- United States

- /

- Leisure

- /

- NasdaqGS:HAS

Did Hasbro’s (HAS) Dragon Shield Collaboration Mark a Turning Point for Its Collectibles Strategy?

Reviewed by Sasha Jovanovic

- Dragon Shield recently announced a collaboration with Hasbro's Wizards of the Coast to produce MAGIC: THE GATHERING trading card game accessories, debuting two collectible sleeve series that honor the game's legacy through iconic creatures and landscapes.

- This partnership builds on Hasbro's focus on expanding its flagship franchises into collectible and licensed product categories, demonstrating the broader commercial appeal of its intellectual property.

- We'll examine how this latest franchise collaboration and new licensed collectibles could influence Hasbro's investment narrative and future growth prospects.

Find companies with promising cash flow potential yet trading below their fair value.

Hasbro Investment Narrative Recap

For investors considering Hasbro today, the core belief centers on the company’s power to turn deeply loved franchises like Magic: The Gathering into recurring, high-margin earnings streams across digital and physical products. The new Dragon Shield collaboration increases the brand’s visibility among collectors, but as with most licensing accessory deals, its impact on near-term earnings or Hasbro’s biggest short-term catalyst, digital gaming expansion, is not expected to be material. A timely connection arises in Hasbro’s recent announcement of a new video game studio in Montréal for Wizards of the Coast, which underscores the significance of digital gaming as a driver of future growth. This strategic focus remains the key short-term catalyst, as Hasbro looks to balance legacy collectibles with digital entertainment initiatives. Yet, in contrast to this opportunity, investors should not overlook the risks tied to over-reliance on a single blockbuster franchise...

Read the full narrative on Hasbro (it's free!)

Hasbro’s outlook anticipates $4.9 billion in revenue and $773.5 million in earnings by 2028. This scenario assumes a 4.7% annual revenue growth rate and a $1,342 million earnings increase from the current earnings of -$568.3 million.

Uncover how Hasbro's forecasts yield a $89.17 fair value, a 17% upside to its current price.

Exploring Other Perspectives

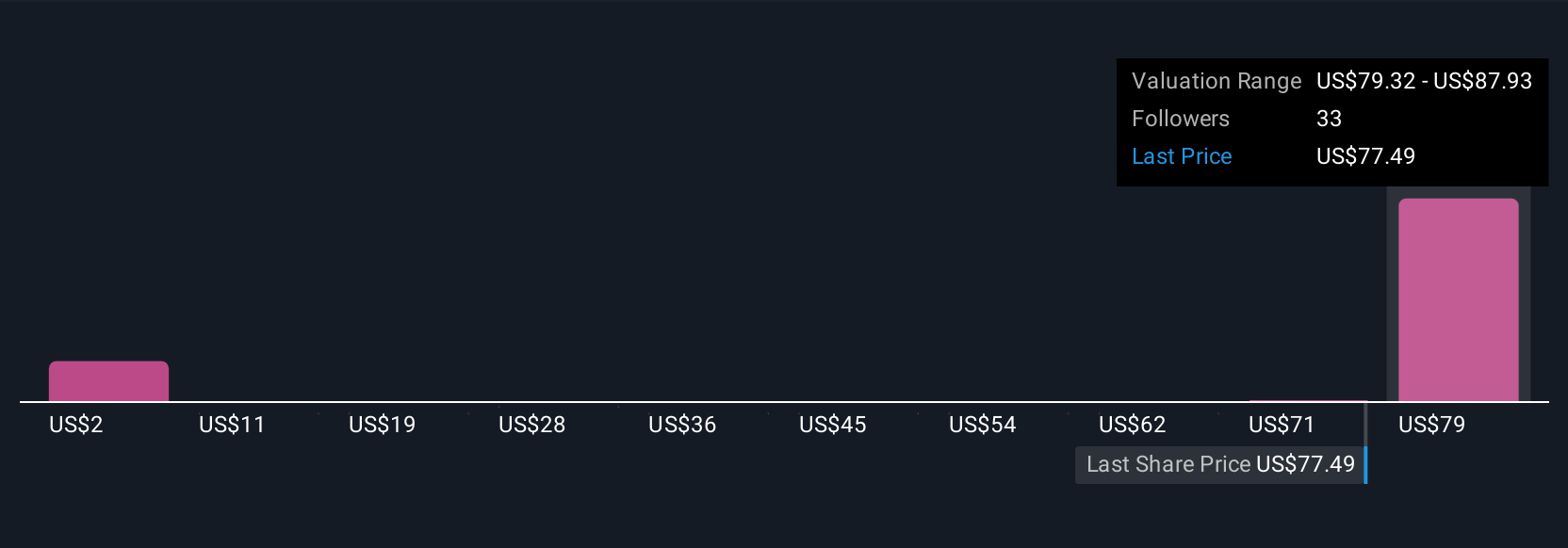

Six members of the Simply Wall St Community estimate Hasbro’s fair value as low as US$1.90 and as high as US$89.17. While opinions vary widely, strong digital gaming growth remains a central focus shaping varied expectations for future performance.

Explore 6 other fair value estimates on Hasbro - why the stock might be worth as much as 17% more than the current price!

Build Your Own Hasbro Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hasbro research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Hasbro research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hasbro's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hasbro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HAS

Hasbro

Operates as a toy and game company in the United States, Europe, Canada, Mexico, Latin America, Australia, China, and Hong Kong.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives