- United States

- /

- Capital Markets

- /

- NYSEAM:CET

Top Dividend Stocks To Consider In June 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a landscape marked by geopolitical tensions and fluctuating oil prices, investors are keeping a close eye on economic indicators and Federal Reserve policies that could impact future growth. In such an environment, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those looking to mitigate risk while maintaining exposure to equity markets.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 5.13% | ★★★★★☆ |

| Universal (UVV) | 5.56% | ★★★★★★ |

| Southside Bancshares (SBSI) | 5.13% | ★★★★★☆ |

| Peoples Bancorp (PEBO) | 5.63% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.94% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 7.17% | ★★★★★★ |

| Ennis (EBF) | 5.41% | ★★★★★★ |

| Dillard's (DDS) | 6.52% | ★★★★★★ |

| CompX International (CIX) | 5.04% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.46% | ★★★★★★ |

Click here to see the full list of 152 stocks from our Top US Dividend Stocks screener.

We'll examine a selection from our screener results.

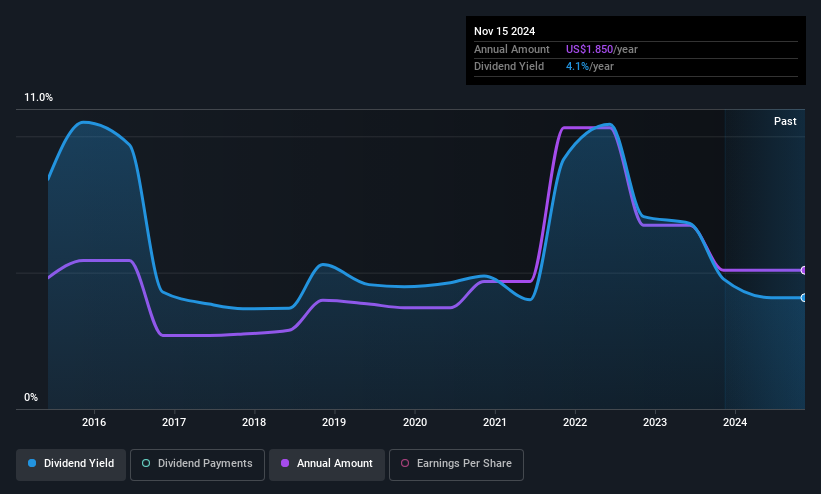

Huntington Bancshares (HBAN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Huntington Bancshares Incorporated is a bank holding company for The Huntington National Bank, offering commercial, consumer, and mortgage banking services in the United States with a market cap of $22.92 billion.

Operations: Huntington Bancshares generates its revenue primarily from Consumer & Regional Banking at $5.09 billion and Commercial Banking at $2.70 billion.

Dividend Yield: 3.9%

Huntington Bancshares offers a stable dividend profile, with dividends reliably increasing over the past decade and currently covered by earnings at a 47% payout ratio. The company forecasts continued coverage in three years (41.9%). Despite trading at 48.7% below estimated fair value, its dividend yield of 3.94% is lower than the top quartile of US dividend payers. Recent earnings growth and an active share repurchase program could support future dividend sustainability despite recent net charge-offs totaling US$86 million for Q1 2025.

- Click here to discover the nuances of Huntington Bancshares with our detailed analytical dividend report.

- Our expertly prepared valuation report Huntington Bancshares implies its share price may be lower than expected.

JAKKS Pacific (JAKK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JAKKS Pacific, Inc. is a company that designs, produces, markets, sells, and distributes toys and related products including consumer items, kids' furniture, costumes, sporting goods, and home furnishings globally with a market cap of approximately $232.84 million.

Operations: JAKKS Pacific, Inc. generates revenue through two main segments: Costumes, which accounts for $119.67 million, and Toys/Consumer Products, contributing $594.55 million.

Dividend Yield: 4.8%

JAKKS Pacific's dividend, newly initiated at US$0.25 per share, is well-covered by earnings and cash flows with a payout ratio of 6% and a cash payout ratio of 28.6%. Despite its recent inception, the dividend yield is competitive within the top quartile of U.S. payers at 4.79%. The company's strategic licensing partnerships, such as the DC x Sonic toy line debuting in Fall 2025, could bolster future revenue streams amidst forecasted earnings decline.

- Click here and access our complete dividend analysis report to understand the dynamics of JAKKS Pacific.

- Our comprehensive valuation report raises the possibility that JAKKS Pacific is priced lower than what may be justified by its financials.

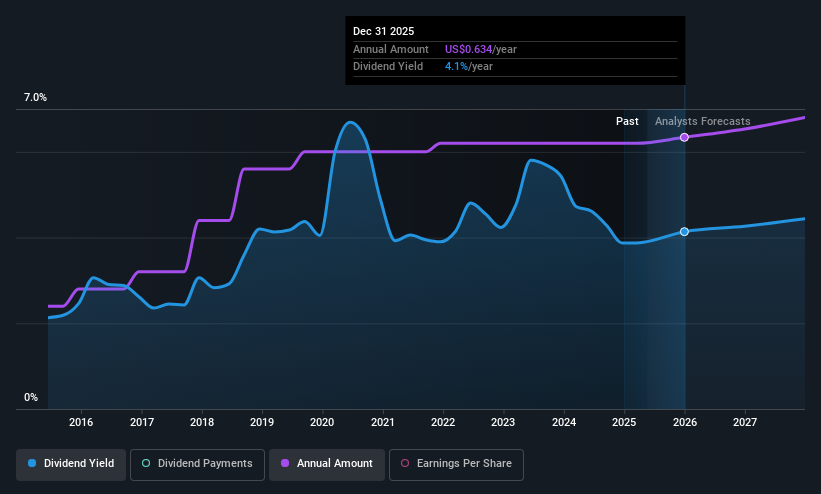

Central Securities (CET)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Central Securities Corp. is a publicly owned investment manager with a market cap of $1.36 billion.

Operations: Central Securities Corp. generates revenue from its Financial Services segment, specifically through Closed End Funds, amounting to $23.70 million.

Dividend Yield: 4.8%

Central Securities offers a dividend yield of 4.78%, placing it in the top 25% of U.S. dividend payers, although the sustainability is questionable due to a high cash payout ratio of 174.7%. Recent increases include a US$0.25 per share dividend, with part taxable as long-term capital gain. Despite trading at a significant discount to estimated fair value and having low payout ratios by earnings, dividends have been volatile over the past decade.

- Dive into the specifics of Central Securities here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Central Securities shares in the market.

Where To Now?

- Investigate our full lineup of 152 Top US Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:CET

Central Securities

Central Securities Corp. is a publicly owned investment manager.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives