- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:PTRN

High Insider Ownership Growth Stocks To Watch In October 2025

Reviewed by Simply Wall St

As the U.S. stock market faces downward pressure amid ongoing U.S.-China trade tensions and mixed earnings reports, investors are closely monitoring growth companies with high insider ownership. In such volatile times, stocks with significant insider investment can signal confidence from those closest to the business, making them intriguing options for those seeking stability and potential growth in uncertain markets.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 92.9% |

| Prairie Operating (PROP) | 31.3% | 75.9% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11% | 30.4% |

| Celsius Holdings (CELH) | 10.8% | 31.8% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.7% |

| Astera Labs (ALAB) | 12.1% | 36.6% |

| AppLovin (APP) | 27.5% | 25.7% |

| Accelerant Holdings (ARX) | 24.9% | 66.5% |

Here's a peek at a few of the choices from the screener.

Pattern Group (PTRN)

Simply Wall St Growth Rating: ★★★★☆☆

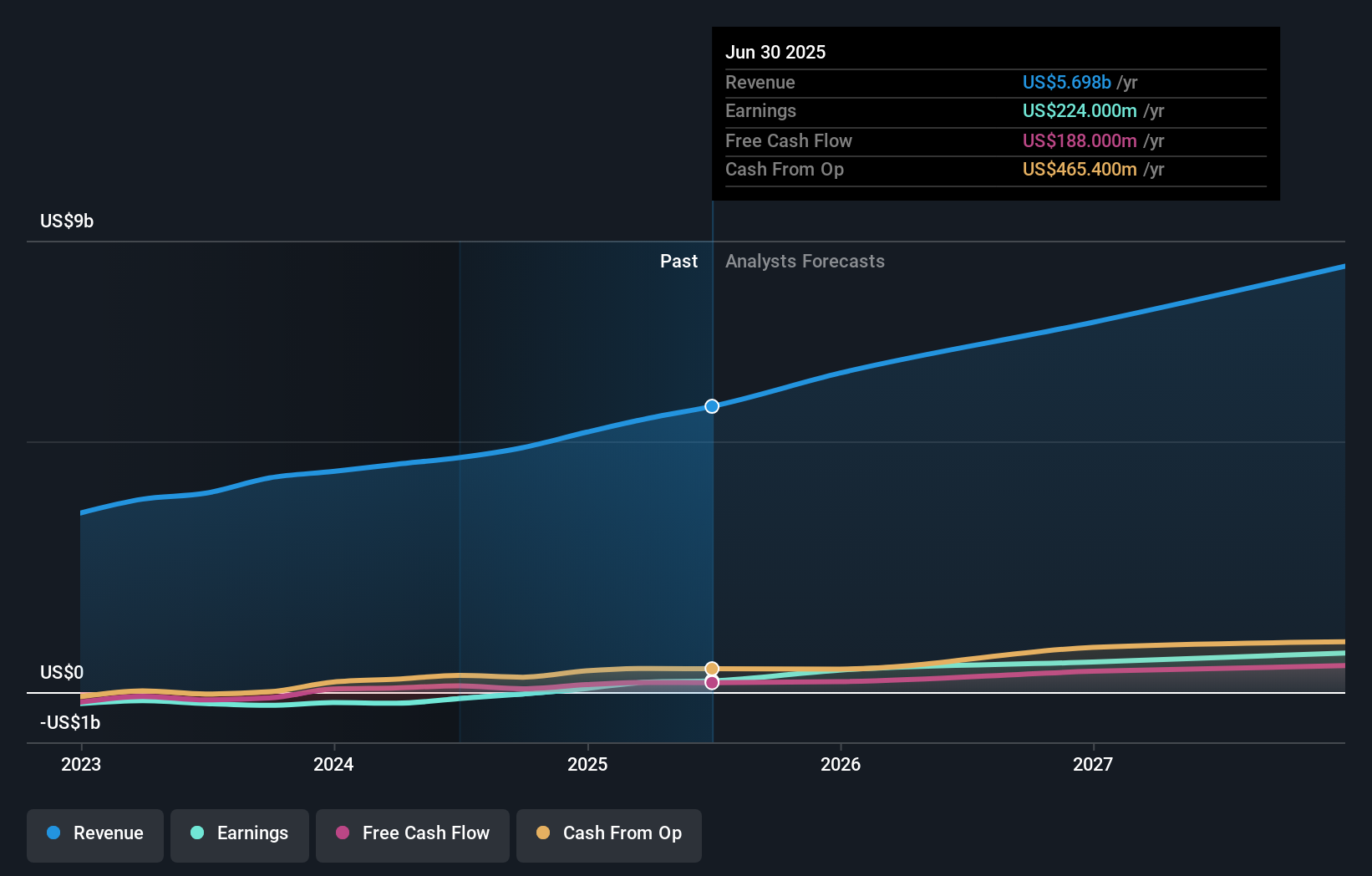

Overview: Pattern Group Inc. accelerates various brands on ecommerce marketplaces using proprietary technology and AI, with a market cap of $2.46 billion.

Operations: The company generates revenue of $2.09 billion from its segment focused on online retailers.

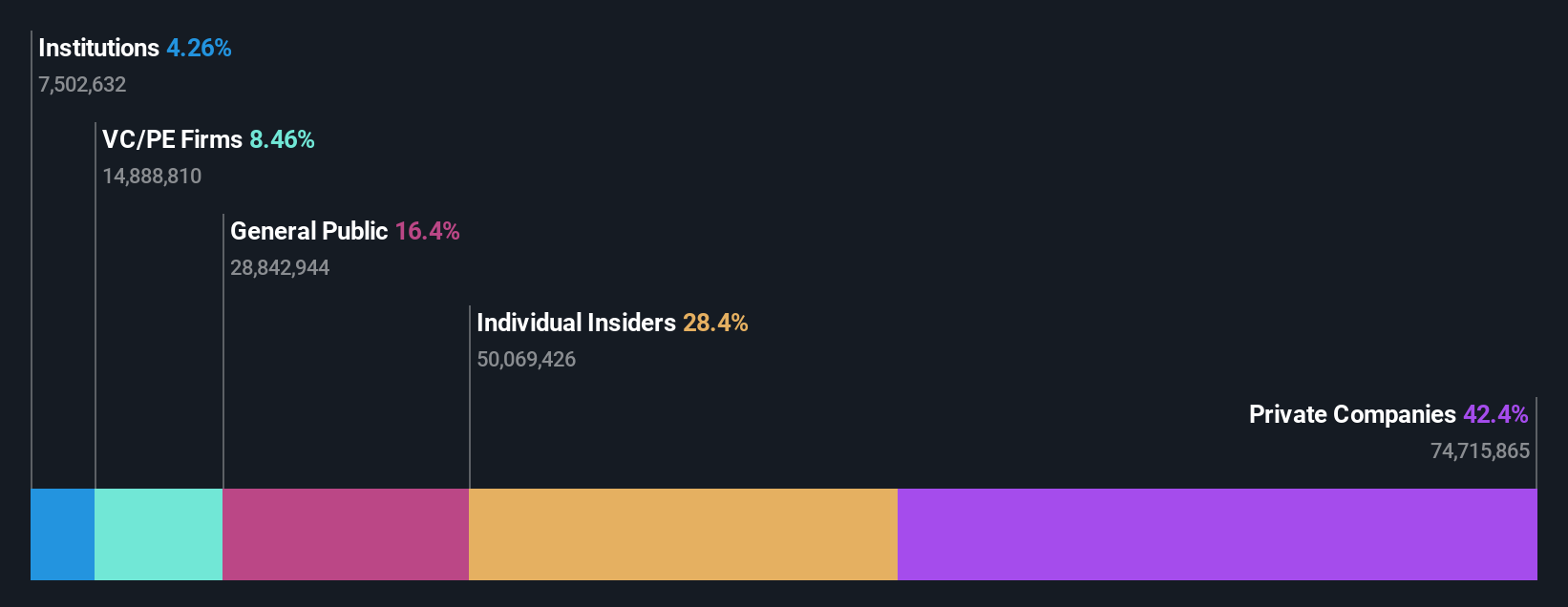

Insider Ownership: 28.4%

Pattern Group recently completed a US$300 million IPO, enhancing its financial flexibility. Insider buying has been strong, with more shares bought than sold in the past three months. Earnings are forecast to grow significantly at 46% annually, outpacing the US market's growth rate. Despite high illiquidity, revenue is projected to rise faster than the market average. The company was added to the NASDAQ Composite Index following its IPO completion and bylaw amendments.

- Click here and access our complete growth analysis report to understand the dynamics of Pattern Group.

- Our expertly prepared valuation report Pattern Group implies its share price may be too high.

Amer Sports (AS)

Simply Wall St Growth Rating: ★★★★☆☆

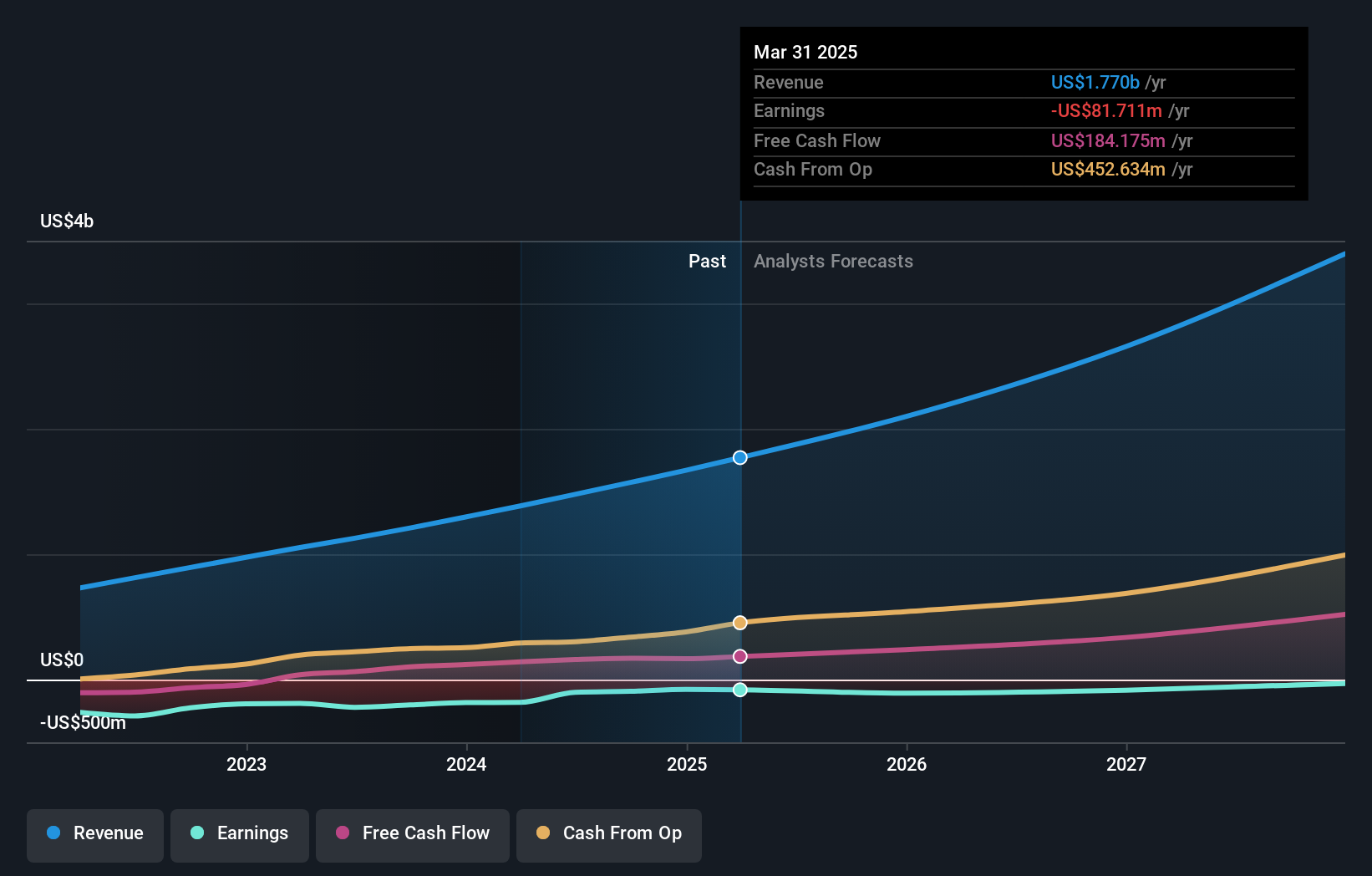

Overview: Amer Sports, Inc. is engaged in the design, manufacture, marketing, distribution, and sale of sports equipment, apparel, footwear, and accessories across various regions including Europe, the Middle East, Africa, the Americas, Mainland China, Hong Kong, Macau, Taiwan and Asia Pacific with a market cap of $17.22 billion.

Operations: The company's revenue is segmented into Technical Apparel at $2.44 billion, Outdoor Performance at $2.04 billion, and Ball & Racquet Sports at $1.22 billion.

Insider Ownership: 18%

Amer Sports has seen significant insider selling recently, contrasting with its expected earnings growth of 29.7% annually, which outpaces the US market. Despite trading 22% below fair value estimates, revenue growth is slower than desired at 14.2% per year but still above the market average. The company raised its third-quarter revenue guidance to high-20s percentage growth and expects annual EPS between $0.77 and $0.82, reflecting a positive outlook amidst leadership changes at Wilson.

- Unlock comprehensive insights into our analysis of Amer Sports stock in this growth report.

- According our valuation report, there's an indication that Amer Sports' share price might be on the cheaper side.

Cloudflare (NET)

Simply Wall St Growth Rating: ★★★★★★

Overview: Cloudflare, Inc. is a cloud services provider offering various solutions to businesses globally, with a market cap of approximately $73.44 billion.

Operations: The company's revenue segments include Internet Telephone, generating $1.88 billion.

Insider Ownership: 10.5%

Cloudflare has experienced significant insider selling recently, yet it is poised for robust growth with revenue expected to increase by 20.2% annually, surpassing the US market average. The company's strategic collaborations in agentic commerce and multicloud networking highlight its innovation in digital transformation. Despite recent losses, Cloudflare's forecasted profitability within three years and high anticipated return on equity of 28% underscore its potential as a transformative force in cloud security and AI integration.

- Click to explore a detailed breakdown of our findings in Cloudflare's earnings growth report.

- Our comprehensive valuation report raises the possibility that Cloudflare is priced higher than what may be justified by its financials.

Next Steps

- Click this link to deep-dive into the 203 companies within our Fast Growing US Companies With High Insider Ownership screener.

- Want To Explore Some Alternatives? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTRN

Pattern Group

Pattern Group Inc. accelerates various brands on ecommerce marketplaces using proprietary technology and AI.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives