- United States

- /

- Luxury

- /

- NasdaqGS:CROX

Does Crocs’ 8% Share Price Rebound Signal a New Opportunity in 2025?

Reviewed by Bailey Pemberton

If you have been eyeing Crocs stock and wondering if now is the right time to jump in or cash out, you are definitely not alone. Investors have had a front-row seat to some dramatic moves lately. Over just the past month, Crocs shares climbed 8.2%, a solid bounce that hints at shifting sentiment compared to the rocky start this year. Of course, with the stock still down 24.1% year-to-date and off by more than a third over the last 12 months, questions about the stability of the business and where the value really lies are only growing louder. Yet, if you zoom out over a longer stretch, Crocs has returned more than 54% over the last five years, showing there is resilience behind all that color and comfort.

Analysts and investors alike are watching closely as the brand continues to expand its global reach, while also navigating changing trends in consumer footwear and facing off against new competition. Some of the recent headlines, for instance fresh collaborations and international launches, offer a glimpse into Crocs’ growth ambitions, even if their near-term impact on share price is still being sorted out by the market. With all this swirling around, it is no wonder there is debate on whether Crocs is truly undervalued right now.

Good news for value seekers: by running Crocs through six key valuation checks, four point to the company being undervalued, resulting in a current value score of 4. Next, we will dive into these popular valuation approaches one at a time to see what they signal, and before we are done, I will share a perspective on valuation you will not want to miss.

Why Crocs is lagging behind its peers

Approach 1: Crocs Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and then discounting them back to today's value. This approach helps investors understand what a business is really worth, based on how much cash it can generate over time.

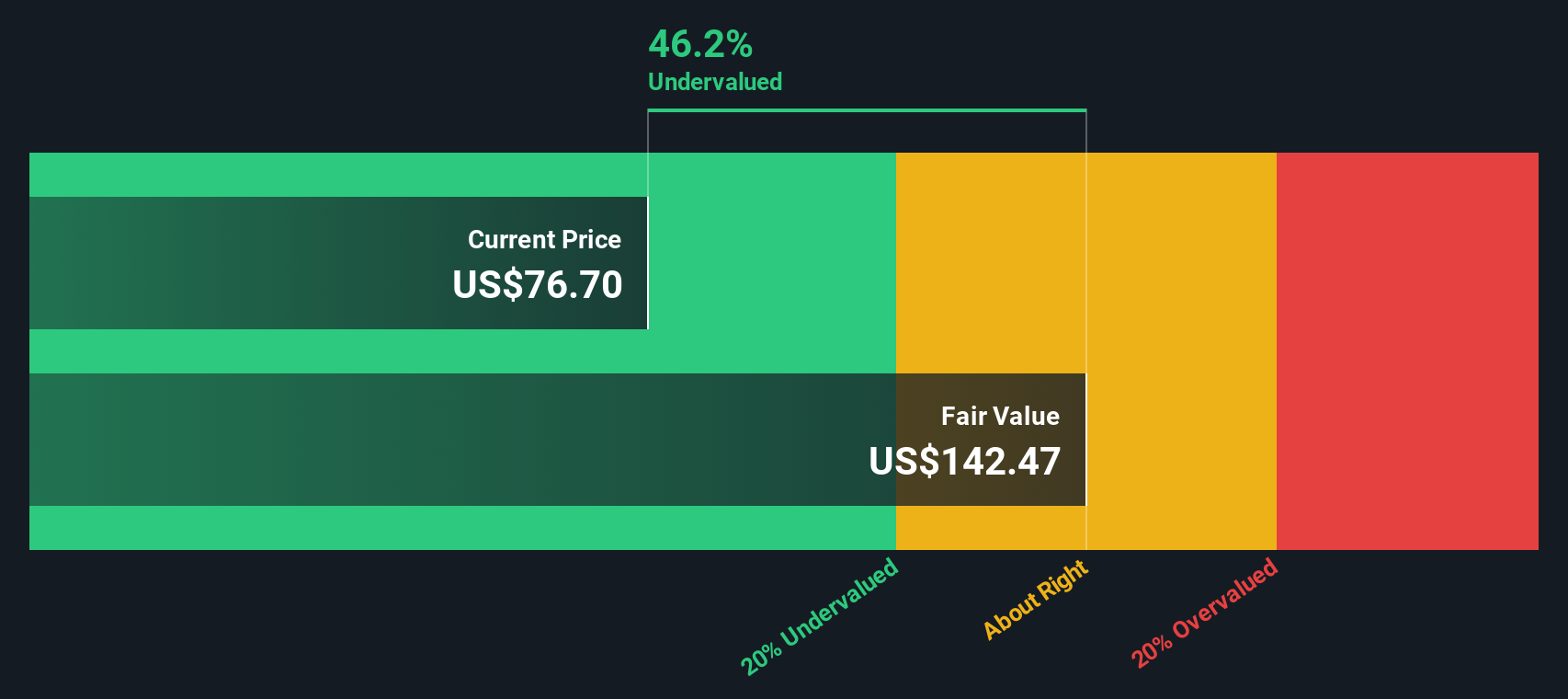

For Crocs, the most recent reported Free Cash Flow stands at $746.8 million. Analysts have provided cash flow estimates up to 2027, where Crocs is expected to generate roughly $591.2 million. After that, projections are calculated using a reasonable growth trajectory, extending a decade out to 2035.

Looking at the 10-year forecast, Free Cash Flows are anticipated to gradually decline and then stabilize, with the model estimating $623.9 million in 2035, all in US dollars. These forecasts, once discounted back using the DCF method, lead to an estimated intrinsic value per share of $141.24.

With the DCF valuation implying a 40.9% discount to the current share price, this suggests that Crocs stock is trading well below its estimated fair value, making it stand out as undervalued by this measure.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Crocs is undervalued by 40.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Crocs Price vs Earnings

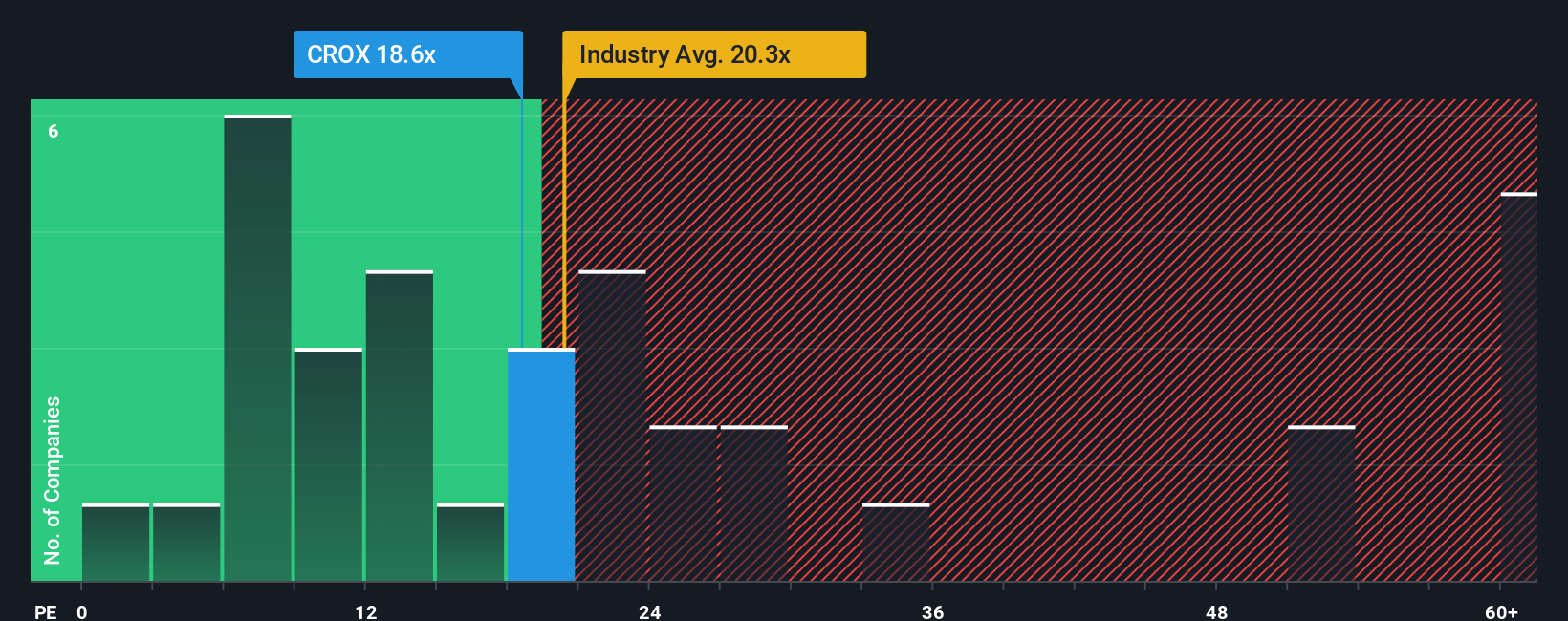

The Price-to-Earnings (PE) ratio is the preferred multiple for valuing profitable companies like Crocs and is widely used because it relates the current share price to the company’s earnings performance. This metric tends to work best when a company is already generating steady profits, as it helps investors quickly gauge how much they are paying for each dollar of earnings.

What counts as a fair or normal PE ratio is influenced by factors such as future earnings growth, stability, and risk. Higher expected growth or lower risk can justify a higher PE. In contrast, slower outlooks or bigger risks usually cause the ratio to move lower. For Crocs, the current PE sits at 19.3x, which is slightly above its peer average of 17.1x but a bit below the luxury industry average of 19.6x.

Simply Wall St's proprietary Fair Ratio for Crocs is 53.6x, a figure that blends in the company’s growth prospects, its profit margins, its market size, and risk profile. This provides a richer picture than a simple comparison to sector peers or industry alone. Because the Fair Ratio accounts for the full context of Crocs’ fundamentals and outlook, it provides a deeper and more tailored benchmark.

Comparing the Fair Ratio to Crocs’ actual PE shows that the stock is trading at a substantial discount to what would be considered fair on Simply Wall St’s metrics. This supports the idea that Crocs is undervalued based on earnings multiples, not just cash flow models.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Crocs Narrative

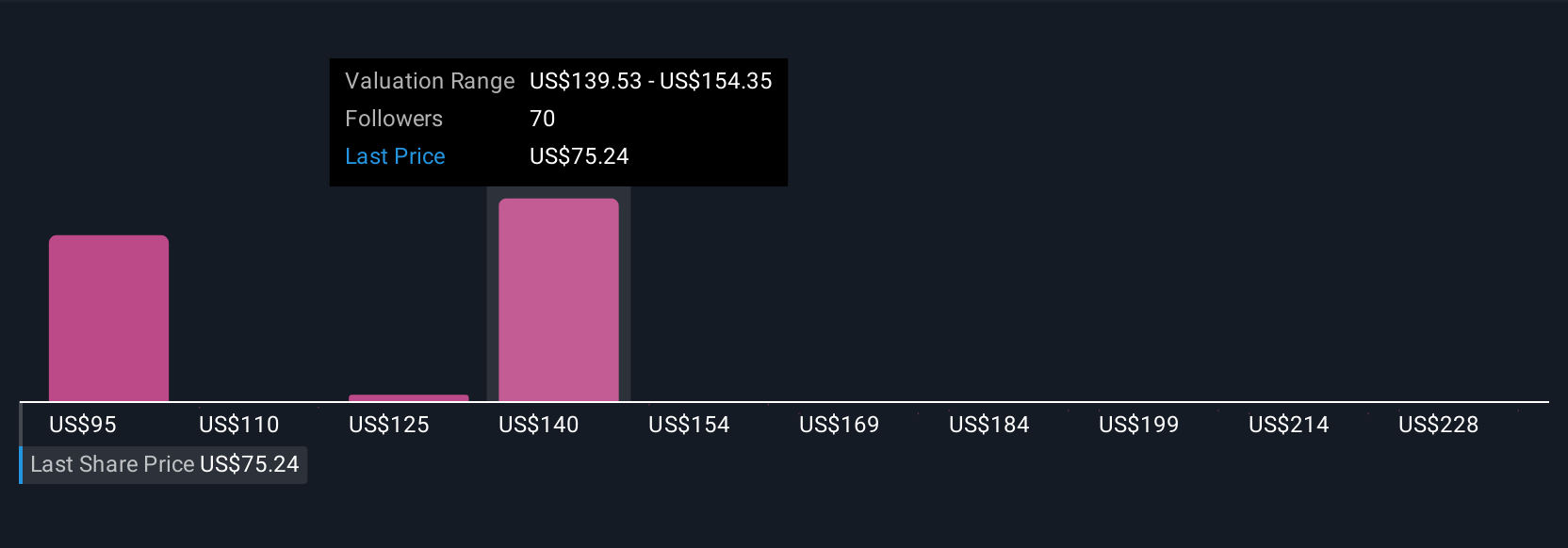

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, the dynamic stories behind the numbers. A Narrative lets you combine your own perspective on Crocs’ future (by setting your assumptions for fair value, future sales, earnings, and margins) with a clear, traceable financial forecast, so you can see exactly how a company’s story leads to a projected share price.

Available to millions of investors on Simply Wall St's Community page, Narratives turn complex valuation into an intuitive process. They help you decide when to buy or sell by tracking how your estimated fair value stacks up against Crocs’ current share price, and they automatically update whenever big news or earnings land, so your view always stays relevant.

For example, some investors project modest growth and see Crocs as worth $151.43 per share, while others focus on near-term risks and set a fair value closer to $67. This demonstrates how your Narrative reflects your view, not just market consensus. With Narratives, you move beyond static multiples and traditional models to make investment decisions with confidence, context, and clarity, all in one place.

Do you think there's more to the story for Crocs? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CROX

Crocs

Designs, develops, manufactures, markets, distributes, and sells casual lifestyle footwear and accessories for men, women, and children under the Crocs and HEYDUDE Brands in the United States and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives