- United States

- /

- Consumer Durables

- /

- NasdaqGS:LGIH

Will Lower Q3 Results and Cautious Guidance Shift LGI Homes' (LGIH) Long-Term Growth Narrative?

Reviewed by Sasha Jovanovic

- LGI Homes, Inc. recently announced third quarter 2025 results, reporting net income of US$19.7 million and diluted earnings per share of US$0.85, both considerably lower than the same period last year; for the nine months ended September 30, net income was US$55.23 million with diluted EPS of US$2.37, also down from a year ago.

- The company also issued new guidance for the fourth quarter, projecting between 1,300 and 1,500 home closings with an average sales price per home between US$365,000 and US$375,000, signaling potential challenges in achieving prior growth levels.

- Given the sharp drop in earnings, we'll assess how LGI Homes' updated results and guidance impact its investment outlook and long-term housing demand thesis.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

LGI Homes Investment Narrative Recap

To be a shareholder in LGI Homes, one typically needs to believe that long-term demand from first-time buyers will eventually outweigh the current headwinds of high interest rates and affordability pressures. The recent earnings decline and the company's cautious guidance for fourth quarter home closings highlight how exposed the business is to these challenges, but the numbers do not introduce a new short-term catalyst or materially change the biggest risk, persistent affordability strain impacting volumes and margins.

One of the most relevant recent developments is LGI Homes' fourth quarter guidance, forecasting 1,300 to 1,500 home closings at average prices between US$365,000 and US$375,000. This announcement is particularly important as it reinforces how market conditions and buyer affordability will likely determine the pace of recovery and the stability of near-term results.

In contrast, investors should be aware that LGI’s overreliance on entry-level buyers means even modest changes in affordability can…

Read the full narrative on LGI Homes (it's free!)

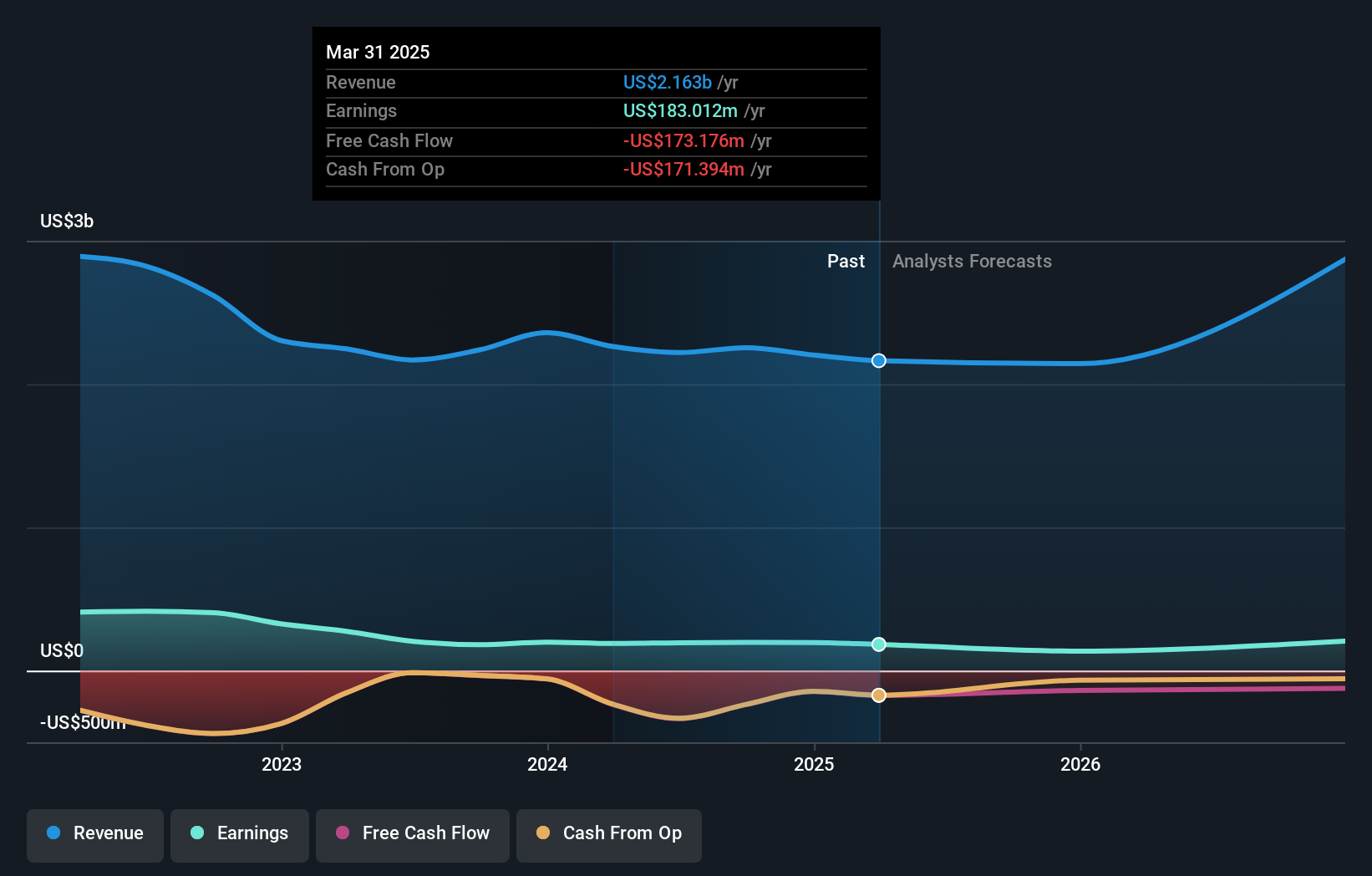

LGI Homes' outlook anticipates $2.8 billion in revenue and $178.8 million in earnings by 2028. This is based on an annual revenue growth rate of 10.5% and a $22.8 million increase in earnings from the current $156.0 million figure.

Uncover how LGI Homes' forecasts yield a $75.67 fair value, a 55% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two separate fair value estimates for LGI Homes ranging from US$47 to US$75.67 per share. As you consider this spread of investor views, remember that current affordability challenges continue to weigh heavily on short-term confidence, driving many different outlooks on the company’s future.

Explore 2 other fair value estimates on LGI Homes - why the stock might be worth as much as 55% more than the current price!

Build Your Own LGI Homes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LGI Homes research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free LGI Homes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LGI Homes' overall financial health at a glance.

No Opportunity In LGI Homes?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LGIH

LGI Homes

Engages in the design, construction, and sale of homes in the United States.

Limited growth with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives