- United States

- /

- Luxury

- /

- NYSE:DECK

A Fresh Look at Deckers Outdoor (DECK) Valuation Following Earnings Beat, Analyst Upgrades, and Market Volatility

Reviewed by Kshitija Bhandaru

Deckers Outdoor (DECK) stock has seen considerable swings lately, attracting investor attention after stronger-than-expected earnings and analyst upgrades. However, broader uncertainty remains regarding management guidance and the macro backdrop.

See our latest analysis for Deckers Outdoor.

This stretch of volatility for Deckers Outdoor follows a wave of upbeat earnings and ongoing enthusiasm for its HOKA and UGG brands. However, the latest share price return reflects recent uncertainty, trading near $103.05 after a notable pullback. While the market is wrestling with shifting risk perceptions, the company’s three- and five-year total shareholder returns show its long-term story remains intact. This suggests momentum could easily return alongside renewed guidance or increased macro clarity.

If you’re watching for fresh growth stories and want more ideas beyond footwear and retail, it’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading near recent lows, while analyst optimism and core brand momentum remain strong, it raises a pressing question for investors: is Deckers Outdoor undervalued at these levels, or is the market fully pricing in future growth?

Most Popular Narrative: 20.3% Undervalued

Compared to Deckers Outdoor’s last close at $103.05, the most widely followed narrative sees fair value substantially higher. This significant gap is driven by ambitious growth expectations. However, are these expectations too bold? The following passage summarizes the key points of that projection.

The UGG and HOKA brands have shown significant growth, with expectations to continue driving revenue increases through innovative product launches and expanding brand recognition globally. This will likely impact revenue growth positively.

Want to know why this forecast is so bullish? The secret lies in the narrative’s aggressive future growth and profit assumptions. Are you ready to uncover the projections behind this high fair value? The numbers may surprise you.

Result: Fair Value of $129.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, currency fluctuations or short-term losses from winding down the Koolaburra brand could undermine the bullish case for Deckers Outdoor’s growth.

Find out about the key risks to this Deckers Outdoor narrative.

Another View: Looking Through a Different Lens

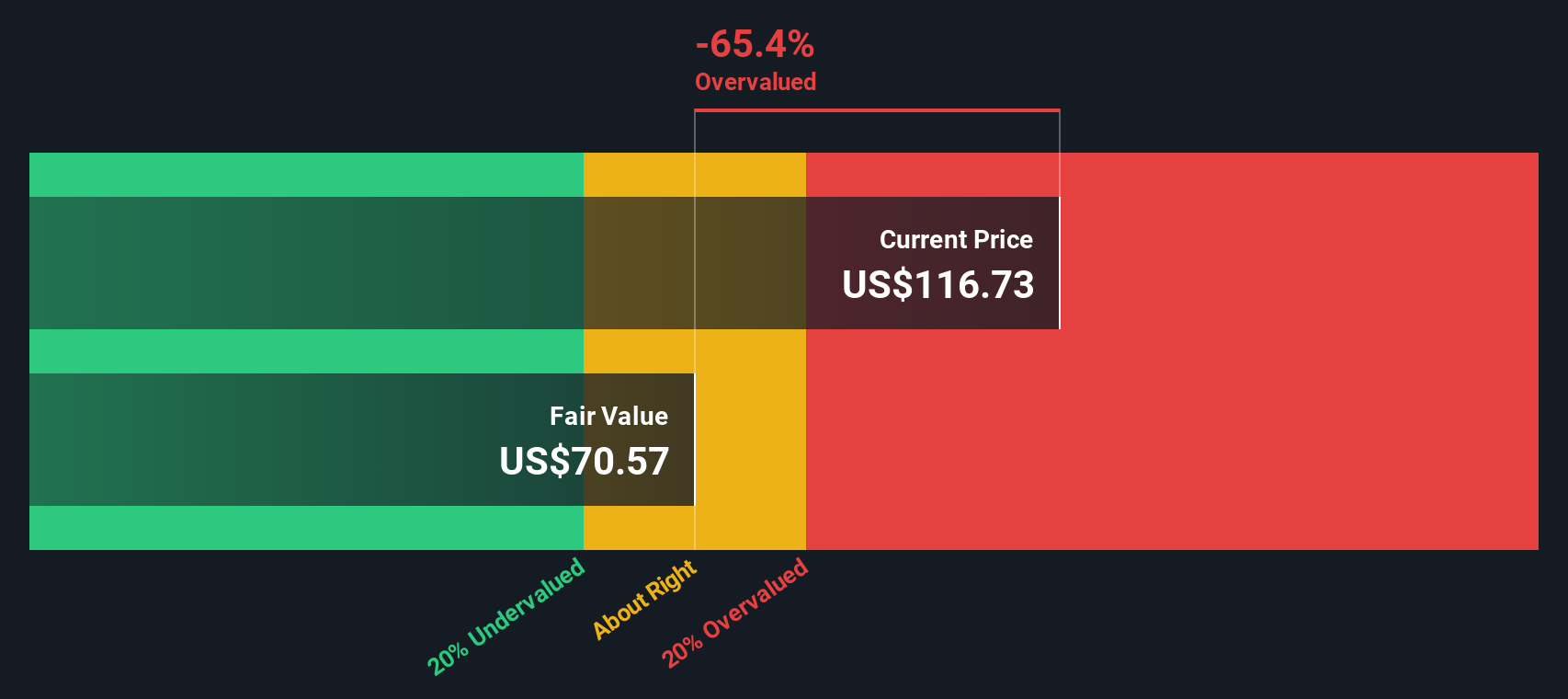

There is another way to test the story. When we use the SWS DCF model, Deckers Outdoor actually appears overvalued, with the current price sitting above our fair value estimate of $96.57. This result stands in contrast to the upbeat analyst target. Could the market be too optimistic, or is DCF missing growth drivers?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Deckers Outdoor for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Deckers Outdoor Narrative

If you have a different take or want to see how your own research stacks up against these narratives, it takes just minutes to build your personal outlook. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Deckers Outdoor.

Looking for more investment ideas?

Take your research further and spot opportunities others might miss by using the Simply Wall Street Screener. These fresh ideas could give your portfolio an edge:

- Spot companies reshaping healthcare and technology by tapping into new breakthroughs with these 32 healthcare AI stocks.

- Uncover reliable sources of passive income offering strong yields thanks to these 19 dividend stocks with yields > 3%.

- Find technology trailblazers working at the intersection of innovation and growth by checking out these 24 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DECK

Deckers Outdoor

Designs, markets, and distributes footwear, apparel, and accessories for casual lifestyle use and high-performance activities in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives