- United States

- /

- Consumer Durables

- /

- NYSE:CCS

Century Communities (CCS): Assessing Valuation After a Recent 9% Monthly Share Price Rebound

Reviewed by Simply Wall St

Century Communities (CCS) has slipped about 1 % over the past week but is still up roughly 9 % this month, leaving investors weighing whether the recent bounce has more room to run.

See our latest analysis for Century Communities.

Zooming out, the 1 month share price return of 9 % contrasts with a weaker year to date share price performance and a negative 1 year total shareholder return. This suggests recent momentum may be a tentative rebound rather than a firm trend shift.

If Century Communities has you watching the housing cycle more closely, it could be worth scanning auto manufacturers for other cyclical names that might be setting up interesting opportunities.

With growth modest, the share price below recent highs, and analysts only seeing limited upside from here, investors now face the key question: Is Century Communities quietly undervalued, or already pricing in its next leg of growth?

Most Popular Narrative Narrative: 2.4% Undervalued

Compared with the last close at $61.50, the most popular narrative sees fair value at $63, implying only a slim upside from here.

The analysts have a consensus price target of $59.5 for Century Communities based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $70.0, and the most bearish reporting a price target of just $49.0.

Want to see what justifies paying more for slower growth and thinner margins over time? The narrative leans on one critical profitability shift and a bolder future earnings multiple. Curious how those moving parts combine to support that fair value call? Click through to unpack the full story behind the target.

Result: Fair Value of $63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent housing undersupply and an expanding community count, backed by a sizable lot pipeline, could support stronger growth than the cautious narrative implies.

Find out about the key risks to this Century Communities narrative.

Another View: Cash Flows Paint a Harsher Picture

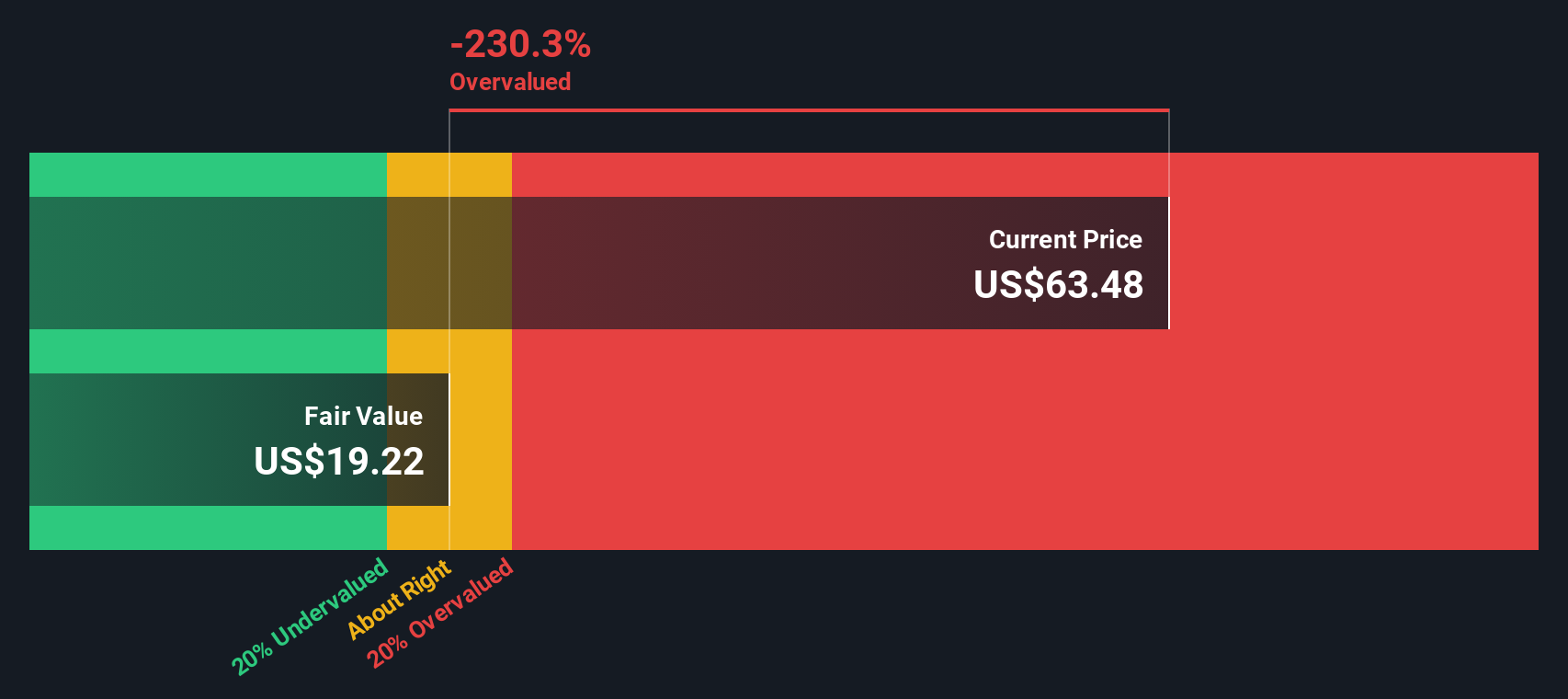

While the narrative-based fair value of $63 suggests Century Communities is slightly undervalued, our DCF model is far more cautious. It estimates fair value closer to $18.92, implying the shares are materially overvalued. Which story on future cash flows do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Century Communities for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 910 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Century Communities Narrative

If you are not convinced by these perspectives or want to dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your Century Communities research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next watchlist candidates with data backed ideas from the Simply Wall St Screener so you do not miss potential opportunities.

- Explore mispriced opportunities by targeting companies flagged as undervalued through these 910 undervalued stocks based on cash flows built on detailed cash flow assessments.

- Focus on innovation by zeroing in on cutting edge names within these 26 AI penny stocks that are contributing to real world AI adoption.

- Review potential income opportunities by filtering for reliable payers via these 13 dividend stocks with yields > 3% focused on yields above 3% with solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCS

Century Communities

Engages in the design, development, construction, marketing, and sale of single-family attached and detached homes.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion