- United States

- /

- Leisure

- /

- NasdaqGS:AOUT

Take Care Before Jumping Onto American Outdoor Brands, Inc. (NASDAQ:AOUT) Even Though It's 27% Cheaper

American Outdoor Brands, Inc. (NASDAQ:AOUT) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Looking at the bigger picture, even after this poor month the stock is up 36% in the last year.

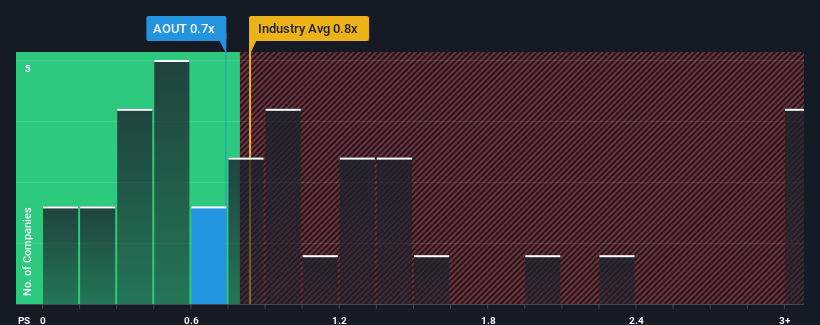

In spite of the heavy fall in price, it's still not a stretch to say that American Outdoor Brands' price-to-sales (or "P/S") ratio of 0.7x right now seems quite "middle-of-the-road" compared to the Leisure industry in the United States, where the median P/S ratio is around 0.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for American Outdoor Brands

How American Outdoor Brands Has Been Performing

Recent times have been pleasing for American Outdoor Brands as its revenue has risen in spite of the industry's average revenue going into reverse. It might be that many expect the strong revenue performance to deteriorate like the rest, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think American Outdoor Brands' future stacks up against the industry? In that case, our free report is a great place to start.How Is American Outdoor Brands' Revenue Growth Trending?

In order to justify its P/S ratio, American Outdoor Brands would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 4.9%. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 22% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 6.1% as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 1.8%, which is noticeably less attractive.

With this information, we find it interesting that American Outdoor Brands is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From American Outdoor Brands' P/S?

With its share price dropping off a cliff, the P/S for American Outdoor Brands looks to be in line with the rest of the Leisure industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that American Outdoor Brands currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for American Outdoor Brands with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AOUT

American Outdoor Brands

Provides outdoor products and accessories for rugged outdoor enthusiasts in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives