- United States

- /

- Consumer Durables

- /

- NYSE:BLD

Is TopBuild’s Latest Earnings Push Justified After 6.8% Weekly Jump?

Reviewed by Bailey Pemberton

If you have been wrestling with the question of whether to buy, sell, or simply hold onto TopBuild stock, you are not alone. With TopBuild closing at $424.55 and notching a 6.8% gain just over the past week, investors are starting to take notice again. Its longer-term returns are even more eye-catching, with the stock up an impressive 154.4% over the last three years and 133.8% over five years. That is the kind of steady outperformance that tends to get people wondering if the best is already behind us or if more gains are in store.

Recent market developments around the building materials and construction sector have helped boost conviction that companies like TopBuild can still surprise investors, sometimes through operational execution and sometimes simply from being in the right place at the right time. Of course, underneath the surface, questions about how “expensive” or “cheap” TopBuild really is remain as relevant as ever.

On that note, when we add up the various approaches investors use to judge a company’s valuation, TopBuild does look undervalued in just 2 out of 6 major checks. Its value score is a 2, signaling that while there is some discount lurking, this is not an across-the-board bargain either.

So what is the real story here? Let us walk through some of the most common valuation methods investors lean on. Later, I will share a perspective on valuation that is a little less conventional but possibly far more useful for decision-making.

TopBuild scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: TopBuild Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its future cash flows and then discounting those back to today's dollars. This approach aims to capture the actual value generated by the business over many years, providing investors with a long-term perspective on whether the stock is a good deal.

For TopBuild, the latest reported Free Cash Flow stands at $786.86 million. According to the 2 Stage Free Cash Flow to Equity model, analysts forecast Free Cash Flow to steadily grow over the next decade, with projections climbing as high as $1.34 billion by 2035. While analyst estimates are typically available for five years, further expectations have been extrapolated out to ten years to capture the longer-term picture.

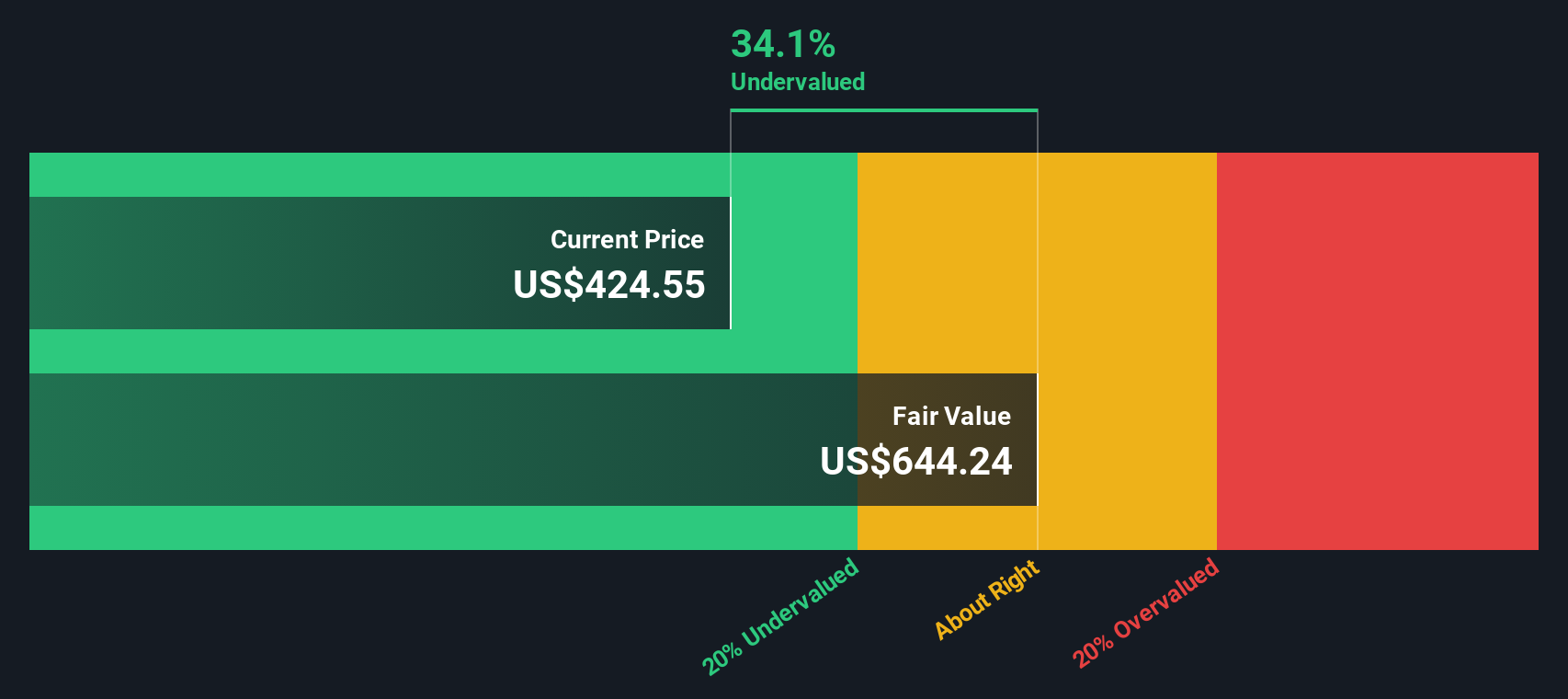

Based on these cash flow projections and after applying an appropriate discount rate, the DCF model calculates an intrinsic value of $644.24 per share for TopBuild compared to its recent closing price of $424.55. This means the stock is trading at a 34.1% discount to its estimated true value, suggesting a notable opportunity for investors who believe in the company's growth trajectory.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests TopBuild is undervalued by 34.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: TopBuild Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used valuation measures for profitable businesses, like TopBuild, because it helps investors gauge how much they are paying for each dollar of earnings generated by the company. The “right” PE ratio can depend on factors like how fast a business is expected to grow, its profitability, and any risks it faces along the way.

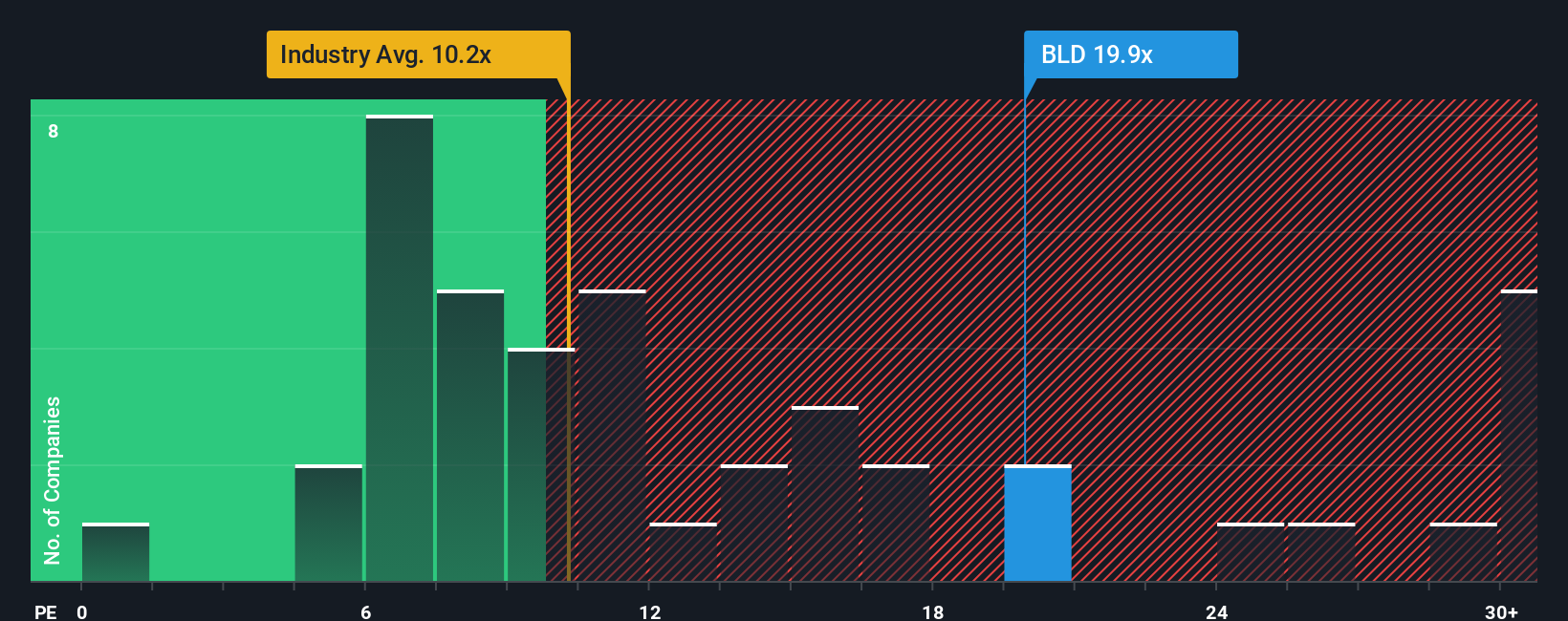

TopBuild currently trades at a PE ratio of 20x. When we compare this figure to major benchmarks, we find the industry average for Consumer Durables sits at about 10.7x. Peer companies average a PE ratio of 14.5x, which is notably below where TopBuild trades today. Both these numbers suggest TopBuild is valued more richly than the typical competitor or industry player. However, relying only on these comparisons can be misleading, as they do not account for the company’s specific growth outlook, profitability, or any unique risks.

This is where Simply Wall St’s proprietary Fair Ratio comes into play. Calculated using factors such as TopBuild’s expected earnings growth, profit margins, market capitalization, and the industry it operates in, the Fair Ratio offers a more comprehensive and tailored benchmark. For TopBuild, the Fair Ratio sits at 15.8x, which is the multiple you might expect to pay given all those considerations. Because TopBuild’s actual PE ratio of 20x is noticeably above this Fair Ratio, it suggests investors are paying a premium for the stock that may not be fully justified by its fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your TopBuild Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is your unique story of how you see a company’s future, combining your expectations for its growth and profitability with the numbers, such as how much revenue, earnings, and margin you believe are realistic, to arrive at your own fair value estimate for the stock.

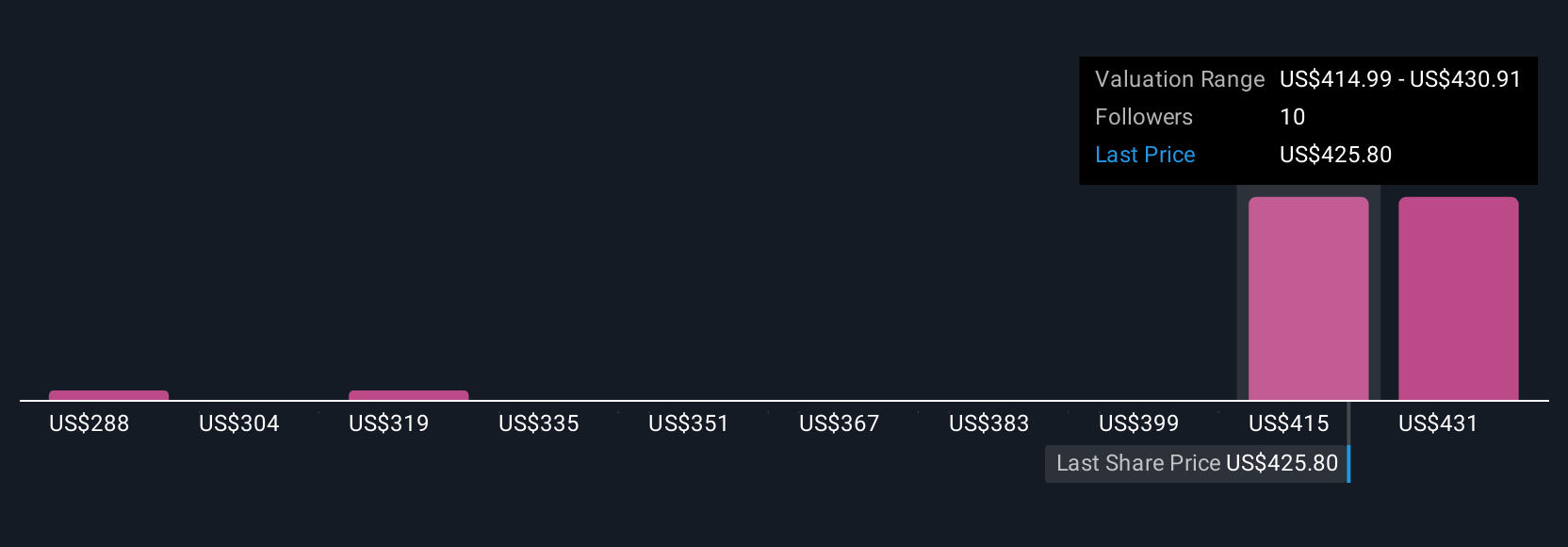

Unlike traditional metrics, Narratives connect the company’s journey and industry outlook to concrete financial forecasts, making them far more meaningful and actionable for investing decisions. Narratives are easy to use on Simply Wall St’s Community page, where millions of investors share and update their views. By creating or following a Narrative, you can instantly see how your fair value compares to the current share price, which may help you decide whether you think TopBuild is a buy, hold, or sell.

The real power is that Narratives are dynamic. They update automatically as new information, such as company news or earnings releases, comes in, so your analysis is always current. For example, on TopBuild, one featured Narrative sees accelerating commercial retrofit demand and strategic acquisitions driving the stock toward a fair value of $487, while another points to riskier execution and rising competition, justifying a much lower estimate at $370. Every investor's perspective becomes actionable, putting you in control of your decision-making process.

Do you think there's more to the story for TopBuild? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TopBuild might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLD

TopBuild

Engages in the installation and distribution of insulation and other building material products to the construction industry.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives