Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Aterian, Inc. (NASDAQ:ATER) makes use of debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Aterian

How Much Debt Does Aterian Carry?

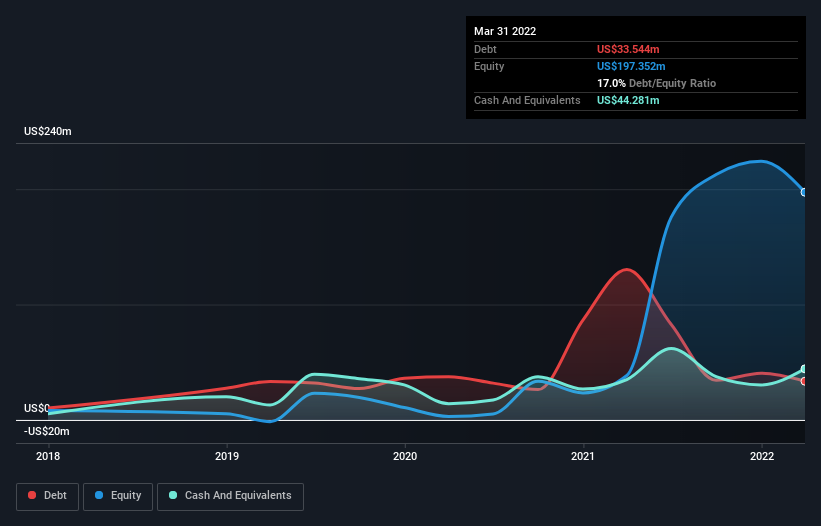

You can click the graphic below for the historical numbers, but it shows that Aterian had US$33.5m of debt in March 2022, down from US$130.3m, one year before. However, its balance sheet shows it holds US$44.3m in cash, so it actually has US$10.7m net cash.

How Strong Is Aterian's Balance Sheet?

The latest balance sheet data shows that Aterian had liabilities of US$99.2m due within a year, and liabilities of US$509.0k falling due after that. On the other hand, it had cash of US$44.3m and US$5.87m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$49.5m.

This deficit isn't so bad because Aterian is worth US$157.8m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. While it does have liabilities worth noting, Aterian also has more cash than debt, so we're pretty confident it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Aterian's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Aterian reported revenue of US$241m, which is a gain of 16%, although it did not report any earnings before interest and tax. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

So How Risky Is Aterian?

Statistically speaking companies that lose money are riskier than those that make money. And the fact is that over the last twelve months Aterian lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of US$47m and booked a US$196m accounting loss. With only US$10.7m on the balance sheet, it would appear that its going to need to raise capital again soon. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Aterian is showing 5 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ATER

Aterian

Operates as a technology-enabled consumer products company in North America and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives