- United States

- /

- Consumer Durables

- /

- NasdaqGS:HOFT

Hooker Furnishings (HOFT) Q3 Loss Driven by Discontinued Ops Deepens Bearish Profitability Narratives

Reviewed by Simply Wall St

Hooker Furnishings (HOFT) just posted Q3 2026 results with revenue of $70.7 million and basic EPS of -$1.18, as discontinued operations weighed on the bottom line. The company has seen quarterly revenue move from $95.1 million in Q2 2025 to $70.7 million most recently, while EPS shifted from -$0.19 to -$1.18 over the same stretch. This underscores how volume and earnings pressure are running together. Against that backdrop of soft sales and deeper losses, investors are likely to focus on how management can stabilize margins and work toward sustainable profitability.

See our full analysis for Hooker Furnishings.With the latest numbers on the table, the next step is to see how this trajectory lines up with the prevailing narratives around Hooker Furnishings, and which assumptions about growth and profitability hold up under closer scrutiny.

See what the community is saying about Hooker Furnishings

Losses Deepen As Discontinued Ops Hit $8.6 Million

- Q3 2026 net income excluding extra items was a loss of $12.5 million, versus losses of about $3.3 million and $3.1 million in Q2 and Q1 2026, while earnings from discontinued operations alone were a negative $8.6 million.

- Bears highlight that significant charges and write downs have already pushed the business into consolidated operating and net losses, and the latest $12.5 million loss fits that concern,

- They point to prior inventory write downs, impairment charges, and bad debt expenses as drivers of recent year losses, and the steep jump from roughly $3 million losses earlier in 2026 to $12.5 million now shows those pressures have not yet eased.

- The bearish view also flags that similar cost actions and charges in earlier periods produced full year losses, so another large quarterly loss raises the risk that near term performance remains driven by cleanup rather than ongoing operations.

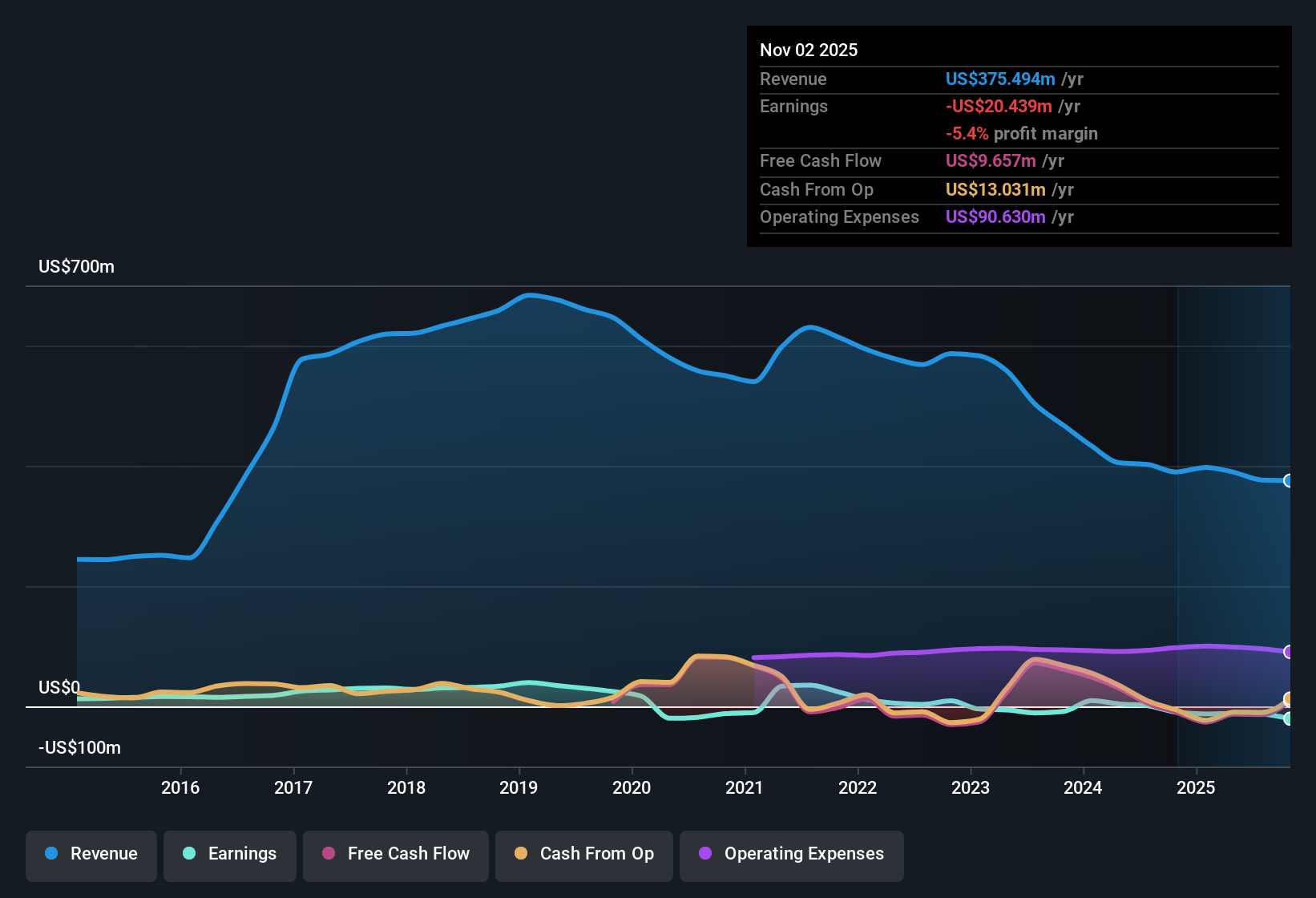

Trailing $375 Million Sales, But Still Losing $20 Million

- On a trailing twelve month basis to Q3 2026, Hooker Furnishings generated $375.5 million in revenue but posted a net loss excluding extra items of $20.4 million and a basic EPS of negative $1.93.

- Analysts' consensus view notes that sales momentum exists but has not turned into profits yet, and the trailing numbers reinforce that tension,

- Revenue over the last year is described as growing at about 7.9 percent annually, yet the company remains unprofitable with $20.4 million of losses, which supports the idea that margin improvement, not just growth, is needed.

- At the same time, forecasts call for earnings to flip from roughly negative $11.6 million today to $28.2 million by around 2028, so the current gap between $375.5 million of sales and negative earnings is exactly what the consensus expects management to close.

Cheap At 0.3x Sales, With 15.00 Target vs $10.54 Price

- The stock trades around $10.54 per share with a price to sales ratio of 0.3 times, compared with about 0.6 times for the broader industry and 0.4 times for peers, while the analyst price target is 15.00 and DCF fair value is about 18.10.

- Supporters with a bullish tilt argue that cost savings and new branding could justify this valuation gap, and the current metrics give them some numerical backing,

- Planned cost actions, including $4 million to $5.7 million in expected annual savings from exiting the Savannah warehouse and another $8 million to $10 million from broader reductions, are being weighed against the roughly $20.4 million trailing loss, which would materially narrow the loss if achieved.

- At the same time, initiatives like the Margaritaville licensing and increased inventory in high velocity collections are intended to grow revenue from the current $375.5 million base, which, combined with cost cuts, is what underpins both the 15.00 target and the DCF fair value estimate of about 18.10.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Hooker Furnishings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? In just a few minutes, you can turn that perspective into a full narrative that reflects your own thesis: Do it your way.

A great starting point for your Hooker Furnishings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternatives

Hooker Furnishings is still posting sizable losses despite modest sales growth, with margin pressure, charges, and discontinued operations all weighing on profitability.

If you want businesses already converting revenue into consistent earnings instead of betting on a turnaround, use our stable growth stocks screener (2093 results) today to focus on steadier compounders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hooker Furnishings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOFT

Hooker Furnishings

Designs, manufactures, imports, and markets residential household, hospitality, and contract furniture products.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion