- United States

- /

- Luxury

- /

- NasdaqGS:LULU

Lululemon Athletica (NasdaqGS:LULU) Announces Strong Financial Results Despite 25% Weekly Price Drop

Reviewed by Simply Wall St

Lululemon Athletica (NasdaqGS:LULU) recently announced strong financial results, with yearly sales and net income both showing healthy increases. Despite this positive development, the company's stock price fell 25% over the last week. This decline coincided with a broader market downturn, driven by escalating trade tensions between the U.S. and China, which led to significant drops in major indices like the Dow Jones and Nasdaq. The market's overall decline of 6% contributed to the fall in Lululemon's stock. These external pressures likely overshadowed the company's otherwise robust earnings report and future revenue projections.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Over the past five years, Lululemon Athletica has delivered a total return of 25.62%, incorporating both share price appreciation and dividends. This performance, while positive, underscores a period marked by vigorous international growth initiatives and strong product innovation, aimed at penetrating high-growth markets like China and Germany. The company consistently advanced these strategies by expanding its physical footprint, increasing store square footage by approximately 10% in 2025 to enhance its market presence.

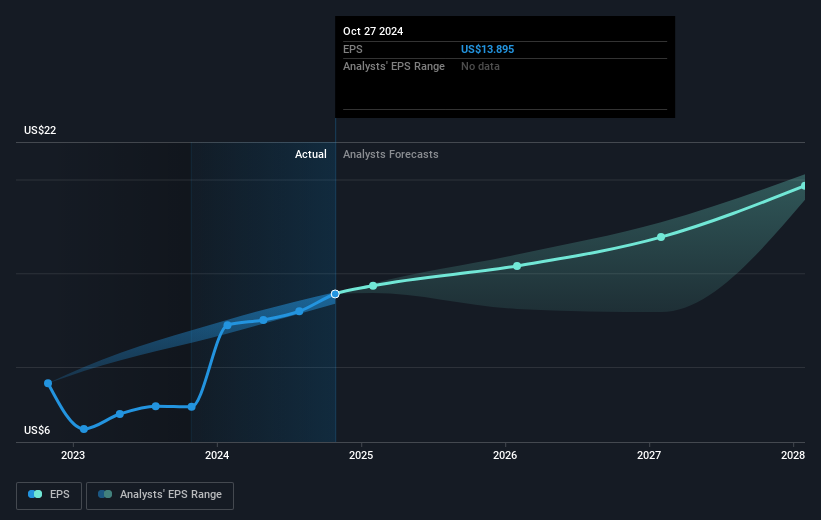

A pivotal element to Lululemon's longer-term narrative has been share buybacks, with over 5.27 million shares repurchased for US$1.66 billion from late 2024 to March 2025. This action boosted shareholder value despite broader market volatility. In the past year, however, Lululemon's earnings growth of 16.9% surpassed the luxury industry average of 2.7%, yet the stock underperformed compared to the broader US market's 3.3% return. The company has also engaged in impactful collaborations, such as its alliances with Peloton and Life Time, further reinforcing its brand within the fitness sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if lululemon athletica might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LULU

lululemon athletica

Designs, distributes, and retails technical athletic apparel, footwear, and accessories for women and men under the lululemon brand in the United States, Canada, Mexico, China Mainland, Hong Kong, Taiwan, Macau, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives