- United States

- /

- Consumer Durables

- /

- NasdaqGS:UEIC

We Think Universal Electronics (NASDAQ:UEIC) Is Taking Some Risk With Its Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Universal Electronics Inc. (NASDAQ:UEIC) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Universal Electronics

What Is Universal Electronics's Debt?

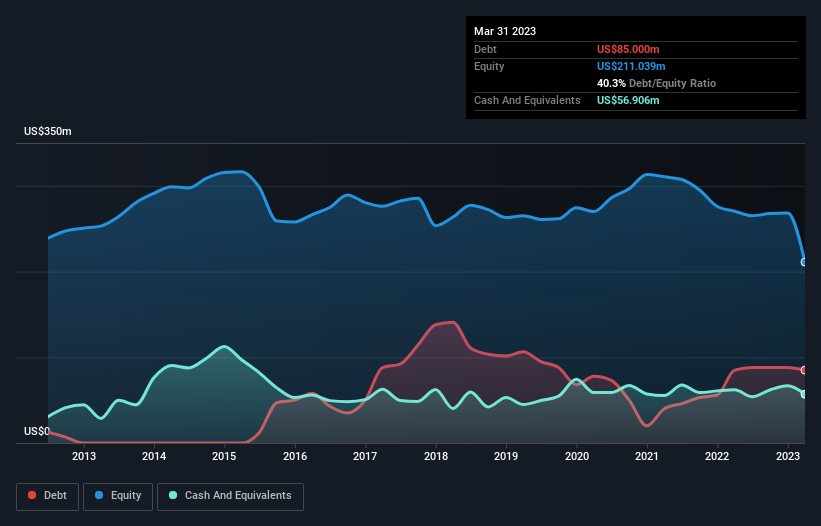

The chart below, which you can click on for greater detail, shows that Universal Electronics had US$85.0m in debt in March 2023; about the same as the year before. However, it also had US$56.9m in cash, and so its net debt is US$28.1m.

A Look At Universal Electronics' Liabilities

Zooming in on the latest balance sheet data, we can see that Universal Electronics had liabilities of US$187.8m due within 12 months and liabilities of US$18.1m due beyond that. Offsetting these obligations, it had cash of US$56.9m as well as receivables valued at US$115.9m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$33.1m.

This deficit isn't so bad because Universal Electronics is worth US$114.6m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Looking at its net debt to EBITDA of 0.90 and interest cover of 2.6 times, it seems to us that Universal Electronics is probably using debt in a pretty reasonable way. So we'd recommend keeping a close eye on the impact financing costs are having on the business. Importantly, Universal Electronics's EBIT fell a jaw-dropping 46% in the last twelve months. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Universal Electronics's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Universal Electronics actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

Neither Universal Electronics's ability to grow its EBIT nor its interest cover gave us confidence in its ability to take on more debt. But its conversion of EBIT to free cash flow tells a very different story, and suggests some resilience. Looking at all the angles mentioned above, it does seem to us that Universal Electronics is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. In light of our reservations about the company's balance sheet, it seems sensible to check if insiders have been selling shares recently.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:UEIC

Universal Electronics

Designs, develops, manufactures, ships, and supports home entertainment control products, technology and software solutions, climate control solutions, wireless sensors and smart home control products, and audio-video accessories.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

Intuit Stock: When Financial Software Becomes the Operating System for Small Business

Meta’s Bold Bet on AI Pays Off

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

The "Sleeping Giant" Stumbles, Then Wakes Up