- United States

- /

- Consumer Durables

- /

- NYSE:CCS

Is Century Communities’ (CCS) Expansion into High-Growth Markets Shaping Its Long-Term Strategy?

Reviewed by Sasha Jovanovic

- Century Communities, Inc. recently announced several new residential community launches and expansions in fast-growing markets such as Spartanburg, SC, Ocala, FL, and Locust, NC, offering a wide range of single-family homes and townhomes with modern amenities.

- These developments highlight the company's efforts to broaden its community footprint in regions with strong population growth and continued housing demand.

- We'll examine how Century Communities' focus on expanding into key growth markets may impact its long-term outlook and investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Century Communities Investment Narrative Recap

To believe in Century Communities, investors need confidence that long-term U.S. housing undersupply and favorable demographics will fuel demand for new homes, supporting sustained sales and cash flow. The company’s recent announcements of new community launches in Spartanburg, Ocala, and Locust show continued momentum in expanding its operational base, but do not materially shift the primary short-term catalyst: affordable housing demand in a higher mortgage rate environment. The biggest risk remains declining affordability, particularly if interest rates rise further, dampening buyer activity.

Among the latest events, the Grand Opening of Meadow Creek Village in Locust, NC, is an example of Century Communities addressing areas with population growth and diverse housing needs. While this supports the company’s focus on underserved markets, affordability pressures and the sensitivity of first-time buyers remain highly relevant to the near-term outlook.

But investors should also be alert to the possibility that waning affordability in a rising rate environment could disproportionately pressure entry-level home sales if...

Read the full narrative on Century Communities (it's free!)

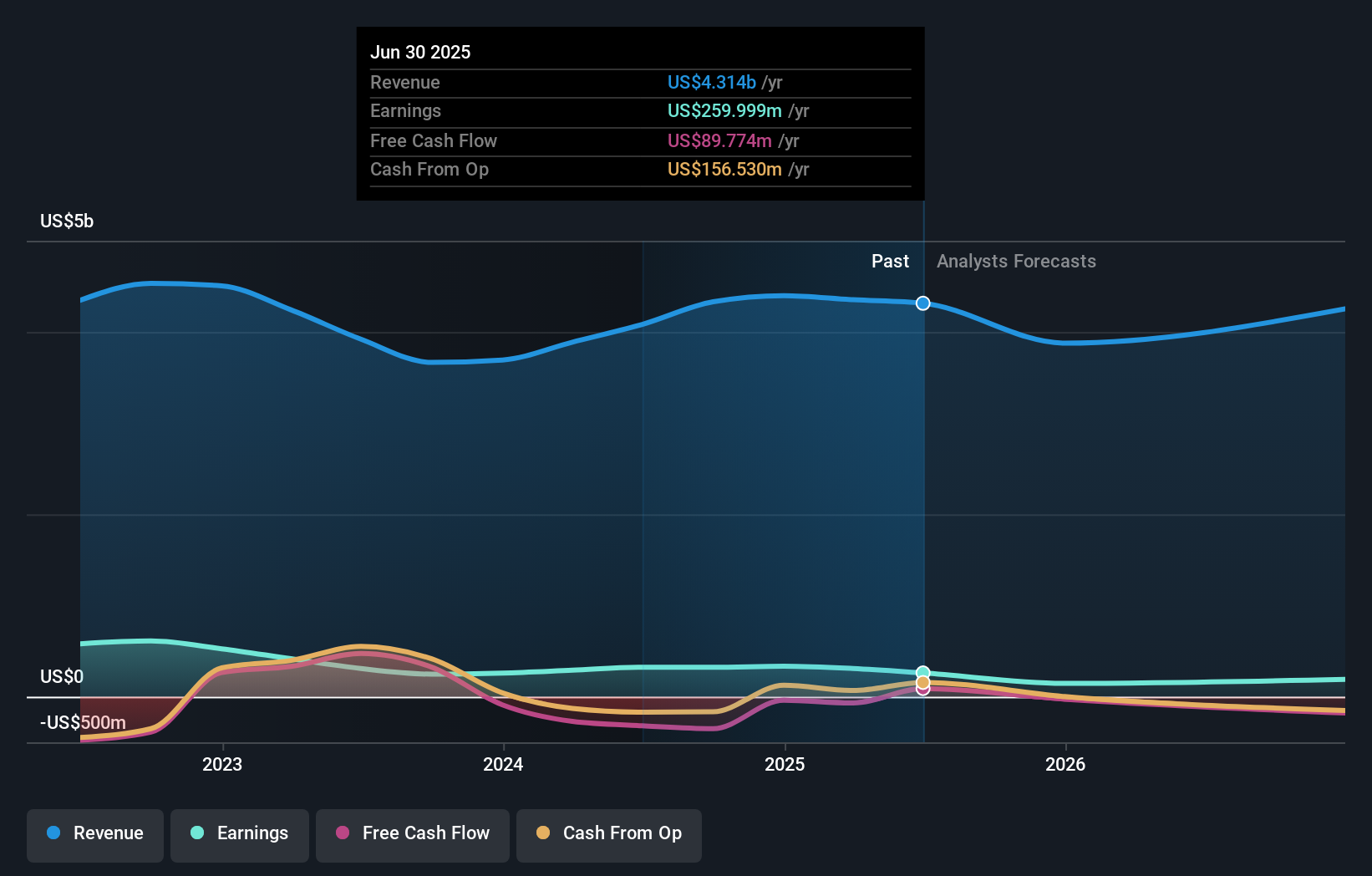

Century Communities' narrative projects $4.1 billion revenue and $114.5 million earnings by 2028. This requires a 1.9% annual revenue decline and a $145.5 million decrease in earnings from the current $260.0 million.

Uncover how Century Communities' forecasts yield a $59.50 fair value, a 7% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members see wide fair value estimates for Century Communities, from US$19.07 to US$59.50 based on two recent analyses. Views are split, and with higher rates putting pressure on affordability, it is worth exploring how your outlook stacks up against others.

Explore 2 other fair value estimates on Century Communities - why the stock might be worth less than half the current price!

Build Your Own Century Communities Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Century Communities research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Century Communities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Century Communities' overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCS

Century Communities

Engages in the design, development, construction, marketing, and sale of single-family attached and detached homes.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives