- United States

- /

- Luxury

- /

- NasdaqGS:CROX

With a Successful Digital Strategy, Crocs, Inc. (NASDAQ: CROX) Can Continue With Outstanding Returns

Multi-bagger stocks are as rare as they are elusive. They are the snow leopards of the market. We're sure they exist, but even after spending significant time trekking through the Himalayas, you might never catch a glimpse of one.

Crocs, Inc.(NASDAQ: CROX) was one of those stocks in the last few years, delivering outstanding returns while keeping a relatively clean balance sheet. Yet, the latest acquisition didn't fare well with the investors.

Check out our latest analysis for Crocs.

Latest Developments

Crocs had an exceptional year, beating the earnings estimates significantly. In Q3, they delivered 35% Y/Y growth and an operating margin of 33%. The company is growing its "green "brand, focusing on sustainable materials and boosting its image by not using the packaging for most of its products.

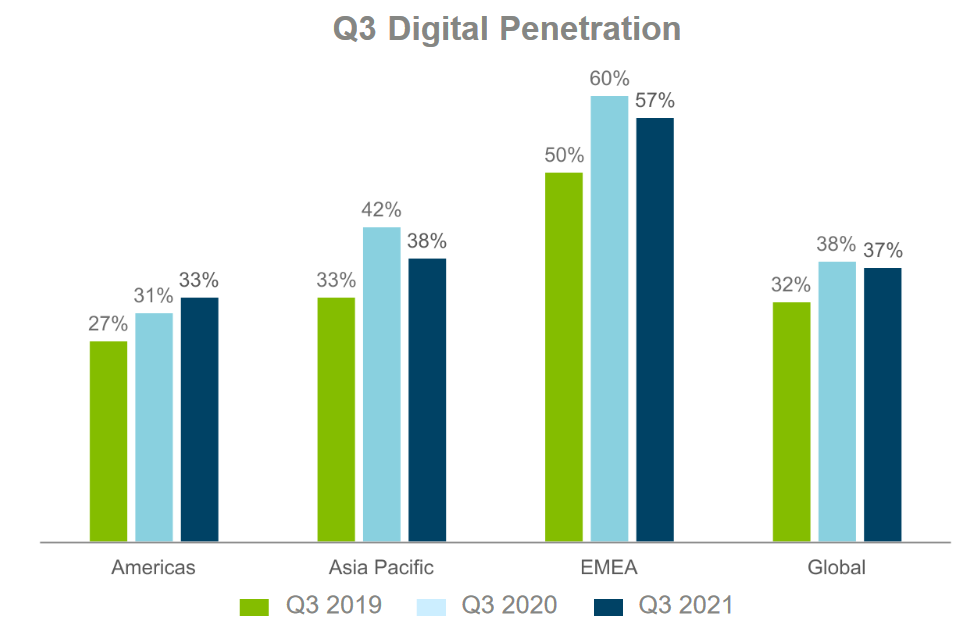

Digital sales channels are currently at 37% but projected at over 50% by 2026. Interestingly, there is much room for improving digital penetration in the domestic market.

Meanwhile, the company announced the acquisition of footwear brand HEYDUDE. The US$2.5b worth deal will be funded by US$2.05b in cash and US$450m in shares.

The market didn't take the news well as the stock fell 6%. The price declined over 23% throughout December, marking the most significant pullback since March 2020.

Examining the Outstanding Results

During the last half-decade, Crocs became profitable. That kind of transition can be an inflection point that justifies a substantial share price gain, just as we have seen here. Since the company was unprofitable five years ago, but not three years ago, it's worth looking at the returns in the last three years, too. We can see that the Crocs share price has been up 364% over the previous three years.

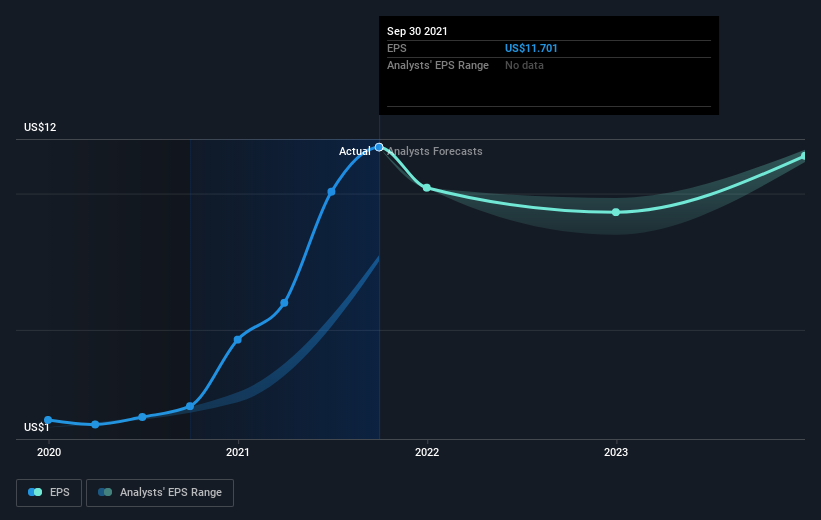

During the same period, EPS grew by 276% each year. This EPS growth is higher than the 67% average annual increase in the share price over the same three years. So you might conclude the market is a little more cautious about the stock these days. This unenthusiastic sentiment is reflected in the stock's reasonably modest P/E ratio of 9.64.

The company's earnings per share (over time) are depicted in the image below (click to see the exact numbers).

It is, of course, excellent to see how Crocs has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Although the latest acquisition might have raised some eyebrows, Piper Sandler defended the deal, reiterating the overweight rating and US$215 price target. Their analyst Erinn Murphy deemed the 12.5x trailing-twelve-month EBITDA acquisition multiplier as a fair deal.

Even after the latest pullback, Crocs has rewarded shareholders with a total shareholder return of 97% in the last twelve months. In the last 5 years, the price jumped an outstanding 1,701% as the company became profitable.

While the shakeout might have scared some more cautious investors, Crocs remains a high-quality name that seems to be doing the right things in the right way - especially when it comes to using the "latest fashion" of marketing (like Tik-Tok influencers) to execute the brand strategy successfully.

But to understand Crocs better, we need to consider many other factors. To that end, you should learn about the 4 warning signs we've spotted with Crocs (including 1 which can't be ignored).

Of course, Crocs may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market-weighted average returns of stocks that currently trade on US exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:CROX

Crocs

Designs, develops, manufactures, markets, distributes, and sells casual lifestyle footwear and accessories for men, women, and children under the Crocs and HEYDUDE Brands in the United States and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives