- United States

- /

- Real Estate

- /

- NasdaqCM:CHCI

With EPS Growth And More, Comstock Holding Companies (NASDAQ:CHCI) Is Interesting

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Comstock Holding Companies (NASDAQ:CHCI), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Comstock Holding Companies

Comstock Holding Companies's Improving Profits

In the last three years Comstock Holding Companies's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like the last firework on New Year's Eve accelerating into the sky, Comstock Holding Companies's EPS shot from US$0.13 to US$0.29, over the last year. Year on year growth of 120% is certainly a sight to behold.

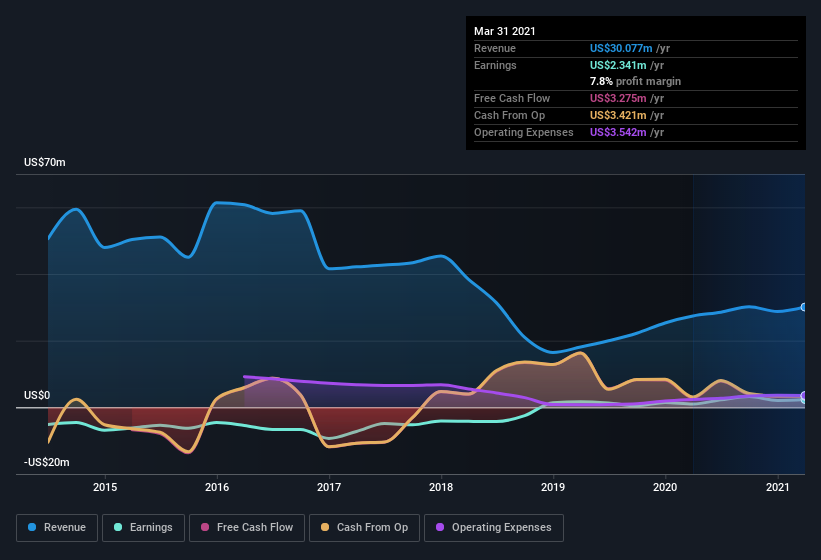

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Comstock Holding Companies's EBIT margins were flat over the last year, revenue grew by a solid 9.8% to US$30m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Comstock Holding Companies is no giant, with a market capitalization of US$54m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Comstock Holding Companies Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Comstock Holding Companies insiders have a significant amount of capital invested in the stock. Indeed, they hold US$14m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 26% of the company; visible skin in the game.

Does Comstock Holding Companies Deserve A Spot On Your Watchlist?

Comstock Holding Companies's earnings have taken off like any random crypto-currency did, back in 2017. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. At times fast EPS growth is a sign the business has reached an inflection point; and I do like those. So yes, on this short analysis I do think it's worth considering Comstock Holding Companies for a spot on your watchlist. We don't want to rain on the parade too much, but we did also find 4 warning signs for Comstock Holding Companies that you need to be mindful of.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Comstock Holding Companies, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:CHCI

Comstock Holding Companies

Operates as a real estate asset manager, developer, and operator of mixed-use and transit-oriented properties in the Washington, D.C.

Flawless balance sheet and good value.