- United States

- /

- Consumer Durables

- /

- NasdaqGS:SONO

Does Analyst Upgrade and Higher Earnings Forecast Change the Bull Case for Sonos (SONO)?

Reviewed by Simply Wall St

- In the past week, Sonos received an analyst upgrade along with an upward revision to its earnings estimate, reflecting growing confidence in the company’s future performance.

- This improved outlook has generated renewed investor optimism regarding Sonos's prospects in the evolving consumer electronics and audio technology market.

- Now, we'll examine how a stronger earnings forecast may influence Sonos's investment outlook and the key drivers underlying its narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Sonos Investment Narrative Recap

To own shares in Sonos, you must believe in continued growth of premium, connected home audio, and that the company can maintain brand loyalty and expand its software-enhanced ecosystem. This latest analyst upgrade and earnings estimate adjustment could bolster short-term sentiment, but the main near-term catalyst remains the company's ability to weather cyclical consumer electronics demand, while the most significant risk continues to be pressure from increased tariffs affecting manufacturing costs and pricing. For now, the impact appears to be more about renewed optimism than a fundamental shift in the risk/reward balance.

Among Sonos's latest initiatives, the launch of its first-ever Sonos Ace headphones stands out as particularly relevant, given the importance of expanding into new product segments during a lull in core hardware cycles. This move aligns with a key catalyst: broadening the product portfolio to reduce seasonal volatility and sustain customer engagement between major home audio releases.

However, it’s important not to overlook that while investor excitement may be rising, the threat of ongoing tariff pressures and potential demand erosion remains a key issue investors should be aware of…

Read the full narrative on Sonos (it's free!)

Sonos' outlook anticipates $1.6 billion in revenue and $120.2 million in earnings by 2028. Achieving this would mean a 5.0% annual revenue growth and an earnings increase of $196.6 million from the current earnings of -$76.4 million.

Uncover how Sonos' forecasts yield a $13.62 fair value, a 10% downside to its current price.

Exploring Other Perspectives

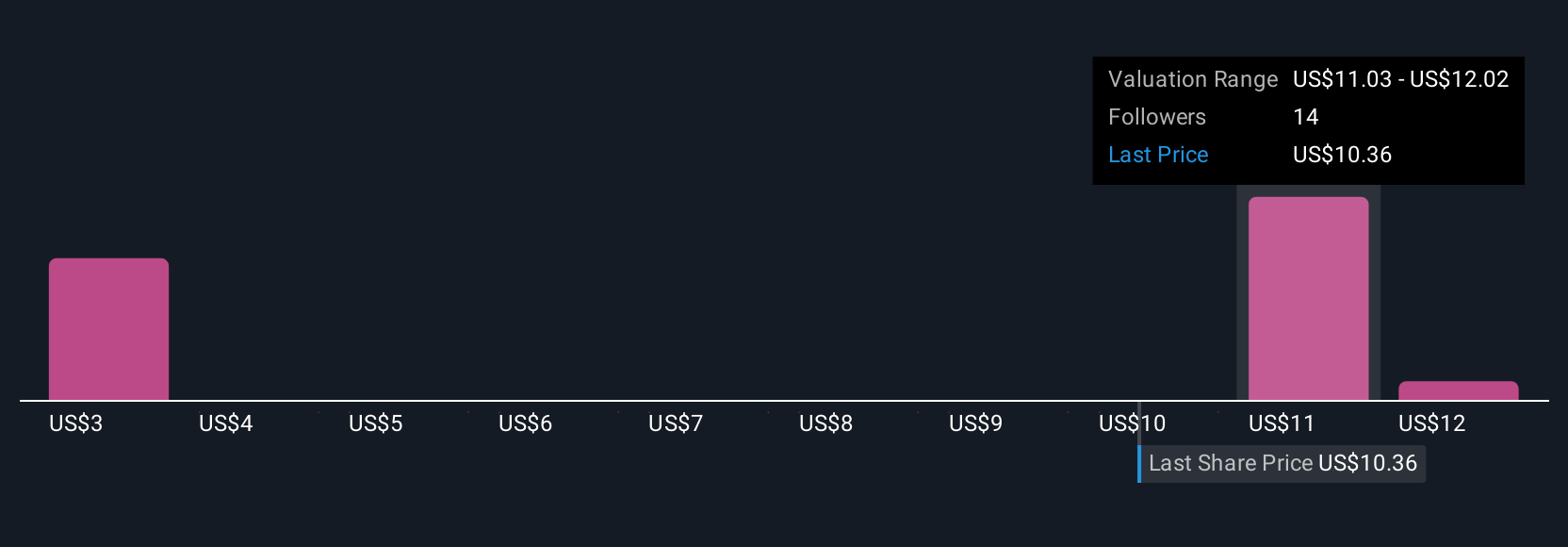

Five recent fair value estimates from the Simply Wall St Community range from as low as US$0.39 to as high as US$17. With product expansion a central catalyst, these wide opinions reflect how future bets on new markets could shape outcomes, explore alternative perspectives to understand what others might see in Sonos’s potential.

Explore 5 other fair value estimates on Sonos - why the stock might be worth as much as 12% more than the current price!

Build Your Own Sonos Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free Sonos research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sonos' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SONO

Sonos

Designs, develops, manufactures, and sells audio products and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives