- United States

- /

- Leisure

- /

- NasdaqGS:PTON

Peloton Interactive (NASDAQ:PTON shareholders incur further losses as stock declines 9.5% this week, taking one-year losses to 81%

Peloton Interactive, Inc. (NASDAQ:PTON) shareholders should be happy to see the share price up 12% in the last month. But that doesn't change the fact that the returns over the last year have been stomach churning. Indeed, the share price is down a whopping 81% in the last year. So it's not that amazing to see a bit of a bounce. The important thing is whether the company can turn it around, longer term. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for Peloton Interactive

Peloton Interactive isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Peloton Interactive grew its revenue by 40% over the last year. That's definitely a respectable growth rate. Unfortunately, the market wanted something better, given it sent the share price 81% lower during the year. It could be that the losses are too much for investors to handle without losing their nerve. We'd posit that the future looks challenging, given the disconnect between revenue growth and the share price.

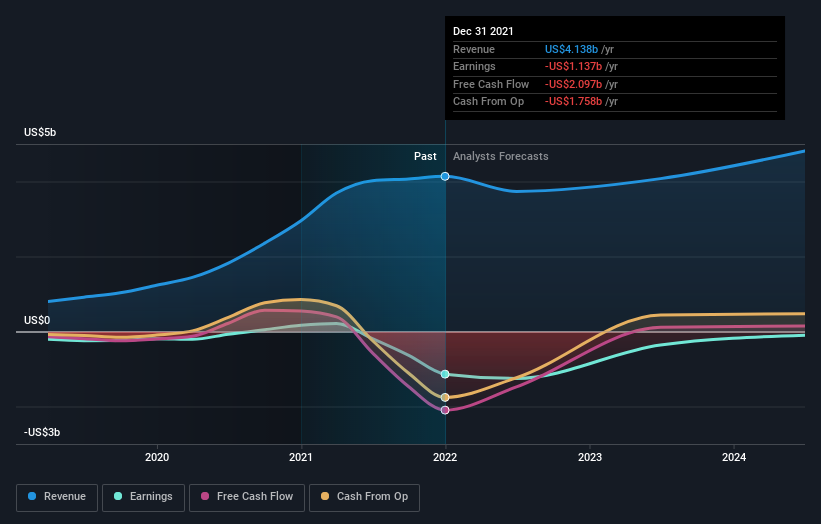

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Peloton Interactive is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Peloton Interactive in this interactive graph of future profit estimates.

A Different Perspective

Peloton Interactive shareholders are down 81% for the year, even worse than the market loss of 0.5%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 31% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Peloton Interactive that you should be aware of before investing here.

But note: Peloton Interactive may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PTON

Peloton Interactive

Provides fitness and wellness products and services in North America and internationally.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives