- United States

- /

- Consumer Durables

- /

- NasdaqGS:GPRO

GoPro, Inc. (NASDAQ:GPRO) Surges 28% Yet Its Low P/S Is No Reason For Excitement

GoPro, Inc. (NASDAQ:GPRO) shareholders have had their patience rewarded with a 28% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 49% over that time.

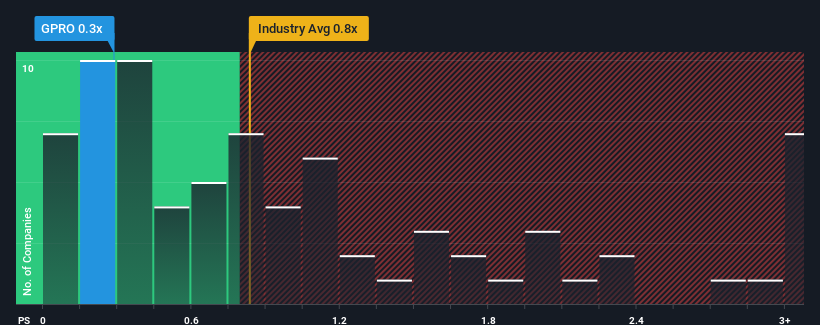

Although its price has surged higher, given about half the companies operating in the United States' Consumer Durables industry have price-to-sales ratios (or "P/S") above 0.8x, you may still consider GoPro as an attractive investment with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for GoPro

What Does GoPro's P/S Mean For Shareholders?

GoPro could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think GoPro's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as GoPro's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 13%. This means it has also seen a slide in revenue over the longer-term as revenue is down 21% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 15% as estimated by the three analysts watching the company. Meanwhile, the broader industry is forecast to expand by 4.9%, which paints a poor picture.

In light of this, it's understandable that GoPro's P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On GoPro's P/S

GoPro's stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that GoPro's P/S is on the lower end of the spectrum. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 1 warning sign for GoPro that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GPRO

GoPro

Provides cameras, mountable and wearable accessories, and subscription and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives