- United States

- /

- Consumer Durables

- /

- NYSE:BLD

TopBuild (BLD): Exploring Valuation Following Mixed Recent Share Price Movements

Reviewed by Kshitija Bhandaru

TopBuild (BLD) shares have seen some swings over the past month, with the stock dipping about 4% even as it remains up nearly 15% for the past 3 months. Investors may be looking for new catalysts or signals as the market reacts to shifting sentiment in the home construction and insulation sector.

See our latest analysis for TopBuild.

Momentum for TopBuild has cooled compared to earlier this year, as the past month's share price slipped while still hanging onto gains from a strong spring run. Over the last 12 months, the company’s total shareholder return stands at about 3.5%. Five-year investors have enjoyed a far bigger payoff, hinting at the lasting value some see in the business, even as recent price action has paused.

If you’re curious what else is attracting investor attention, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

The stock’s recent cool-off could point to a bargain in the making. However, with shares still up solidly on the year, the real question is whether TopBuild is undervalued right now or if the market has already priced in future growth potential.

Most Popular Narrative: 10.6% Undervalued

TopBuild’s last close of $399.39 sits notably below the narrative’s fair value, suggesting some upside if consensus assumptions prove correct. The story behind this valuation highlights significant shifts underway in TopBuild’s business model and sector positioning.

The company's expansion into commercial and industrial end-markets, especially through the Progressive Roofing acquisition, is increasing TopBuild's diversification away from cyclical residential exposure and growing access to non-discretionary, recurring revenue streams. This supports sustained revenue and margin resilience over time.

Want to know the story behind this premium outlook? The narrative hinges on bold growth targets, narrower margins, and an earnings forecast the market does not expect. Discover what assumptions set this target apart. One number in particular may surprise you.

Result: Fair Value of $446.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in U.S. residential construction and challenges integrating recent acquisitions could quickly shift sentiment and undermine this bullish outlook.

Find out about the key risks to this TopBuild narrative.

Another View: What Do Market Multiples Say?

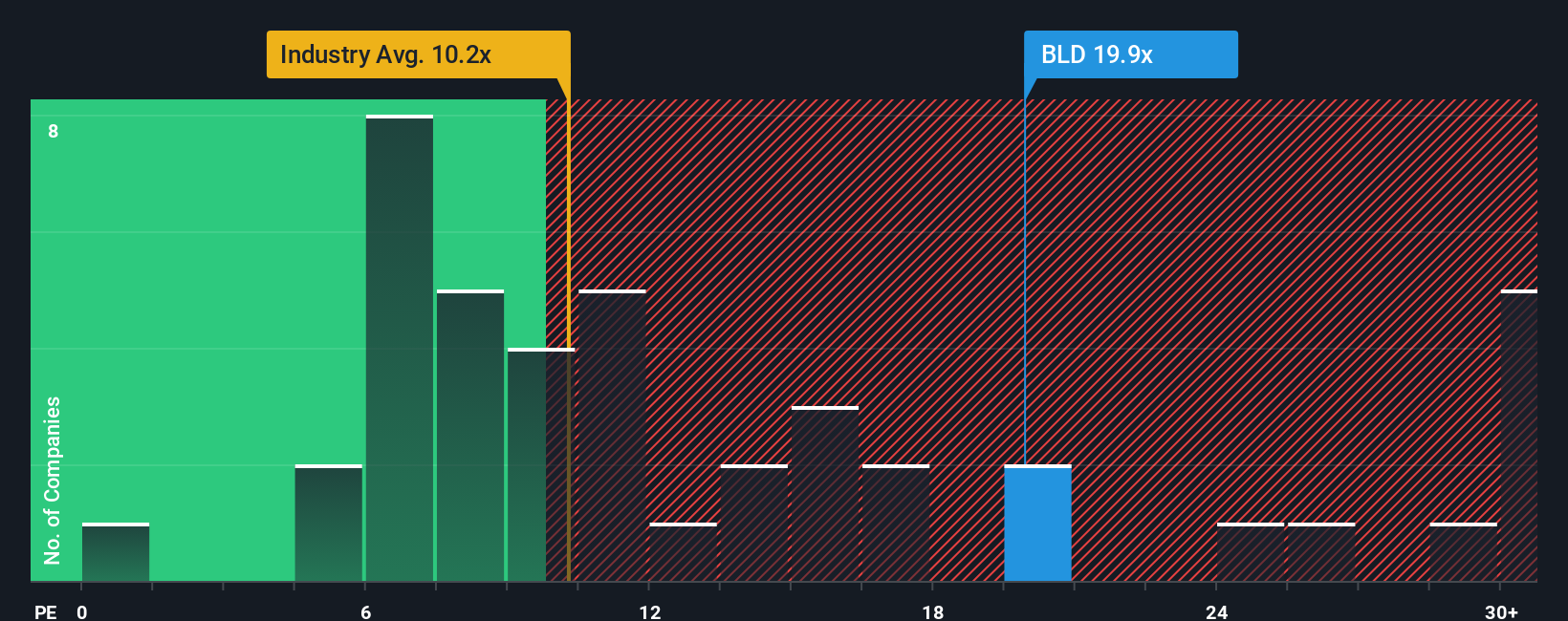

Looking at TopBuild’s valuation through its price-to-earnings ratio reveals a different story. The company trades at 18.8 times earnings, which is significantly higher than both its industry peers (11.7x) and the fair ratio derived from historical trends (15.9x). This premium suggests the market sees more growth or less risk, but it could also mean shares are at risk if expectations fall short. What is driving the willingness to pay extra, and could sentiment flip?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TopBuild Narrative

If you think there’s more to the story, or would rather do your own deep dive, you can shape your own TopBuild perspective in just a few minutes with Do it your way.

A great starting point for your TopBuild research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the curve and make smarter moves by checking out these hand-picked investment themes on Simply Wall Street. Don’t miss your chance to spot winners where others aren’t even looking.

- Unlock the potential of market innovators by scanning these 24 AI penny stocks, as they are reshaping industries with artificial intelligence advancements.

- Boost your income with reliability by exploring these 19 dividend stocks with yields > 3%, which offer attractive yields and steady performance for long-term investors.

- Step into the next wave of technology by examining these 26 quantum computing stocks, which are pioneering breakthroughs in computing and high-performance innovations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TopBuild might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLD

TopBuild

Engages in the installation and distribution of insulation and other building material products to the construction industry.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives