- United States

- /

- Luxury

- /

- NasdaqGS:SHOO

Steven Madden (SHOO): A Fresh Look at Valuation as Supply Chain Overhaul Sparks Investor Interest

Reviewed by Kshitija Bhandaru

Steven Madden (SHOO) has attracted renewed attention as investor focus shifts to its vertical integration strategy and efforts to diversify its supply chain away from China. These moves are widely seen as ways to improve profit margins and earnings stability.

See our latest analysis for Steven Madden.

Steven Madden’s share price has rebounded sharply with a 12% gain over the last month, reflecting a swing in sentiment as investors look past earlier concerns about tariffs and slowing growth. However, over the last 12 months, the total shareholder return remains down more than 25%. This serves as a reminder that momentum is only just showing signs of returning after a tough year.

If this renewed optimism in SHOO caught your attention, now’s a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

The question now is whether Steven Madden's recent rebound signals an undervalued opportunity for investors, or if the market has already factored in the company’s turnaround prospects and future growth.

Most Popular Narrative: 7.6% Overvalued

Steven Madden's last close at $34.15 sits above the narrative's latest fair value estimate of $31.75. This creates a tension between recent bullish price momentum and what analysts view as a reasonable valuation ceiling.

Vertical integration efforts and ongoing supply chain diversification away from China (expecting U.S. imports sourced from China to drop from 71% to 30% year over year) provide a pathway to improve gross margin stability and working capital management. These factors support future earnings recovery once tariff disruptions stabilize.

Curious what numbers are driving this premium? The narrative is powered by aggressive profit forecasts, ambitious international expansion assumptions, and margin improvements not yet realized. Unpack the full story behind the contentious valuation and see which metrics could spark a major market shift.

Result: Fair Value of $31.75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tariff uncertainty and potential challenges integrating recent acquisitions could still spark renewed volatility and test Steven Madden’s path to sustainable earnings growth.

Find out about the key risks to this Steven Madden narrative.

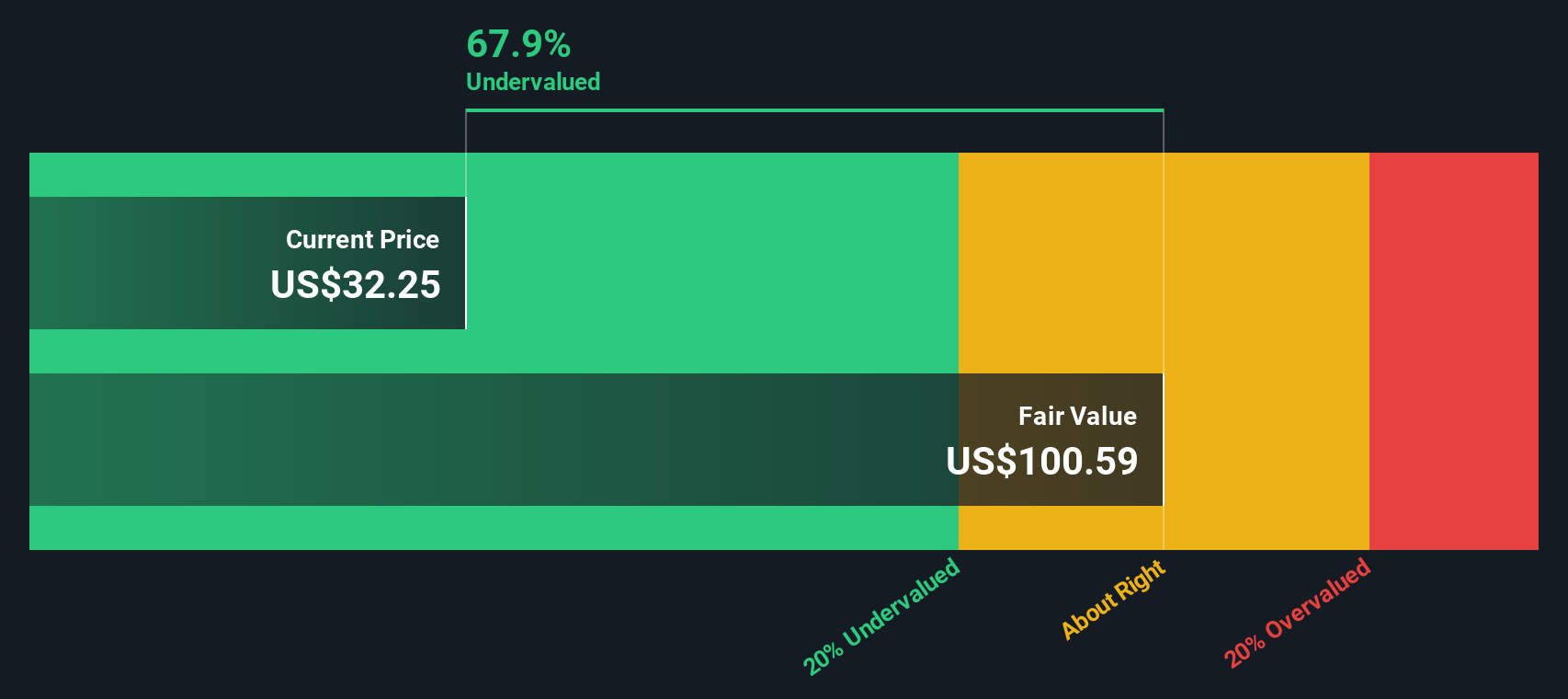

Another View: Discounted Cash Flow Suggests a Different Story

While analysts see Steven Madden as overvalued based on their fair value estimates, the SWS DCF model reaches a very different conclusion. According to this approach, SHOO is trading at a significant discount to its estimated fair value. This raises questions about whether the market is overly pessimistic or missing something important.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Steven Madden for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Steven Madden Narrative

If you prefer to draw your own conclusions or want a closer look at the numbers, you can put together a personal narrative analysis in just minutes. Do it your way

A great starting point for your Steven Madden research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Thousands of investors have already spotted strong opportunities outside the headlines. Make your next move count with these handpicked strategies:

- Uncover value with companies that are trading well below their fair price. Start reviewing these 890 undervalued stocks based on cash flows that could offer long-term upside.

- Tap into potential market disruptors by checking out these 3572 penny stocks with strong financials with robust financials and promising growth stories.

- Secure reliable income streams with these 19 dividend stocks with yields > 3% featuring yields above 3%, perfect for building stability into your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHOO

Steven Madden

Designs, sources, and markets fashion-forward branded and private label footwear, accessories, and apparel in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives