- United States

- /

- Consumer Durables

- /

- NasdaqGS:VOXX

Shareholders in VOXX International (NASDAQ:VOXX) have lost 79%, as stock drops 15% this past week

Every investor on earth makes bad calls sometimes. But you want to avoid the really big losses like the plague. So consider, for a moment, the misfortune of VOXX International Corporation (NASDAQ:VOXX) investors who have held the stock for three years as it declined a whopping 79%. That would certainly shake our confidence in the decision to own the stock. And more recent buyers are having a tough time too, with a drop of 73% in the last year. The falls have accelerated recently, with the share price down 61% in the last three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

After losing 15% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for VOXX International

Because VOXX International made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years VOXX International saw its revenue shrink by 12% per year. That's not what investors generally want to see. Having said that the 21% annualized share price decline highlights the risk of investing in unprofitable companies. This business clearly needs to grow revenues if it is to perform as investors hope. Don't let a share price decline ruin your calm. You make better decisions when you're calm.

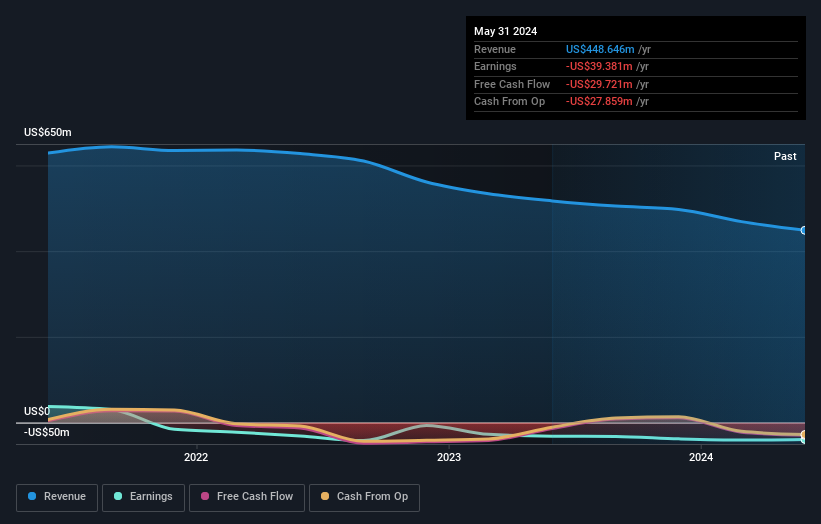

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

VOXX International shareholders are down 73% for the year, but the market itself is up 19%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 4 warning signs for VOXX International (2 are significant!) that you should be aware of before investing here.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VOXX

VOXX International

Manufactures and distributes automotive electronics, consumer electronics, and biometric products in the United States, Europe, and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives