- United States

- /

- Luxury

- /

- NasdaqGS:GIII

G-III Apparel Group (GIII): Exploring Valuation After Earnings Beat and Cautious Outlook

Reviewed by Kshitija Bhandaru

G-III Apparel Group (GIII) posted quarterly results that came in above expectations, highlighting ongoing strength in its core brands. However, the company's outlook for the next quarter is softer, raising questions around near-term growth.

See our latest analysis for G-III Apparel Group.

Despite G-III Apparel Group’s recent beat on both net sales and earnings, the stock has lost a bit of momentum this year, with a year-to-date share price return of -16% and a 1-year total shareholder return just under flat. Insider buying, including a significant purchase by an executive VP, not only aligns management with shareholders but may signal that those closest to the business see untapped value ahead. This comes even as softer forward guidance has weighed on sentiment of late.

If you’re interested in what else the market might be signaling, now’s a good moment to broaden your investing journey and discover fast growing stocks with high insider ownership

With shares down for the year but insiders stepping in to buy, investors may wonder whether G-III Apparel Group is trading at an attractive valuation or if the market is accurately reflecting cautious guidance and muted near-term growth prospects.

Price-to-Earnings of 6.2x: Is it justified?

G-III Apparel Group is trading at a price-to-earnings (P/E) ratio of 6.2x, well below both the US market average of 19.2x and the US Luxury industry average of 21.2x. At a last close price of $26.92, the market appears to be putting a conservative value on the company’s earnings power compared to its peers.

The P/E ratio illustrates how much investors are willing to pay today for a dollar of company earnings. In cyclical sectors like apparel, a lower multiple can either signal undervaluation or reflect muted expectations for future growth and profitability, especially if the outlook is challenged.

Given that G-III's earnings have declined over the past year and its revenue is forecast to shrink over the next three years, the subdued valuation could be the market’s way of discounting near-term challenges. However, this multiple still stands out as cheap compared to where peers and the broader market are trading, making it a figure worth a closer look.

Compared to both the US Luxury industry average and its peer group average, G-III’s P/E is dramatically lower. This signals that the market is not pricing in much optimism for a rebound in earnings, even as the company demonstrates consistent profitability over the longer term. If broader industry multiples persist, the valuation gap could eventually narrow in G-III’s favor.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 6.2x (UNDERVALUED)

However, revenue growth remains negative, and cautious guidance could outweigh undervaluation if near-term industry headwinds persist.

Find out about the key risks to this G-III Apparel Group narrative.

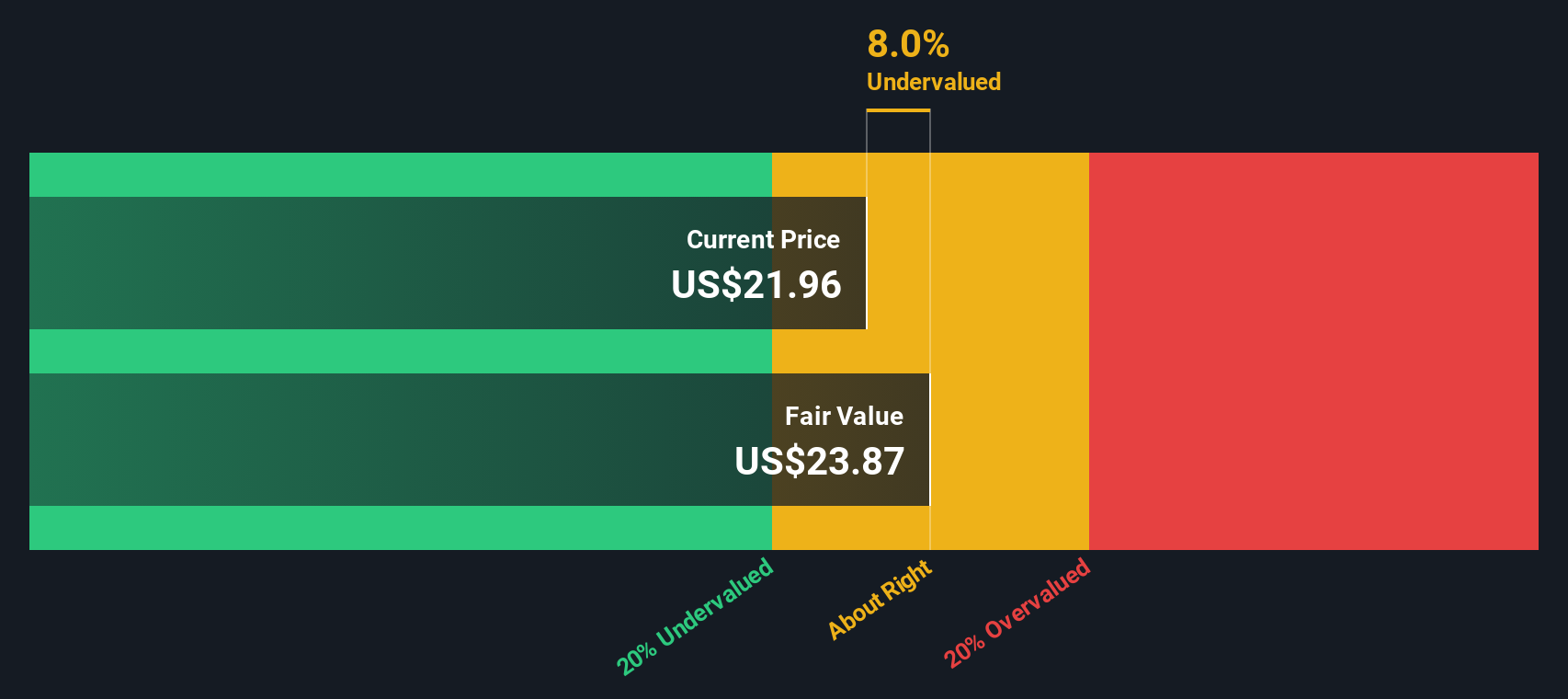

Another View: Discounted Cash Flow Says Overvalued

While the low price-to-earnings ratio hints at possible value, our DCF model presents a different picture. Based on expected future cash flows, G-III Apparel Group is trading significantly above its estimated fair value. Could the market be overlooking risk factors, or is there more to the story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out G-III Apparel Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own G-III Apparel Group Narrative

If you see things differently or want to form your own perspective, you can dive into the fundamentals and craft a narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding G-III Apparel Group.

Looking for more investment ideas?

Smart investing means staying ahead of the trends and not letting opportunities slip through your fingers. Use the Simply Wall Street Screener to uncover stocks that match your strategy and risk profile. Start building your advantage today.

- Benefit from stable income and long-term growth potential by reviewing these 19 dividend stocks with yields > 3% with reliable yields and proven track records.

- Ride the wave of breakthrough technology and see which companies stand out among these 24 AI penny stocks powering artificial intelligence innovation.

- Catch undervalued gems before the market notices by checking out these 904 undervalued stocks based on cash flows priced attractively based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GIII

G-III Apparel Group

Designs, sources, distributes, and markets women’s and men’s apparel in the United States and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives