- United States

- /

- Consumer Durables

- /

- NasdaqGS:NWL

Newell Brands Inc.'s (NASDAQ:NWL) Price Is Out Of Tune With Revenues

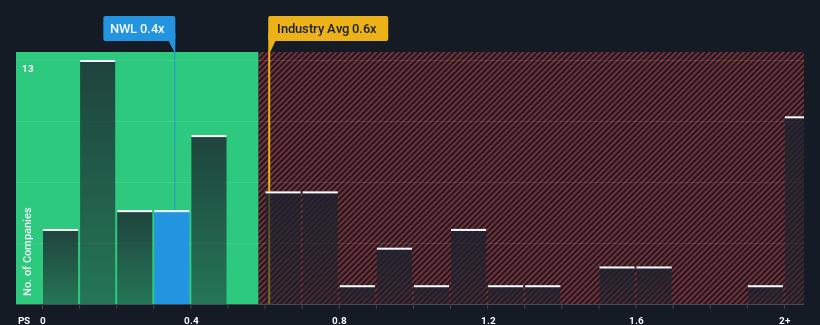

There wouldn't be many who think Newell Brands Inc.'s (NASDAQ:NWL) price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S for the Consumer Durables industry in the United States is similar at about 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Newell Brands

What Does Newell Brands' Recent Performance Look Like?

Newell Brands hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Newell Brands will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

Newell Brands' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 6.8%. The last three years don't look nice either as the company has shrunk revenue by 28% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 0.06% each year as estimated by the ten analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 6.4% per year, which is noticeably more attractive.

In light of this, it's curious that Newell Brands' P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at the analysts forecasts of Newell Brands' revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Newell Brands that you should be aware of.

If these risks are making you reconsider your opinion on Newell Brands, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Newell Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:NWL

Newell Brands

Engages in the design, manufacture, sourcing, and distribution of consumer and commercial products worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives