- United States

- /

- Luxury

- /

- NYSE:AS

Amer Sports, Inc.'s (NYSE:AS) P/S Is Still On The Mark Following 47% Share Price Bounce

Amer Sports, Inc. (NYSE:AS) shares have continued their recent momentum with a 47% gain in the last month alone. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

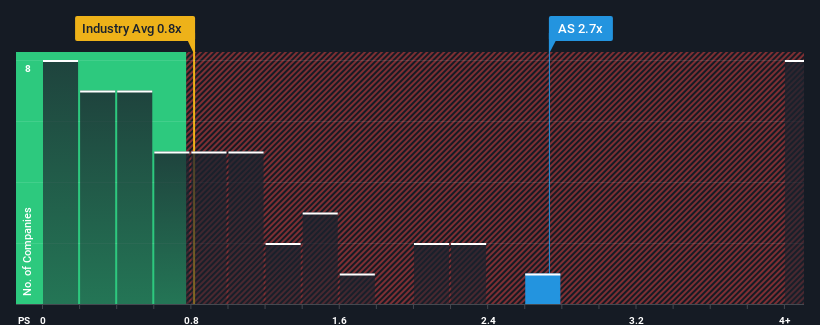

Since its price has surged higher, given close to half the companies operating in the United States' Luxury industry have price-to-sales ratios (or "P/S") below 0.8x, you may consider Amer Sports as a stock to potentially avoid with its 2.7x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Amer Sports

What Does Amer Sports' P/S Mean For Shareholders?

Recent times have been advantageous for Amer Sports as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Amer Sports.How Is Amer Sports' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Amer Sports' is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. The latest three year period has also seen an excellent 58% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 13% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 6.9% each year, which is noticeably less attractive.

With this in mind, it's not hard to understand why Amer Sports' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Amer Sports' P/S

Amer Sports shares have taken a big step in a northerly direction, but its P/S is elevated as a result. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Amer Sports shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Amer Sports with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AS

Amer Sports

Designs, manufactures, markets, distributes, and sells sports equipment, apparel, footwear, and accessories in Europe, the Middle East, Africa, the Americas, China, and the Asia Pacific.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives