- United States

- /

- Basic Materials

- /

- NYSE:LOMA

Undiscovered Gems in United States for September 2024

Reviewed by Simply Wall St

Over the last 7 days, the market has dropped 2.7%, yet it remains up 21% over the past year with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can uncover hidden opportunities for investors.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| River Financial | 122.41% | 16.43% | 18.50% | ★★★★★★ |

| First Ottawa Bancshares | 85.49% | 7.25% | 25.81% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Lifeway Foods (NasdaqGM:LWAY)

Simply Wall St Value Rating: ★★★★★★

Overview: Lifeway Foods, Inc. produces and markets probiotic-based products in the United States and internationally, with a market cap of $295.37 million.

Operations: Lifeway Foods generates revenue primarily from its cultured dairy products, amounting to $176.78 million.

Lifeway Foods, a small cap company, has shown impressive performance with earnings growing by 139% over the past year, significantly outpacing the food industry's 3%. The company's recent Q2 results reported US$49.16 million in sales and US$3.78 million in net income. Lifeway is debt-free and trades at 54% below its estimated fair value. Despite internal governance challenges, including calls for board changes and anti-nepotism policies, it remains a strong performer with high-quality earnings.

- Click to explore a detailed breakdown of our findings in Lifeway Foods' health report.

Gain insights into Lifeway Foods' past trends and performance with our Past report.

Cricut (NasdaqGS:CRCT)

Simply Wall St Value Rating: ★★★★★★

Overview: Cricut, Inc. designs, markets, and distributes a creativity platform that allows users to create professional-looking handmade goods, with a market cap of $1.28 billion.

Operations: Cricut generates revenue primarily through the sale of its creativity platform, which includes hardware, digital content, and accessories. The company's gross profit margin stands at 43%.

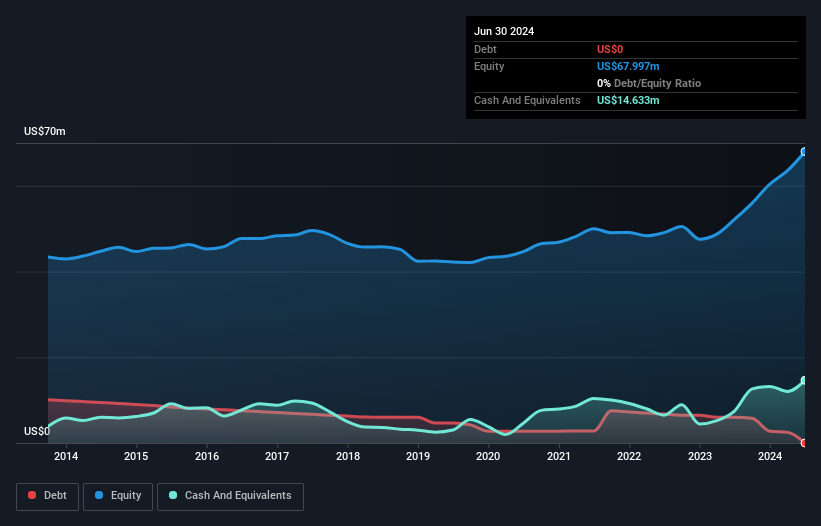

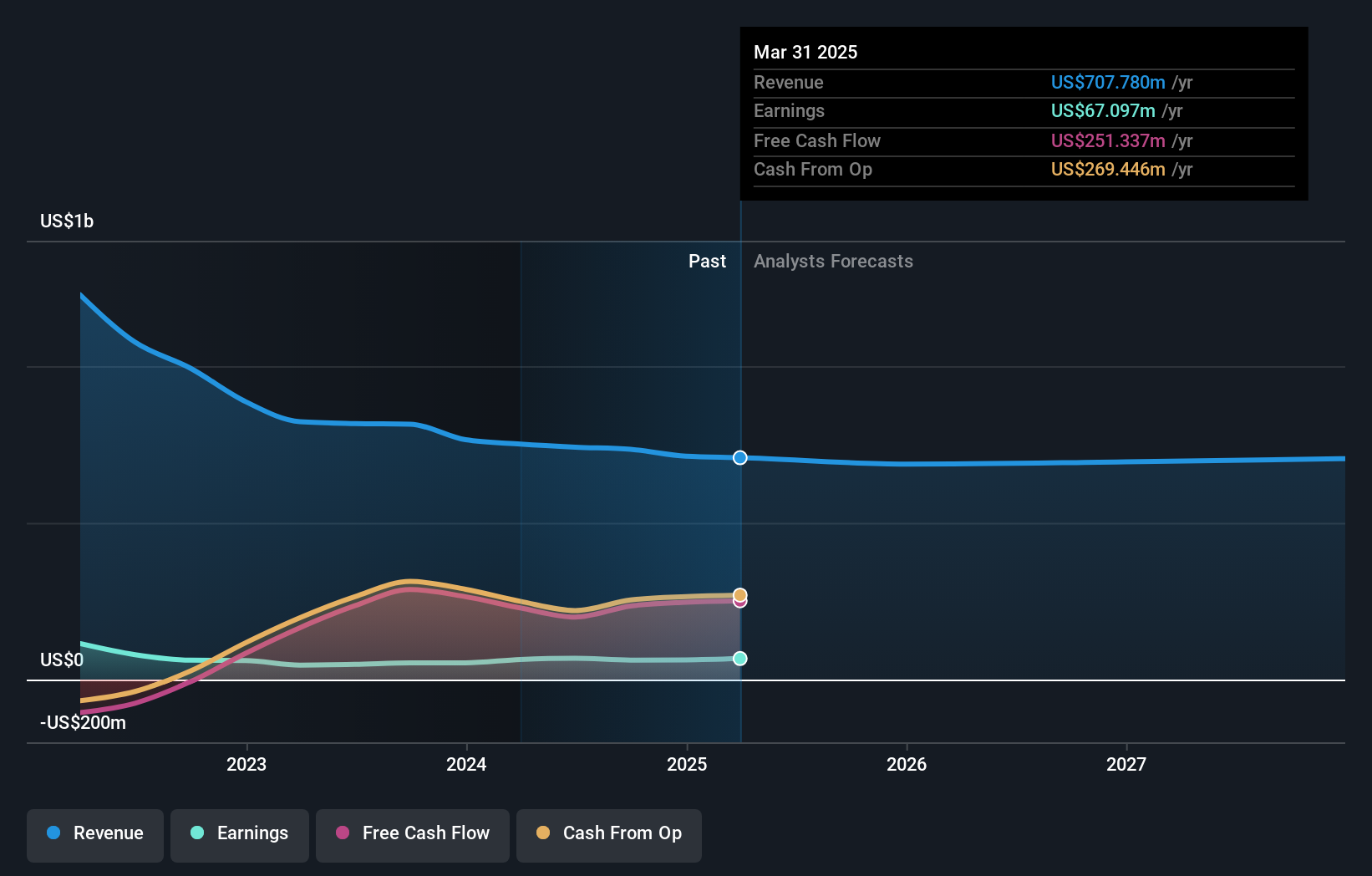

Cricut's financial health is solid, with no debt and high-quality earnings. The company repurchased 1.41 million shares for US$8.86 million recently, reflecting confidence in its value, which trades at 49.4% below fair value estimates. Despite a revenue dip to US$167.95 million in Q2 2024 from US$177.77 million a year ago, net income rose to US$19.77 million from US$16.02 million, showcasing strong profitability and resilience amidst industry challenges.

- Click here and access our complete health analysis report to understand the dynamics of Cricut.

Review our historical performance report to gain insights into Cricut's's past performance.

Loma Negra Compañía Industrial Argentina Sociedad Anónima (NYSE:LOMA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Loma Negra Compañía Industrial Argentina Sociedad Anónima, along with its subsidiaries, manufactures and sells cement and its derivatives in Argentina, with a market cap of approximately $847.22 million.

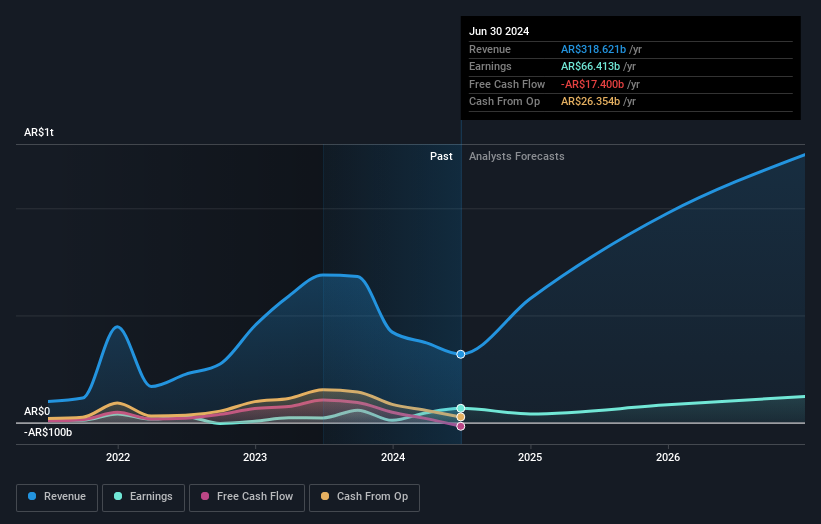

Operations: Loma Negra generates revenue primarily from the sale of cement, masonry cement, and lime (ARS 337.88 billion), followed by its railroad operations (ARS 32.78 billion) and concrete sales (ARS 31.52 billion). The company's net profit margin is a key indicator to consider when evaluating its financial health.

Loma Negra, a notable player in the Basic Materials sector, has shown impressive earnings growth of 369.3% over the past year, far outpacing the industry average of 36.1%. The company's net debt to equity ratio stands at a satisfactory 32%, down from 36.6% five years ago. Trading at a price-to-earnings ratio of 12.4x, it offers good value compared to the broader US market's 17.7x P/E ratio. Recent buybacks included repurchasing 65,624 shares for ARS0.41 million earlier this year.

Make It Happen

- Click here to access our complete index of 213 US Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOMA

Loma Negra Compañía Industrial Argentina Sociedad Anónima

Manufactures and sells cement and its derivatives in Argentina.

Solid track record with reasonable growth potential.