- United States

- /

- Luxury

- /

- NasdaqGS:CROX

Crocs (CROX): Evaluating Valuation After a Sharp 1-Month Share Price Rebound

Reviewed by Simply Wall St

Crocs (CROX) has quietly staged a comeback, with shares up roughly 25% over the past month and about 14% in the past 3 months, despite flat revenue and volatile long term returns.

See our latest analysis for Crocs.

Zooming out, that strong 1 month share price return contrasts with a negative year to date share price return and a weak 1 year total shareholder return, hinting that sentiment may be turning after a choppy stretch.

If Crocs has you rethinking where growth might show up next in consumer and retail, it could be worth exploring fast growing stocks with high insider ownership.

With earnings up sharply but sales treading water, Crocs now trades below many valuation estimates yet just above Wall Street targets. This raises a key question: Is this a fresh buying opportunity, or is future growth already priced in?

Most Popular Narrative: 2.1% Overvalued

With Crocs closing at $91.65 against a narrative fair value of $89.75, the story leans toward modest overpricing while hinging on powerful margin and earnings assumptions.

The company's accelerating direct-to-consumer (DTC) strategy, expanding owned retail and digital channels, experimenting with new retail concepts, and scaling global social commerce, is enabling Crocs to maintain higher pricing, reduce reliance on promotional activity, and capture higher-margin sales. Over time, this is expected to structurally increase net margins and improve the overall quality and predictability of earnings.

Curious how flat sales can still support sharply rising profits and a lower future earnings multiple, even as discounting pulls back and buybacks accelerate? The narrative leans on a surprising mix of shrinking top line assumptions, swelling margins, and a compressed valuation that does not look typical for a discretionary brand. Want to see exactly how those moving parts stack up into today’s fair value call?

Result: Fair Value of $89.75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained U.S. demand weakness or a deeper HEYDUDE stumble could derail the margin story and force analysts to rethink today’s fair value.

Find out about the key risks to this Crocs narrative.

Another View on Value

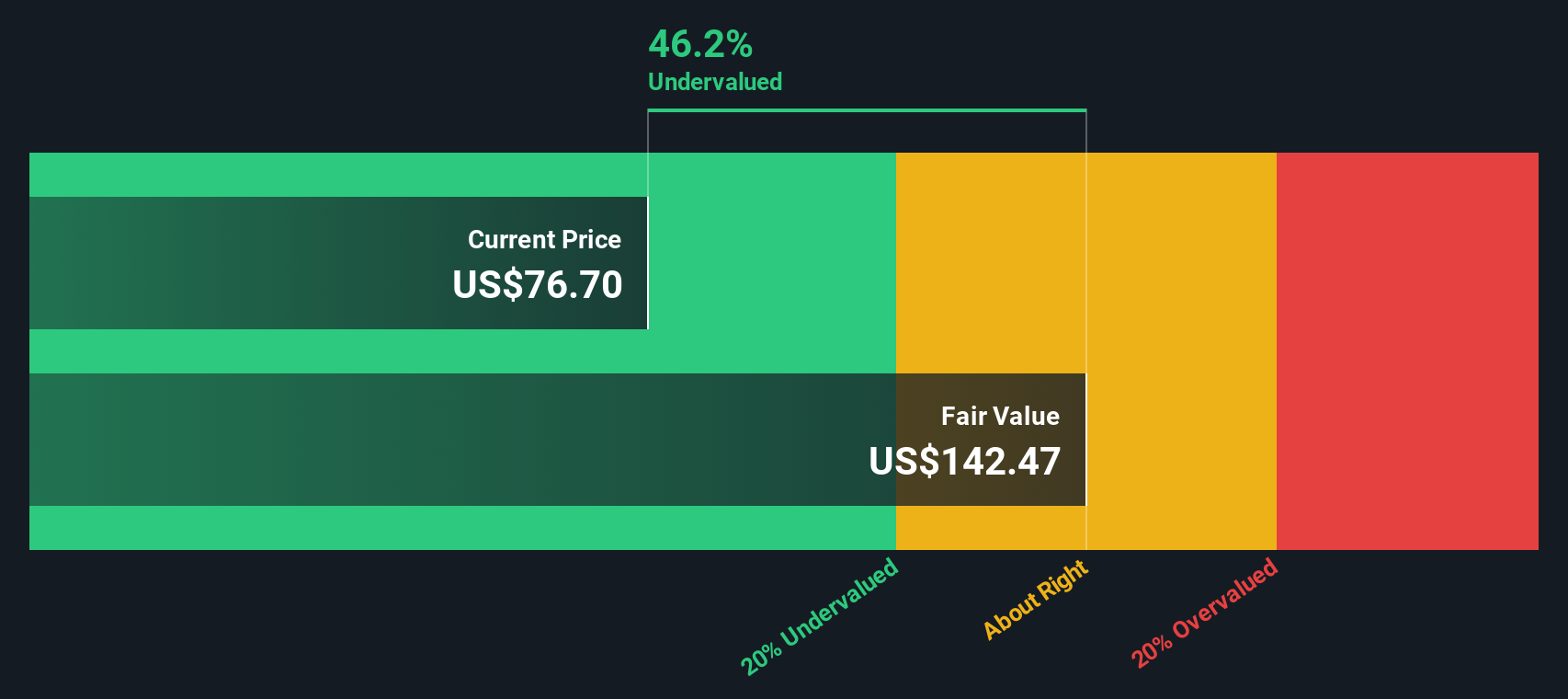

While the narrative fair value suggests Crocs is modestly overvalued, our DCF model points the other way, indicating the shares trade about 42% below intrinsic value. One lens leans cautious; the other sees upside, leaving investors to decide which future feels more believable.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Crocs for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Crocs Narrative

If you see the story differently or would rather dig into the numbers yourself, you can build a complete narrative in minutes, Do it your way.

A great starting point for your Crocs research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for your next investment move?

Do not stop at one compelling story. Use the Simply Wall Street Screener to find high potential opportunities before everyone else notices them.

- Capture early stage growth potential by assessing these these 3636 penny stocks with strong financials with strong financial foundations that many investors are still overlooking.

- Position yourself at the forefront of automation and data intelligence by targeting these 30 healthcare AI stocks shaping the future of medicine and diagnostics.

- Build a cash generating core in your portfolio by focusing on these 13 dividend stocks with yields > 3% that can help support long term income and stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CROX

Crocs

Designs, develops, manufactures, markets, distributes, and sells casual lifestyle footwear and accessories for men, women, and children under the Crocs and HEYDUDE Brands in the United States and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion