- United States

- /

- Luxury

- /

- NasdaqGM:SGC

Undiscovered Gems in United States: Top Picks for November 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 2.1% decline, yet it remains up by 30% over the past year with earnings projected to grow by 15% annually in the coming years. In this dynamic environment, identifying stocks that are poised for growth but remain underappreciated can offer unique opportunities for investors seeking to capitalize on these trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 169.49% | 12.30% | 1.92% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| AirJoule Technologies | NA | nan | 127.67% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| Nanophase Technologies | 40.87% | 24.19% | -9.71% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Superior Group of Companies (NasdaqGM:SGC)

Simply Wall St Value Rating: ★★★★★★

Overview: Superior Group of Companies, Inc. is engaged in the manufacturing and sale of apparel and accessories both domestically and internationally, with a market cap of $265.22 million.

Operations: Superior Group of Companies generates revenue from three primary segments: Branded Products ($358.64 million), Healthcare Apparel ($116.86 million), and Contact Centers ($95.99 million).

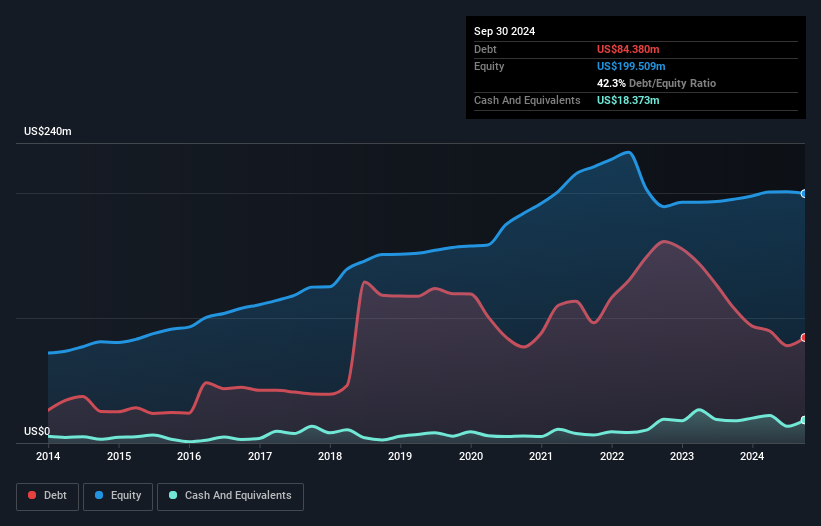

Superior Group of Companies, a small player in the apparel industry, has shown impressive earnings growth of 81.8% over the past year, outpacing the luxury industry's 8.2%. Trading at 28.2% below its estimated fair value and maintaining a satisfactory net debt to equity ratio of 33.1%, it presents an interesting case for potential investors. Recent results show significant improvements with Q3 sales reaching US$149.69 million and net income rising to US$5.4 million compared to last year's figures, while basic earnings per share increased from US$0.19 to US$0.34, reflecting solid financial health amidst strategic market positioning efforts.

ASA Gold and Precious Metals (NYSE:ASA)

Simply Wall St Value Rating: ★★★★★☆

Overview: ASA Gold and Precious Metals Limited is a publicly owned investment manager with a market cap of $371.94 million.

Operations: ASA Gold and Precious Metals Limited generates revenue primarily from its financial services segment, specifically through closed-end funds, amounting to $1.99 million.

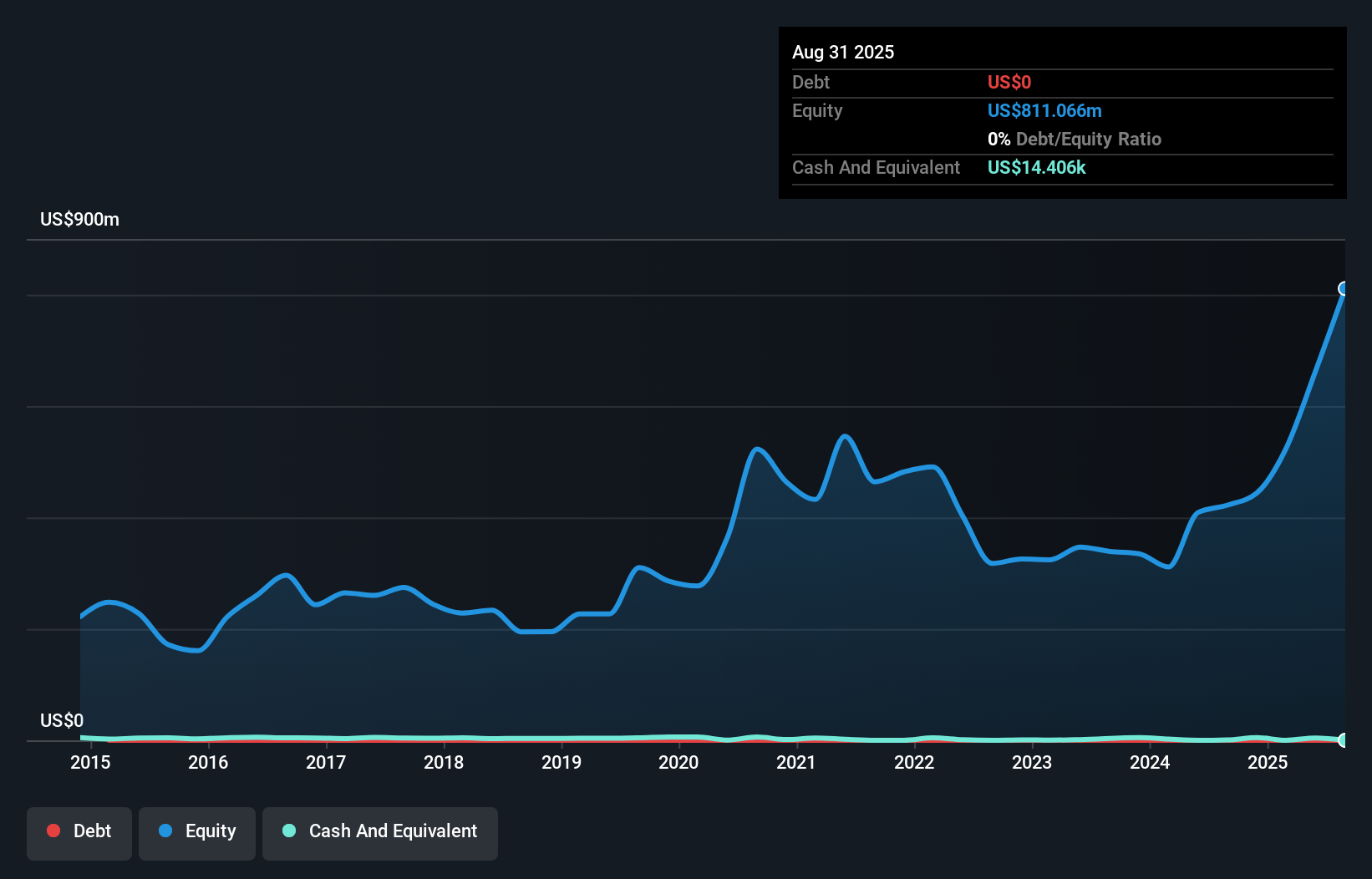

ASA Gold and Precious Metals, a nimble player in its field, reported earnings of US$91.18 million for the nine months ending August 2024, significantly impacted by a one-off gain of US$91.3 million. Despite this boost in earnings, revenue remains modest at US$1.5 million annually, reflecting the company's niche focus. Its price-to-earnings ratio stands attractively low at 4.4x compared to the broader market's 18.9x, suggesting potential undervaluation. Notably debt-free for five years, ASA's financial health is stable but faces challenges from investor activism as Saba Capital seeks board control through legal action and shareholder rights plans are contested.

Gatos Silver (NYSE:GATO)

Simply Wall St Value Rating: ★★★★★★

Overview: Gatos Silver, Inc. is involved in the exploration, development, and production of precious metals with a market cap of approximately $1.10 billion.

Operations: Gatos Silver generates revenue primarily through the exploration, development, and production of precious metals. The company's market capitalization is approximately $1.10 billion.

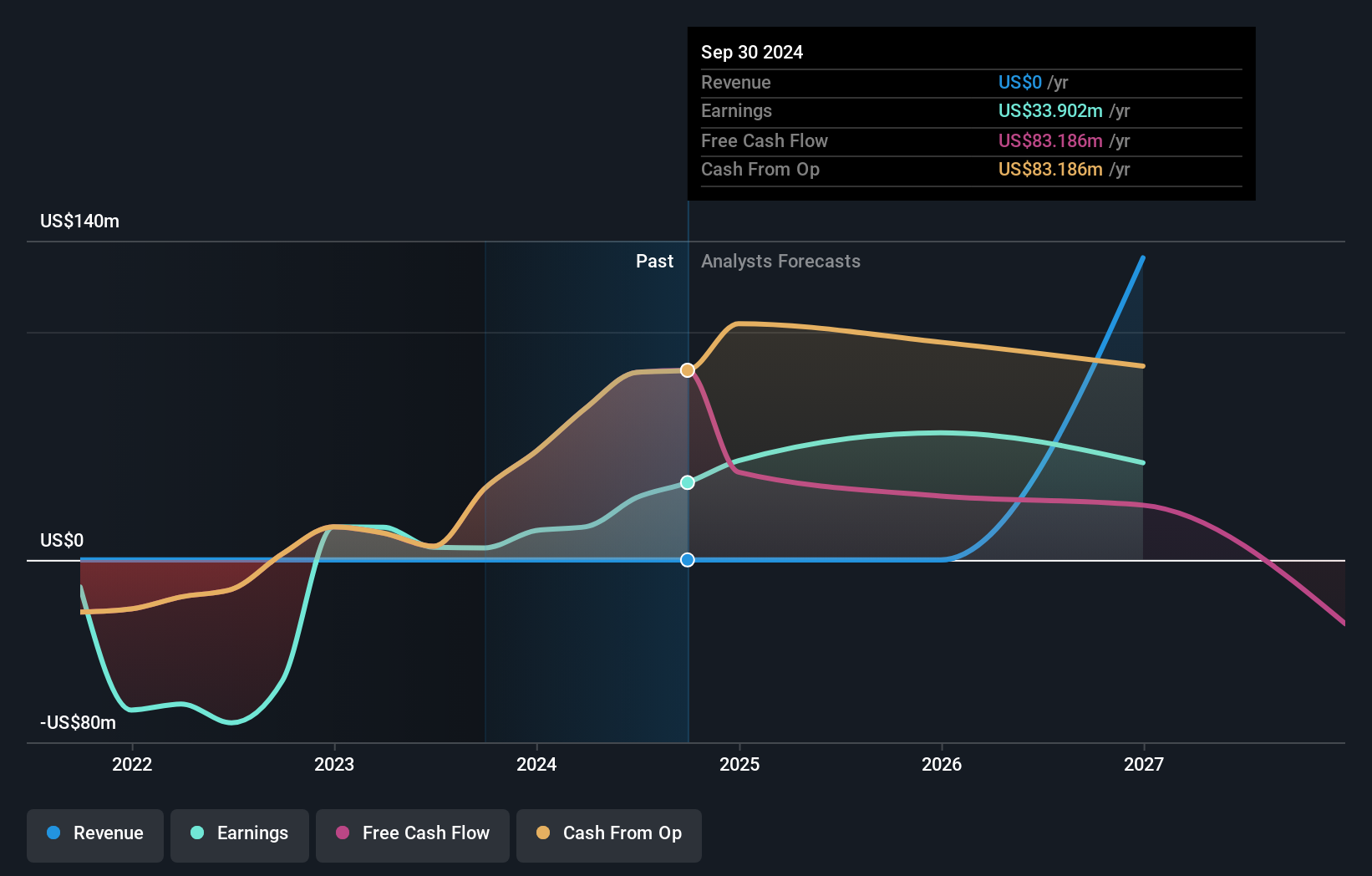

Gatos Silver, a promising player in the mining industry, has shown impressive growth with earnings surging by 542.8% over the past year, outpacing its sector significantly. The company remains debt-free and reported a net income of US$9.88 million for Q3 2024, up from US$3.29 million last year, translating to basic earnings per share of US$0.14 compared to US$0.05 previously. Recent exploration at Cerro Los Gatos Mine indicates potential for further mineralization extensions, enhancing future production prospects as evidenced by increased silver output guidance for 2024 between 9.2 and 9.7 million ounces.

- Click to explore a detailed breakdown of our findings in Gatos Silver's health report.

Evaluate Gatos Silver's historical performance by accessing our past performance report.

Make It Happen

- Embark on your investment journey to our 228 US Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SGC

Superior Group of Companies

Manufactures and sells apparel and accessories in the United States and internationally.

Flawless balance sheet, good value and pays a dividend.