- United States

- /

- Luxury

- /

- NYSE:AS

A Look at Amer Sports (NYSE:AS) Valuation Following Latest Profit Surge and Rising Institutional Ownership

Reviewed by Kshitija Bhandaru

Amer Sports (NYSE:AS) just posted a notable jump in pre-tax profit for the June 2025 quarter, making it five consecutive quarters of growth. Institutional ownership now stands at 34%, signaling ongoing investor confidence.

See our latest analysis for Amer Sports.

Amer Sports’ latest results have added fuel to a rally that has delivered a standout 72% total shareholder return over the past year. However, the share price has cooled off recently with a 14% decline in the past month. The momentum remains over the long run, which is drawing attention from investors who closely monitor sustained profit growth and changing sentiment around valuation risk.

If Amer Sports’ recent run piqued your interest, now is the perfect time to broaden your horizons and discover fast growing stocks with high insider ownership

With robust earnings momentum but a recent dip in share price, investors are left to ponder whether Amer Sports is undervalued after its latest results or if the market is already factoring in the company’s future growth.

Most Popular Narrative: 30.9% Undervalued

The most widely followed narrative points to a fair value of $46.35, which is notably higher than Amer Sports’ last close at $32.04. This has fueled debate over what is powering this valuation gap.

Ongoing investment in direct-to-consumer channels (both physical stores and e-commerce) is fueling higher full-price sales, reduced markdowns, and enhanced customer engagement. These factors support scalable top-line growth and drive adjusted operating margin expansion.

Want the full story behind this calculation? The narrative rests on a powerful combination of runaway earnings growth and ambitious margin expansion targets. See which financial forecasts are driving that bold price estimate.

Result: Fair Value of $46.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on Asia-Pacific growth and the risks of overexpansion into new markets could challenge Amer Sports’ current trajectory if conditions change.

Find out about the key risks to this Amer Sports narrative.

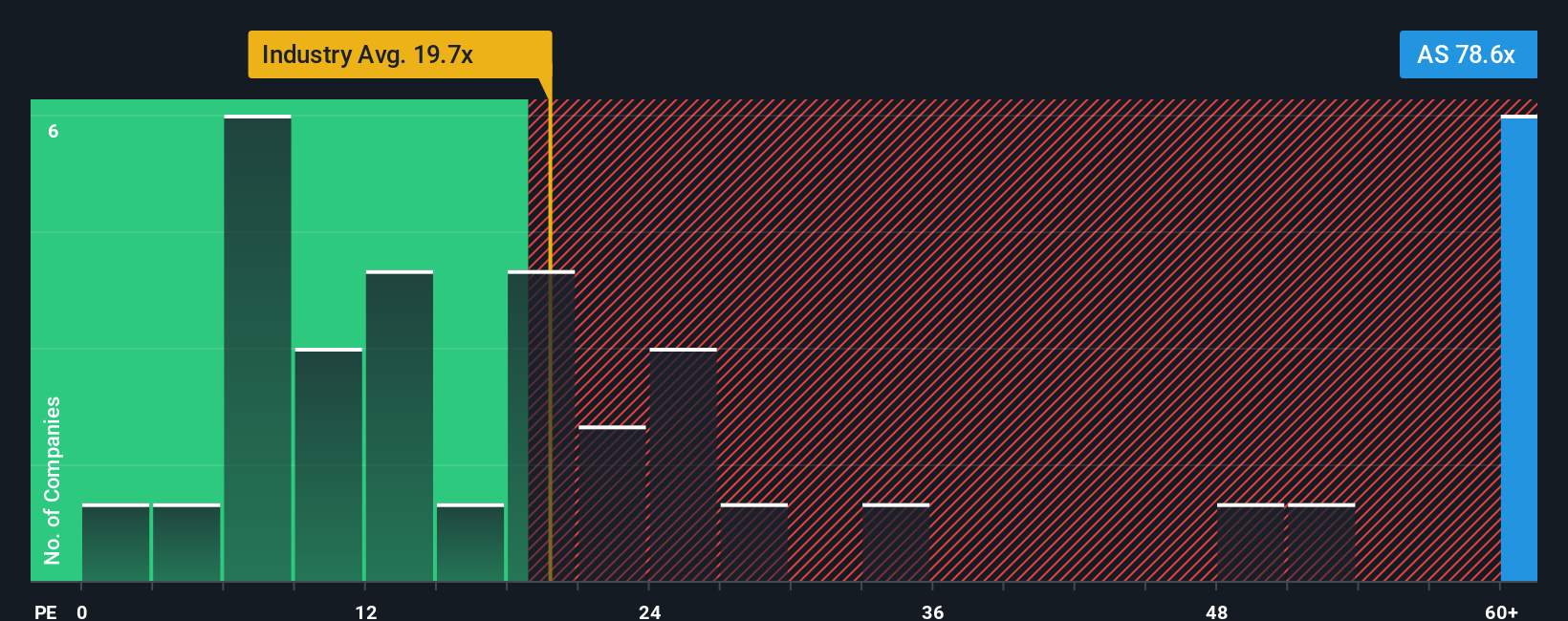

Another View: Valuation Through Multiples

While analysts see Amer Sports as significantly undervalued based on future growth projections, the company's current price-to-earnings ratio tells a different story. At 79.3x, it is well above the US Luxury sector average of 19.5x and also far higher than the calculated fair ratio of 30.4x. This wide gap signals that the market is pricing in a lot of optimism, leaving little margin for error if growth expectations falter.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amer Sports Narrative

If you want a different perspective or like to dig into the numbers for yourself, it's easy to craft your own take in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Amer Sports.

Looking for more investment ideas?

Secure your edge by looking beyond just one stock. Unlock new opportunities others might overlook and put yourself ahead of the curve with these timely themes:

- Seize the growth in artificial intelligence by checking out these 24 AI penny stocks with strong momentum and innovative market strategies.

- Benefit from steady income potential by reviewing these 18 dividend stocks with yields > 3% offering attractive yields and consistent returns.

- Catch the next wave of financial innovation in digital assets through these 79 cryptocurrency and blockchain stocks making breakthroughs in blockchain and cryptocurrency adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AS

Amer Sports

Designs, manufactures, markets, distributes, and sells sports equipment, apparel, footwear, and accessories in Europe, the Middle East, Africa, the Americas, Mainland China, Hong Kong, Macau, Taiwan, and the Asia Pacific.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives