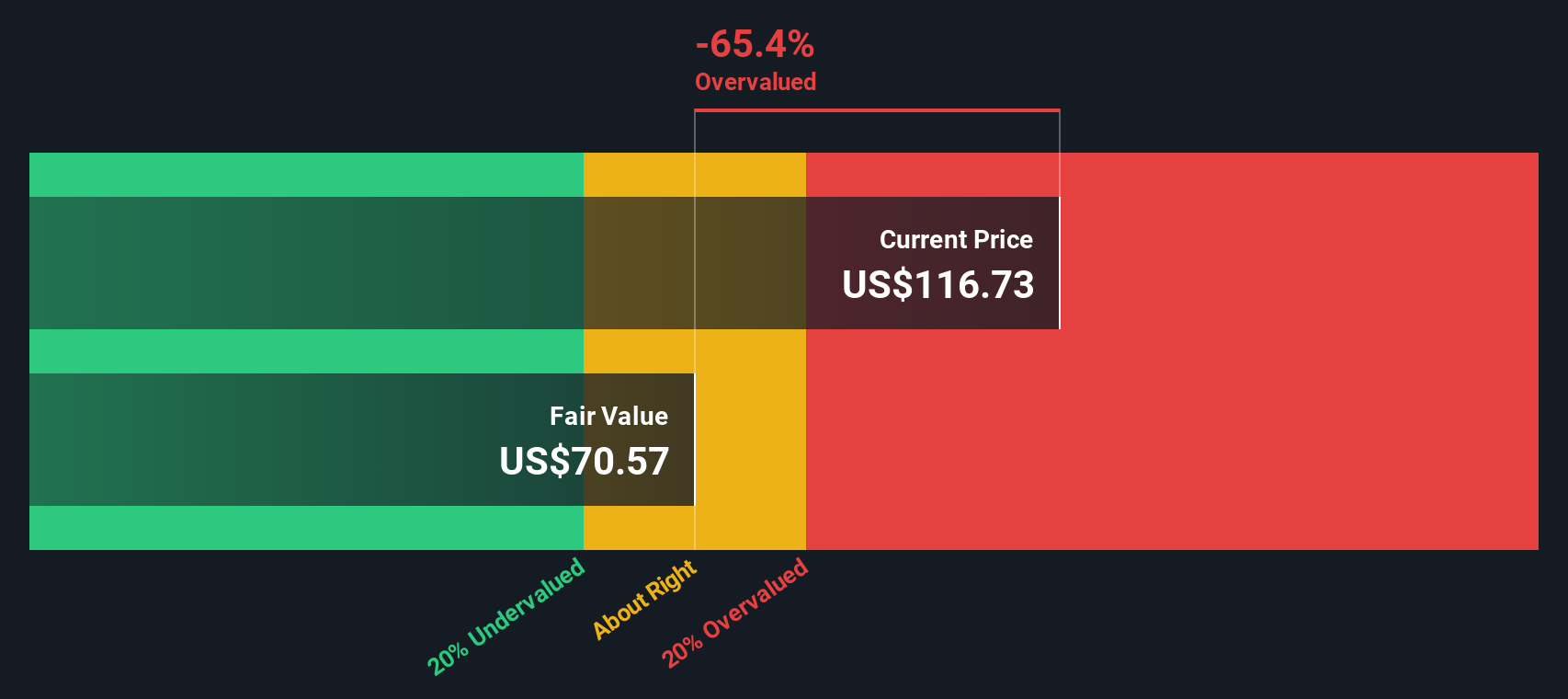

While analyst targets suggest Deckers Outdoor is undervalued, our SWS DCF model offers a different angle. According to this approach, shares currently trade slightly above their estimated fair value. This highlights a real divide. Are analyst growth forecasts too optimistic, or is the DCF too conservative? Which view should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Deckers Outdoor for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Deckers Outdoor Narrative

If you think differently or want to dig deeper into the numbers yourself, it’s quick and easy to build your own big-picture narrative in just minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Deckers Outdoor.

Looking for more investment ideas?

Don't limit yourself to just one opportunity. Uncover stocks that others overlook or miss out on market shifts that could work to your advantage.

- Capitalize on the latest healthcare breakthroughs by checking out these 33 healthcare AI stocks which brings medical innovation to the forefront.

- Supercharge your portfolio’s income potential and discover opportunities for higher yields by exploring these 20 dividend stocks with yields > 3% with returns above 3%.

- Catch the momentum of the digital economy early with these 79 cryptocurrency and blockchain stocks as it transforms how we think about finance and technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DECK

Deckers Outdoor

Designs, markets, and distributes footwear, apparel, and accessories for casual lifestyle use and high-performance activities in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives