- United States

- /

- Leisure

- /

- NasdaqCM:VMAR

Vision Marine Technologies Slides As Insider Purchases Lose Another CA$28k

The recent price decline of 10% in Vision Marine Technologies Inc.'s (NASDAQ:VMAR) stock may have disappointed insiders who bought CA$103.0k worth of shares at an average price of CA$3.91 in the past 12 months. Insiders buy with the expectation to see their investments rise in value over a period of time. However, recent losses have rendered their above investment worth CA$75.1k which is not ideal.

Although we don't think shareholders should simply follow insider transactions, we do think it is perfectly logical to keep tabs on what insiders are doing.

See our latest analysis for Vision Marine Technologies

Vision Marine Technologies Insider Transactions Over The Last Year

The CTO & COO Xavier Montagne made the biggest insider purchase in the last 12 months. That single transaction was for US$100k worth of shares at a price of US$3.80 each. So it's clear an insider wanted to buy, even at a higher price than the current share price (being US$2.85). It's very possible they regret the purchase, but it's more likely they are bullish about the company. In our view, the price an insider pays for shares is very important. As a general rule, we feel more positive about a stock if insiders have bought shares at above current prices, because that suggests they viewed the stock as good value, even at a higher price.

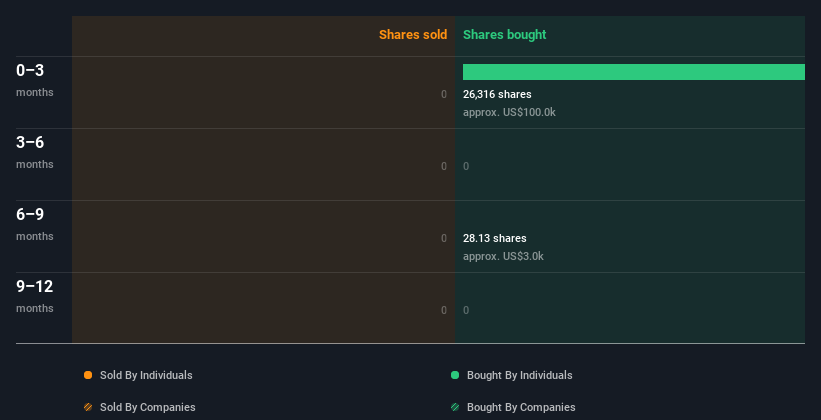

While Vision Marine Technologies insiders bought shares during the last year, they didn't sell. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

Vision Marine Technologies is not the only stock that insiders are buying. For those who like to find small cap companies at attractive valuations, this free list of growing companies with recent insider purchasing, could be just the ticket.

Insiders At Vision Marine Technologies Have Bought Stock Recently

Over the last quarter, Vision Marine Technologies insiders have spent a meaningful amount on shares. CTO & COO Xavier Montagne spent US$100k on stock, and there wasn't any selling. This could be interpreted as suggesting a positive outlook.

Does Vision Marine Technologies Boast High Insider Ownership?

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. It's great to see that Vision Marine Technologies insiders own 75% of the company, worth about US$213k. I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

So What Do The Vision Marine Technologies Insider Transactions Indicate?

It's certainly positive to see the recent insider purchase. And the longer term insider transactions also give us confidence. However, we note that the company didn't make a profit over the last twelve months, which makes us cautious. When combined with notable insider ownership, these factors suggest Vision Marine Technologies insiders are well aligned, and quite possibly think the share price is too low. That's what I like to see! In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Vision Marine Technologies. Be aware that Vision Marine Technologies is showing 5 warning signs in our investment analysis, and 2 of those make us uncomfortable...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:VMAR

Vision Marine Technologies

Designs, develops, manufactures, rents, and sells electric boats in Canada, the United States, and internationally.

Flawless balance sheet moderate.

Similar Companies

Market Insights

Community Narratives