- United States

- /

- Consumer Durables

- /

- NasdaqCM:LIVE

Even With A 169% Surge, Cautious Investors Are Not Rewarding Live Ventures Incorporated's (NASDAQ:LIVE) Performance Completely

Live Ventures Incorporated (NASDAQ:LIVE) shares have had a really impressive month, gaining 169% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 10% in the last twelve months.

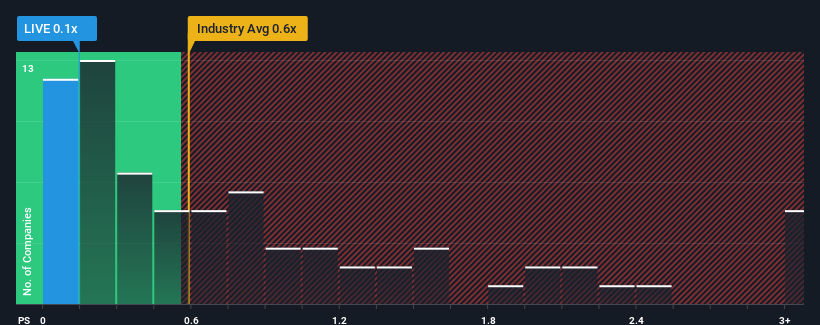

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Live Ventures' P/S ratio of 0.1x, since the median price-to-sales (or "P/S") ratio for the Consumer Durables industry in the United States is also close to 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

We've discovered 4 warning signs about Live Ventures. View them for free.See our latest analysis for Live Ventures

How Has Live Ventures Performed Recently?

Revenue has risen firmly for Live Ventures recently, which is pleasing to see. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for Live Ventures, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Live Ventures' Revenue Growth Trending?

In order to justify its P/S ratio, Live Ventures would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 16% last year. The strong recent performance means it was also able to grow revenue by 63% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is only predicted to deliver 3.3% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we find it interesting that Live Ventures is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From Live Ventures' P/S?

Live Ventures' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To our surprise, Live Ventures revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

You should always think about risks. Case in point, we've spotted 4 warning signs for Live Ventures you should be aware of, and 3 of them can't be ignored.

If you're unsure about the strength of Live Ventures' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LIVE

Live Ventures

Engages in the flooring and steel manufacturing, and retail businesses in the United States.

Mediocre balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

GE Vernova revenue will grow by 13% with a future PE of 64.7x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026