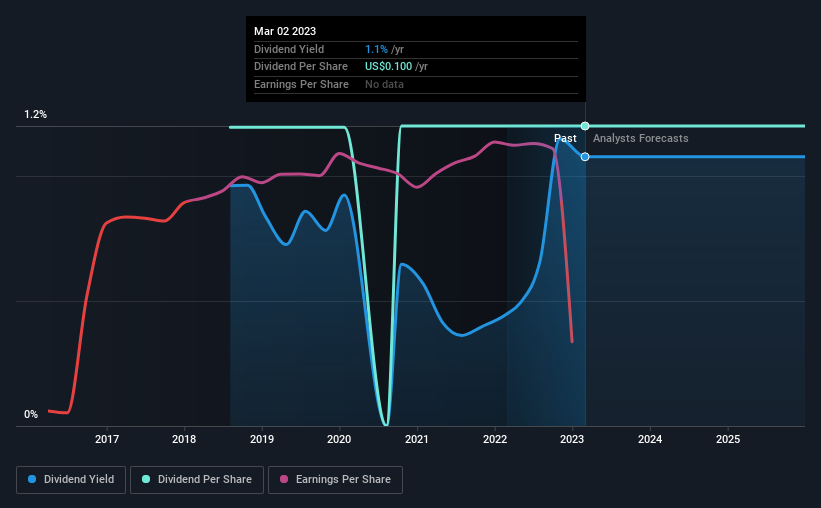

The board of Clarus Corporation (NASDAQ:CLAR) has announced that it will pay a dividend of $0.025 per share on the 17th of March. This means the annual payment will be 1.1% of the current stock price, which is lower than the industry average.

Check out our latest analysis for Clarus

Clarus' Earnings Easily Cover The Distributions

Even a low dividend yield can be attractive if it is sustained for years on end. While Clarus is not profitable, it is paying out less than 75% of its free cash flow, which means that there is plenty left over for reinvestment into the business. In general, cash flows are more important than the more traditional measures of profit so we feel pretty comfortable with the dividend at this level.

Looking forward, earnings per share is forecast to rise exponentially over the next year. If the dividend extends its recent trend, estimates say the dividend could reach 0.6%, which we would be comfortable to see continuing.

Clarus' Dividend Has Lacked Consistency

The track record isn't the longest, but we are already seeing a bit of instability in the payments. Since 2019, the dividend has gone from $0.0996 total annually to $0.10. Dividend payments have been growing, but very slowly over the period. We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments the total shareholder return may be limited.

Dividend Growth May Be Hard To Achieve

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Although it's important to note that Clarus' earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time.

Clarus' Dividend Doesn't Look Sustainable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Given that earnings are not growing, the dividend does not look nearly so attractive. Very few businesses see earnings consistently shrink year after year in perpetuity though, and so it might be worth seeing what the 9 analysts we track are forecasting for the future. Is Clarus not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

If you're looking to trade Clarus, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CLAR

Clarus

Designs, develops, manufactures, and distributes outdoor equipment and lifestyle products in the United States, Australia, China, Austria and internationally.

Excellent balance sheet and slightly overvalued.