- United States

- /

- Consumer Durables

- /

- NasdaqGS:UEIC

The Price Is Right For Universal Electronics Inc. (NASDAQ:UEIC) Even After Diving 26%

The Universal Electronics Inc. (NASDAQ:UEIC) share price has fared very poorly over the last month, falling by a substantial 26%. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

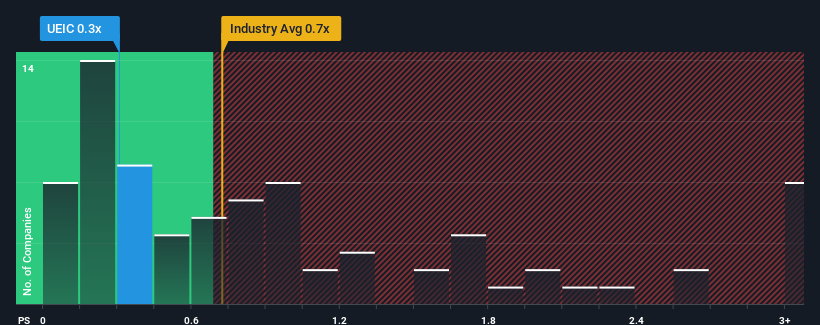

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Universal Electronics' P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Consumer Durables industry in the United States is also close to 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Universal Electronics

What Does Universal Electronics' P/S Mean For Shareholders?

Universal Electronics hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Universal Electronics will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Universal Electronics?

Universal Electronics' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 21%. As a result, revenue from three years ago have also fallen 37% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 4.0% during the coming year according to the three analysts following the company. That's shaping up to be similar to the 5.5% growth forecast for the broader industry.

In light of this, it's understandable that Universal Electronics' P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

With its share price dropping off a cliff, the P/S for Universal Electronics looks to be in line with the rest of the Consumer Durables industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at Universal Electronics' revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Universal Electronics with six simple checks will allow you to discover any risks that could be an issue.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:UEIC

Universal Electronics

Designs, develops, manufactures, ships, and supports home entertainment control products, technology and software solutions, climate control solutions, wireless sensors and smart home control products, and audio-video accessories.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives