- United States

- /

- Consumer Durables

- /

- NasdaqGS:CRCT

3 Intriguing Penny Stocks With Market Caps At Least $50M

Reviewed by Simply Wall St

As the U.S. stock market navigates a volatile landscape marked by potential interest rate cuts and fluctuating tech valuations, investors are seeking new avenues for growth. Penny stocks, often considered relics of past trading days, still hold relevance by offering unique opportunities in smaller or newer companies with strong financial foundations. In this context, we explore three intriguing penny stocks that exhibit balance sheet strength and potential for significant returns.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Here Group (HERE) | $3.08 | $271.92M | ✅ 3 ⚠️ 1 View Analysis > |

| Dingdong (Cayman) (DDL) | $1.72 | $370.75M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.58 | $589.51M | ✅ 4 ⚠️ 0 View Analysis > |

| LexinFintech Holdings (LX) | $3.39 | $607.43M | ✅ 4 ⚠️ 2 View Analysis > |

| FinVolution Group (FINV) | $4.77 | $1.4B | ✅ 4 ⚠️ 1 View Analysis > |

| Puma Biotechnology (PBYI) | $4.84 | $246.16M | ✅ 3 ⚠️ 3 View Analysis > |

| Performance Shipping (PSHG) | $2.12 | $26.85M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.35 | $560.81M | ✅ 5 ⚠️ 0 View Analysis > |

| BAB (BABB) | $0.88614 | $6.49M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.71 | $84.28M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 365 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Nephros (NEPH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nephros, Inc. is a commercial-stage company that develops and sells water solutions to the medical and commercial markets in the United States, with a market cap of $53.45 million.

Operations: Nephros generates revenue from its Water Filtration segment, excluding pathogen detection, amounting to $17.93 million.

Market Cap: $53.45M

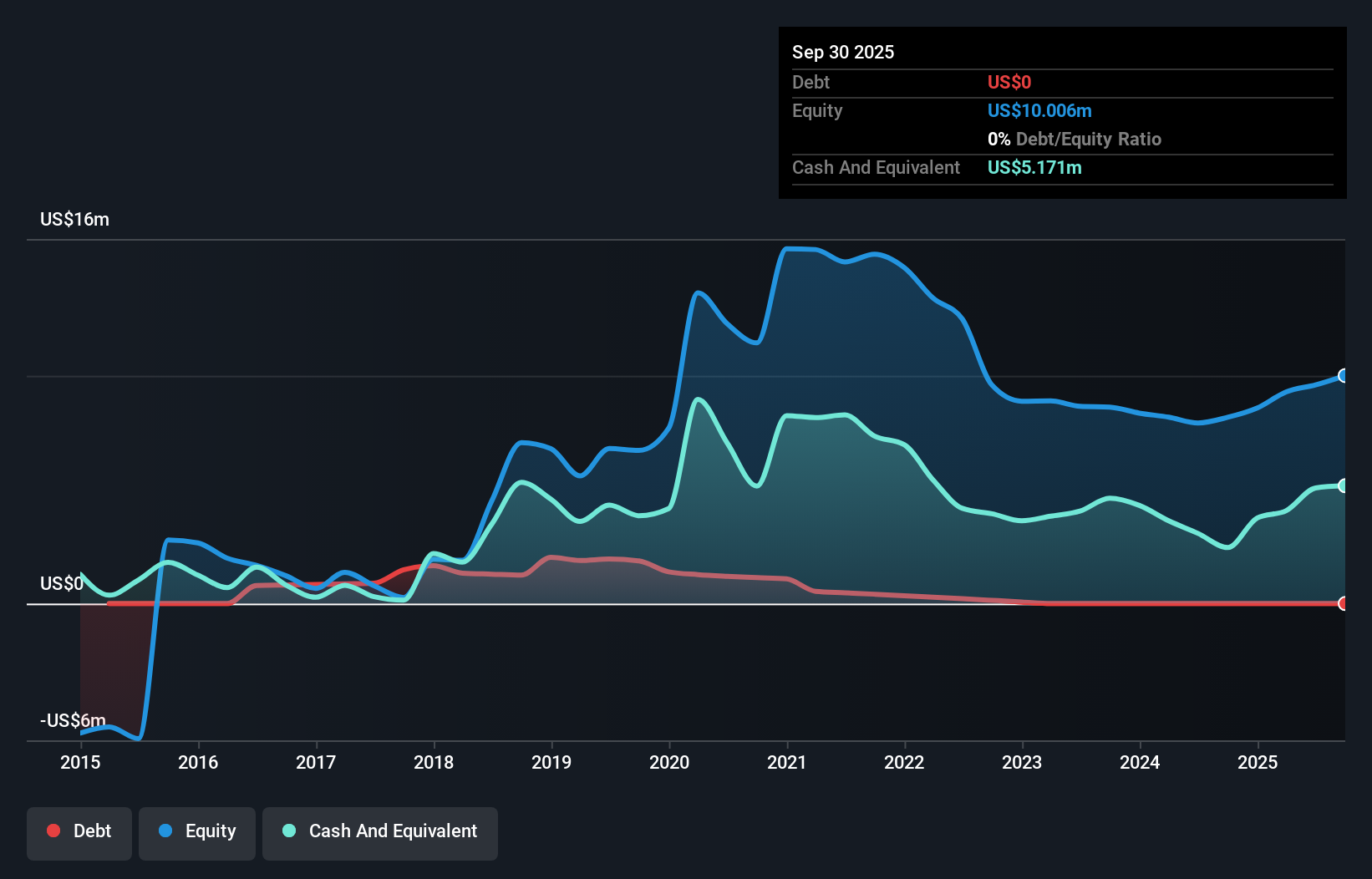

Nephros, Inc. has shown promising financial progress, reporting revenue of US$4.76 million for Q3 2025, up from US$3.52 million a year earlier, and achieving net income of US$0.337 million compared to US$0.183 million previously. The company is debt-free and maintains a stable financial position with short-term assets exceeding liabilities significantly. Despite its low return on equity at 14.8%, Nephros' profitability growth is notable as it recently became profitable after years of losses, aided by the launch of innovative products like its PFAS-reducing water filter that addresses critical environmental concerns.

- Get an in-depth perspective on Nephros' performance by reading our balance sheet health report here.

- Explore Nephros' analyst forecasts in our growth report.

Cricut (CRCT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cricut, Inc. designs, markets, and distributes a creativity platform for crafting handmade goods across various regions including the United States, Canada, and Europe, with a market cap of approximately $969.79 million.

Operations: The company generates revenue from its platform segment, totaling $322.83 million.

Market Cap: $969.79M

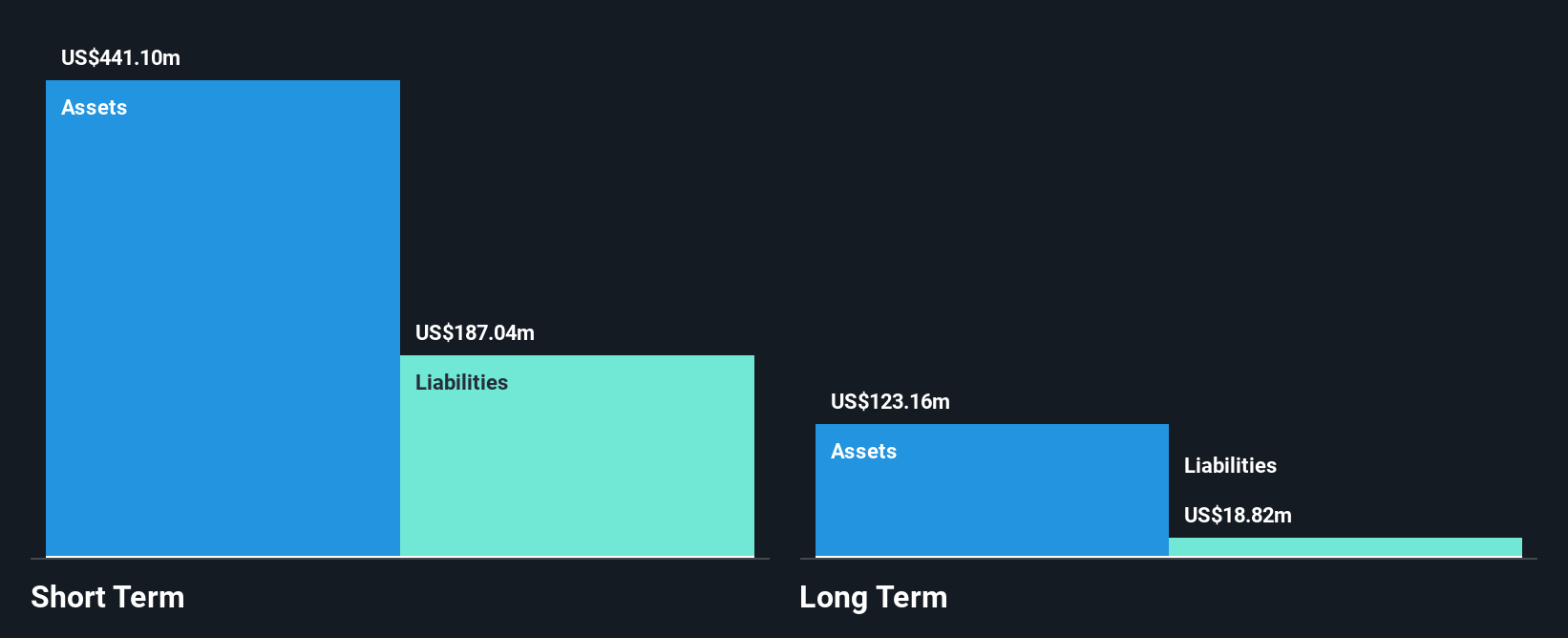

Cricut, Inc. demonstrates resilience in the penny stock space with a market cap of approximately US$969.79 million and solid revenue streams, reporting US$170.44 million for Q3 2025, up from US$167.89 million year-on-year. The company is debt-free and boasts high-quality earnings with a return on equity of 22.6%. Despite past earnings declines averaging -24.1% annually over five years, recent profit growth of 30% signals positive momentum, supported by stable net profit margins at 11.3%. Cricut's financial health is reinforced by short-term assets exceeding both long-term and short-term liabilities significantly, enhancing investor confidence amidst volatility considerations.

- Click to explore a detailed breakdown of our findings in Cricut's financial health report.

- Examine Cricut's earnings growth report to understand how analysts expect it to perform.

Dingdong (Cayman) (DDL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dingdong (Cayman) Limited is an e-commerce company operating in China with a market cap of approximately $370.75 million.

Operations: The company's revenue primarily comes from its online retail operations, generating CN¥24.02 billion.

Market Cap: $370.75M

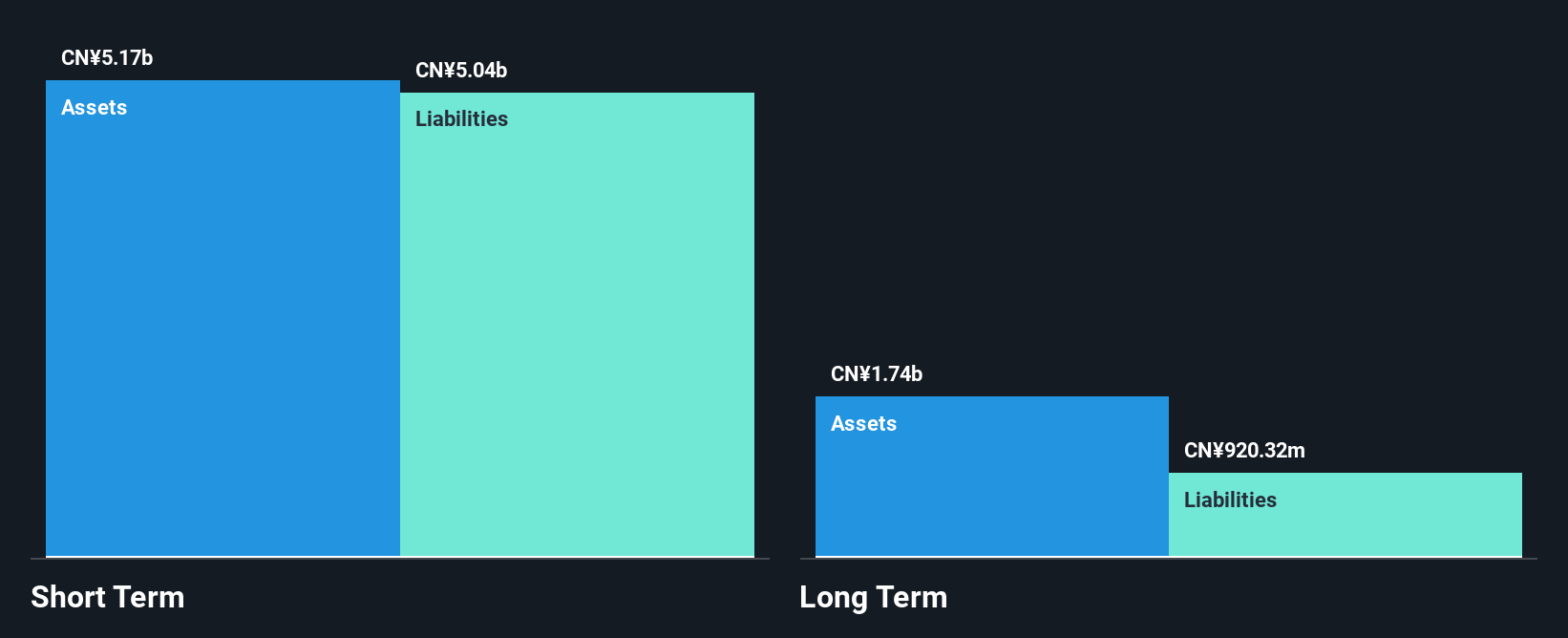

Dingdong (Cayman) Limited, with a market cap of approximately US$370.75 million, shows potential in the penny stock arena due to its robust financial structure and growth metrics. The company has transitioned from negative shareholder equity five years ago to positive, reflecting improved financial health. Dingdong's earnings have grown by 43.3% over the past year, surpassing industry averages, although recent quarterly net income saw a decline compared to last year. Its short-term assets comfortably cover both short- and long-term liabilities, while high-quality earnings and a strong cash position relative to debt further support its stability amidst market fluctuations.

- Jump into the full analysis health report here for a deeper understanding of Dingdong (Cayman).

- Gain insights into Dingdong (Cayman)'s future direction by reviewing our growth report.

Seize The Opportunity

- Access the full spectrum of 365 US Penny Stocks by clicking on this link.

- Looking For Alternative Opportunities? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRCT

Cricut

Engages in the design, marketing, and distribution of a creativity platform that enables users to turn ideas into professional-looking handmade goods in the United States, Canada, the United Kingdom, Ireland, Australia, New Zealand, Western Europe, the Middle East, Latin America, South Africa, and Asia.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives