- United States

- /

- Leisure

- /

- NasdaqGS:HAS

Digital Gaming and Collectibles Surge Could Be a Game Changer for Hasbro (HAS)

Reviewed by Sasha Jovanovic

- At New York Comic Con, Kayou, in partnership with Hasbro, provided U.S. fans an early hands-on preview of the MY LITTLE PONY Card Game – Friendships Begin, while Hasbro and Gameberry Labs introduced the first stand-alone SORRY! mobile app and announced a series of collectible action figures and toy releases tied to Ghostbusters, Tron, Star Wars, and Marvel franchises.

- The surge of product launches and analyst upgrades reflects Hasbro's expanding presence in digital gaming and collectibles, aligning with shifts in fan engagement and industry trends.

- We'll examine how momentum in Hasbro's digital and collector product lines, highlighted by these announcements, impacts its investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Hasbro Investment Narrative Recap

To be a Hasbro shareholder today, you need to believe that the company’s pivot toward digital gaming and high-engagement collectible products can offset ongoing challenges in its traditional consumer products division, where volatile sales and retailer caution remain the most pressing near-term risk. The latest wave of new product launches and positive analyst sentiment support the view that momentum in digital and collector-driven offerings is a key short-term catalyst; however, these developments are not yet material enough to offset the structural headwinds that could weigh on overall results.

The recent preview of the MY LITTLE PONY Card Game – Friendships Begin at New York Comic Con exemplifies Hasbro’s effort to grow its cross-platform entertainment and collectibles reach, a theme at the heart of current investor interest. Its success with TCGs and broadening franchise appeal remains vital to the company’s narrative, especially as Hasbro seeks to diversify away from legacy toys and drive growth through higher-margin, recurring revenue streams.

But while the expansion of digital and licensed collectibles draws headlines, investors should also keep a close eye on...

Read the full narrative on Hasbro (it's free!)

Hasbro's outlook anticipates $4.9 billion in revenue and $773.5 million in earnings by 2028. This implies a 4.7% annual revenue growth and a $1,341.8 million increase in earnings from the current level of -$568.3 million.

Uncover how Hasbro's forecasts yield a $89.17 fair value, a 23% upside to its current price.

Exploring Other Perspectives

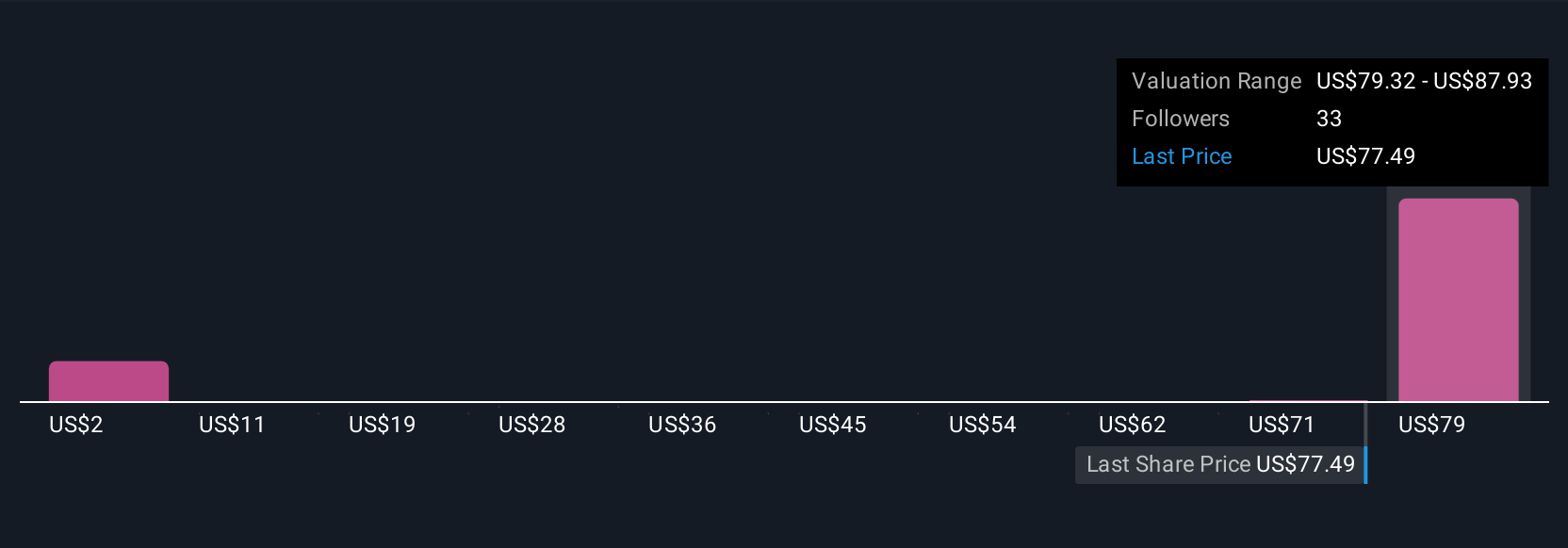

Six private investors in the Simply Wall St Community estimate Hasbro’s fair value anywhere from US$1.90 to US$89.17 per share. As Hasbro’s revenue mix shifts toward digital and collectibles, franchise concentration risk could still weigh on longer-term performance, explore how others view this balance.

Explore 6 other fair value estimates on Hasbro - why the stock might be worth as much as 23% more than the current price!

Build Your Own Hasbro Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hasbro research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Hasbro research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hasbro's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hasbro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HAS

Hasbro

Operates as a toy and game company in the United States, Europe, Canada, Mexico, Latin America, Australia, China, and Hong Kong.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives