- United States

- /

- Luxury

- /

- NasdaqGS:COLM

Should Investors Reconsider Columbia Sportswear After 33% Stock Drop in 2025?

Reviewed by Bailey Pemberton

If you’ve been tracking Columbia Sportswear, you’re probably asking the same question as a lot of smart investors right now: is this a good moment to step in, or does it make sense to wait and see? The company’s shares closed recently at $53.19, and while there have been short-term upticks—the stock gained 1.0% over the past week—it’s hard to ignore the longer-term downward trend. Over the past year, Columbia Sportswear is down 32.7%, and since the start of the year, returns have dropped by 35.7%. Even stretching the timeline further back, the five-year change stands at a negative 38.4%.

So what’s behind these moves? While some of the decline reflects shifting sentiment about the broader retail and apparel sector, there has also been a wave of investor caution as outdoor brands adjust to a post-pandemic landscape and evolving consumer trends. This does not mean the story is all negative. Prices like these have historically attracted bargain hunters, and sometimes, periods of doubt can turn into opportunity for those who see value others may have overlooked.

When it comes to valuation, the numbers paint a mixed picture. On a standardized score that measures undervaluation across six different checks, Columbia Sportswear earns a 2. That means it is considered undervalued by two valuation approaches, but not by the majority. Still, numbers are only the beginning. Up next, we will break down these valuation methods so you can see for yourself how Columbia stacks up, and hint at an even smarter way to judge what you are really getting for your investment.

Columbia Sportswear scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Columbia Sportswear Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) is a method that estimates a company’s intrinsic value based on its projected future dividends, which are discounted back to what they would be worth today. This model is particularly useful for evaluating companies that consistently pay dividends, as it focuses on the sustainability and growth of those payments.

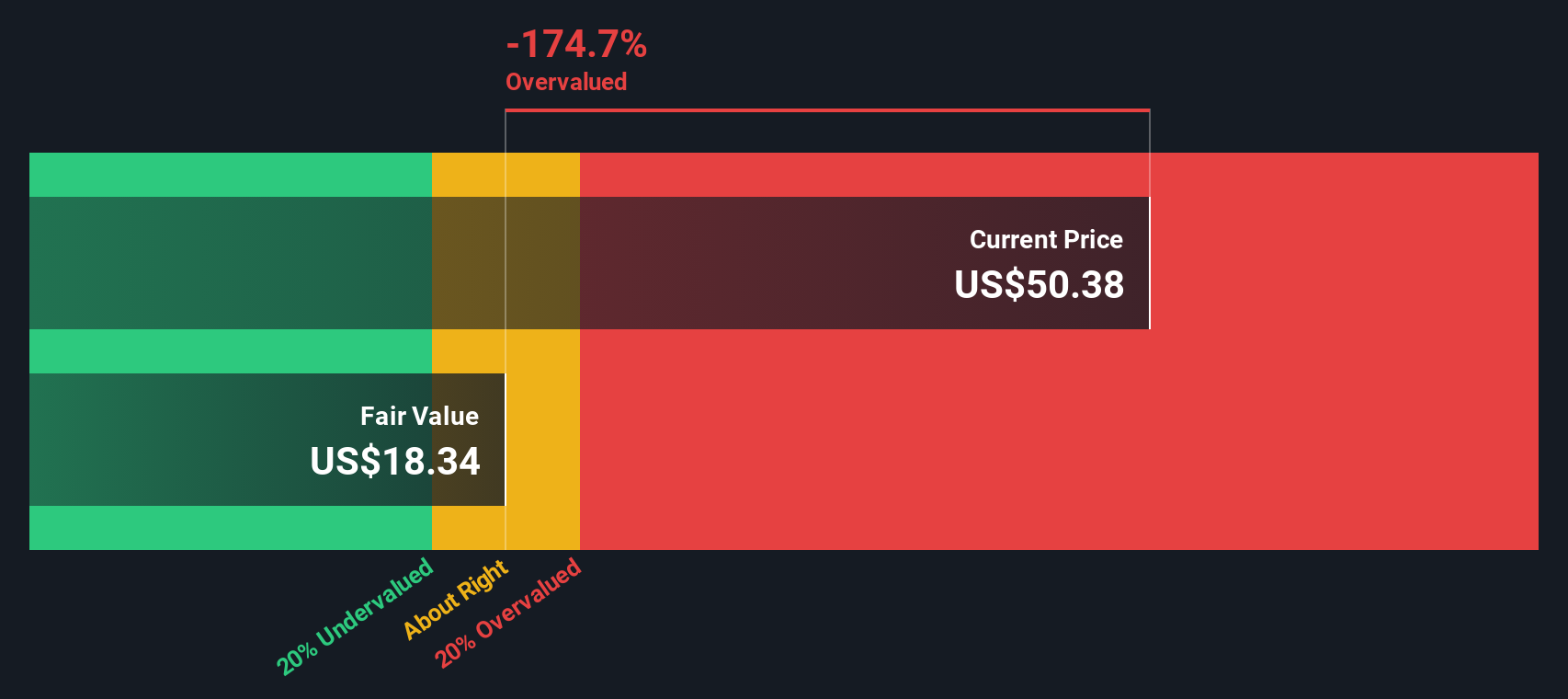

For Columbia Sportswear, the most recent data shows an annual dividend per share of $1.19, with a dividend payout ratio of 29.2%. The company’s return on equity stands at 13.0%. The model assumes a sustainable dividend growth rate capped at 3.08%. While management and analyst estimates once suggested a higher growth rate, more restrained expectations reflect the challenged environment for outdoor apparel.

According to the DDM valuation, Columbia Sportswear’s intrinsic fair value is estimated at $18.57 per share. With the current share price at $53.19, the model implies the stock is trading at a hefty 186.4% premium to its projected value using the DDM approach. This suggests that, based strictly on dividend forecasts and growth prospects, the shares are significantly overvalued at current levels.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Columbia Sportswear may be overvalued by 186.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Columbia Sportswear Price vs Earnings

The Price-to-Earnings (PE) ratio is widely considered one of the best ways to value profitable companies like Columbia Sportswear, because it directly relates the company’s market price to its earnings power. Investors use the PE ratio to get a sense of how much they’re paying for each dollar of a company’s net profit. Typically, a higher PE ratio is justified by strong growth expectations, while elevated risks or stagnating profits generally result in a lower “fair” multiple.

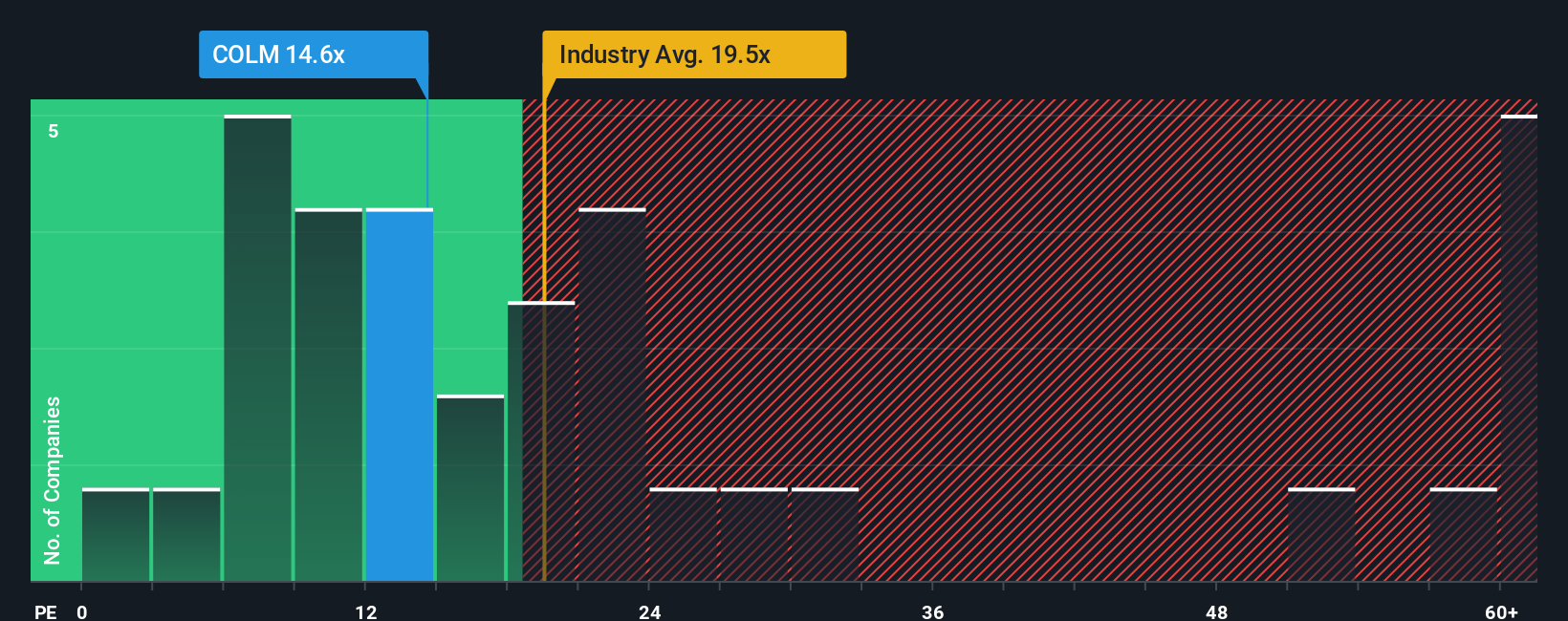

At present, Columbia Sportswear trades at a PE ratio of 13x, sitting well below the industry average of 21x and also below the average of its peer group at 18x. On the surface, this suggests the stock is cheap compared to its sector. However, raw comparisons do not tell the whole story because differences in growth prospects, profit margins, and risk profiles can affect what is considered a fair multiple from one company to another.

This is where Simply Wall St’s proprietary “Fair Ratio” comes into play. Unlike a standard peer or industry comparison, the Fair Ratio weighs Columbia's own growth rate, its profit margins, market cap, and business risks alongside industry and macro trends to provide a custom benchmark for valuation. In this case, Columbia’s Fair PE Ratio stands at 12.5x, which is very close to its current PE of 13x. This suggests the market price accurately reflects the company’s prospects and risks at the moment.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Columbia Sportswear Narrative

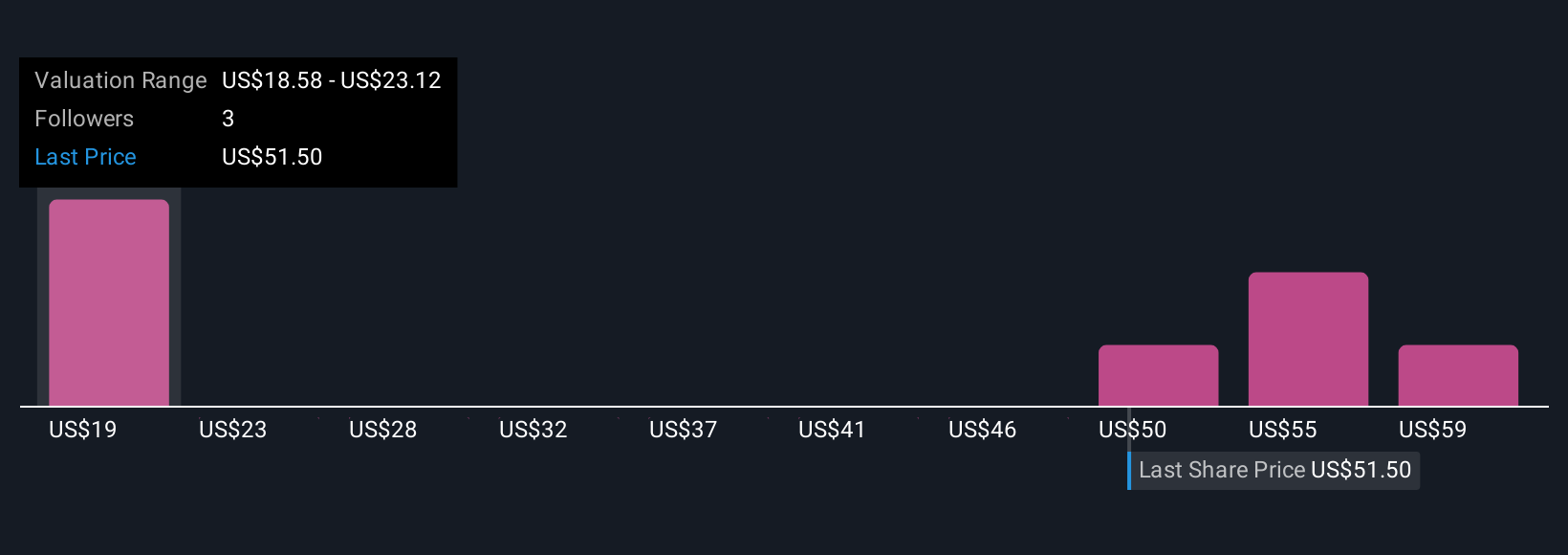

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story behind the numbers—your perspective on a company's future and what you expect for its revenue, profits, and margins. Narratives connect your view of Columbia Sportswear’s business outlook to real financial forecasts, and then translate those directly into a custom fair value, making your thinking both actionable and logical.

Narratives are an easy tool available on Simply Wall St’s Community page, where millions of investors share and update their outlooks. You can use Narratives to compare your estimated fair value for Columbia to the latest market price and decide if it is time to buy, hold, or exit. Best of all, Narratives update dynamically, instantly reflecting new information like quarterly results or breaking news.

For example, in the Community, one investor may see tariffs and climate challenges reducing earnings, forecasting a fair value of $40 per share and cautioning against buying. Another may weigh stronger international brand momentum and innovation, arriving at a fair value of $79 per share. Narratives empower you to invest with conviction by linking your reasoning to real numbers and market prices so your decisions are both informed and adaptable.

Do you think there's more to the story for Columbia Sportswear? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COLM

Columbia Sportswear

Designs, develops, markets, and distributes outdoor, active, and lifestyle products in the United States, Latin America, the Asia Pacific, Europe, the Middle East, Africa, and Canada.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives