- United States

- /

- Luxury

- /

- NasdaqGS:CROX

Will Crocs’ (CROX) Share Buybacks Shield Its Long-Term Story Amid Weak Q2 Results?

Reviewed by Simply Wall St

- In August 2025, Crocs, Inc. reported second-quarter earnings that included sales of US$1,149.37 million but a net loss of US$492.28 million, and provided guidance for a 9% to 11% revenue decrease in the third quarter compared to the previous year.

- Alongside ongoing share repurchases totaling over US$2.58 billion since 2013, Crocs faced a significant swing to quarterly losses and signaled softer demand ahead.

- We'll now examine how Crocs' weaker third quarter revenue outlook impacts its previously optimistic long-term investment narrative.

AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Crocs Investment Narrative Recap

To be a Crocs shareholder today, you need to believe in the company’s ability to reignite demand and stabilize long-term earnings, particularly as international growth offsets pressures at home. The sharp Q2 2025 loss, coupled with guidance for a 9% to 11% revenue drop in Q3, poses a real challenge to the near-term recovery narrative and amplifies the short-term risk of softening consumer demand in core markets; the impact is therefore material for the most immediate catalyst.

The company’s ongoing share buyback remains highly relevant: Crocs repurchased over US$133 million in shares this past quarter, signaling confidence in its long-term prospects and returning capital to shareholders, even as it moves through operational and industry headwinds. In context of heightened revenue risk, this approach stands out, as the focus on capital allocation efficiency could influence investor sentiment or cushion longer-term downside.

By contrast, one risk investors should be aware of is how persistent competitive pressures and shifting consumer preferences in North America could force deeper markdowns if...

Read the full narrative on Crocs (it's free!)

Crocs' outlook projects $4.0 billion in revenue and $925.2 million in earnings by 2028. This implies a 1.0% annual revenue decline and an earnings increase of $688.7 million from current earnings of $236.5 million.

Uncover how Crocs' forecasts yield a $90.92 fair value, a 7% upside to its current price.

Exploring Other Perspectives

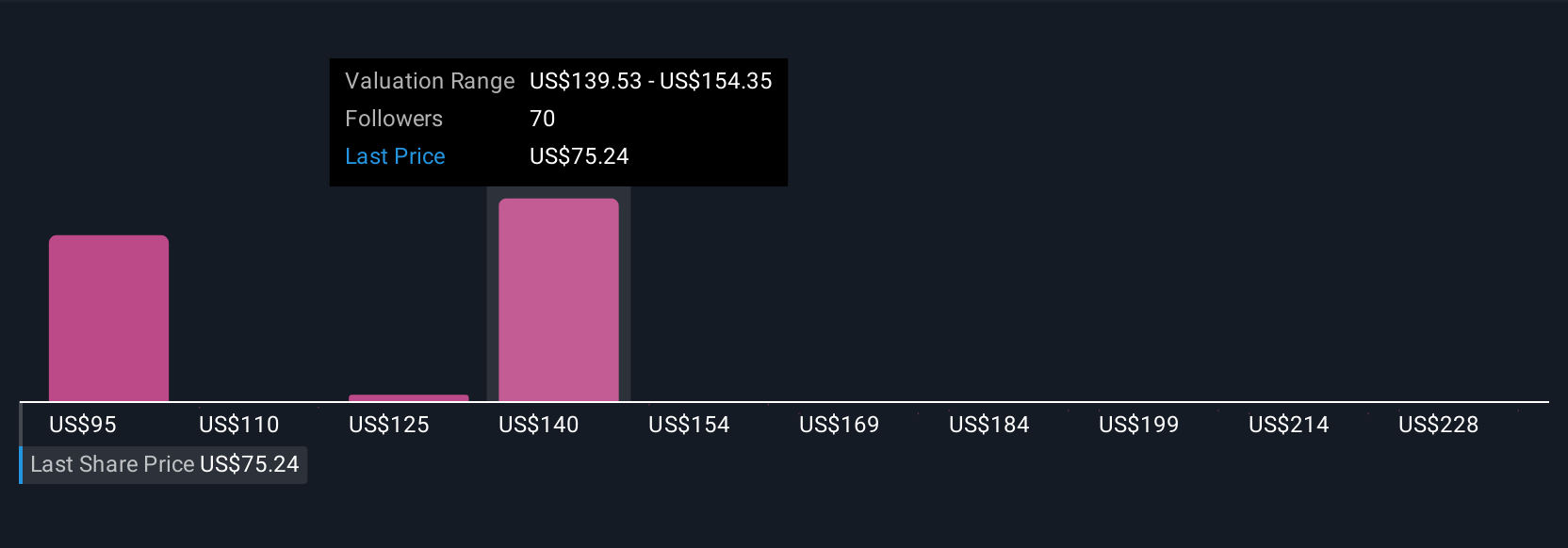

Fair value estimates from 18 Simply Wall St Community members range widely from US$90.92 to US$235.67 per share. With Crocs’ near-term revenue outlook now under pressure, these varied opinions reflect just how differently you might view the company’s future after accounting for challenges in its largest market.

Explore 18 other fair value estimates on Crocs - why the stock might be worth over 2x more than the current price!

Build Your Own Crocs Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crocs research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Crocs research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crocs' overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CROX

Crocs

Designs, develops, manufactures, markets, distributes, and sells casual lifestyle footwear and accessories for men, women, and children under the Crocs and HEYDUDE Brands in the United States and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives